Three Stocks Estimated To Be Trading Below Their Intrinsic Value In December 2025

As the Dow Jones and S&P 500 approach record highs, investors are closely watching market movements amidst expectations of a potential interest rate cut by the Federal Reserve. In this environment, identifying stocks that may be trading below their intrinsic value can offer opportunities for those seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Webull (BULL) | $9.26 | $17.92 | 48.3% |

| Super Group (SGHC) (SGHC) | $10.89 | $21.53 | 49.4% |

| Spotify Technology (SPOT) | $557.17 | $1095.48 | 49.1% |

| Sotera Health (SHC) | $16.84 | $33.44 | 49.6% |

| Lyft (LYFT) | $22.33 | $43.57 | 48.8% |

| Freshworks (FRSH) | $12.45 | $23.78 | 47.6% |

| DexCom (DXCM) | $64.85 | $126.43 | 48.7% |

| Chagee Holdings (CHA) | $15.28 | $29.66 | 48.5% |

| BioLife Solutions (BLFS) | $25.51 | $49.69 | 48.7% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $18.70 | $37.29 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

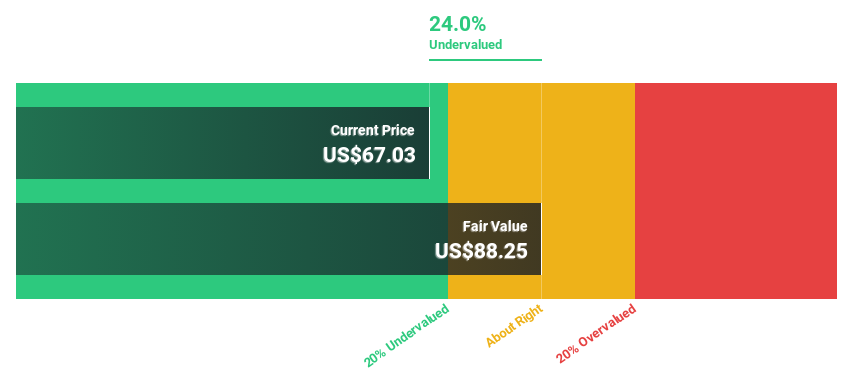

Blackbaud (BLKB)

Overview: Blackbaud, Inc. provides cloud software and services globally, with a market capitalization of approximately $2.84 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated $1.14 billion.

Estimated Discount To Fair Value: 29.7%

Blackbaud is trading at a significant discount to its estimated fair value, with shares priced at US$61.69 against a calculated fair value of US$87.69. Despite recent insider selling, Blackbaud's strategic innovations in AI and partnerships, such as the collaboration with Anthropic, position it for potential revenue growth and improved cash flows. The company’s increased buyback plan further reflects confidence in its financial health and ability to enhance shareholder value through efficient capital allocation.

- Our comprehensive growth report raises the possibility that Blackbaud is poised for substantial financial growth.

- Get an in-depth perspective on Blackbaud's balance sheet by reading our health report here.

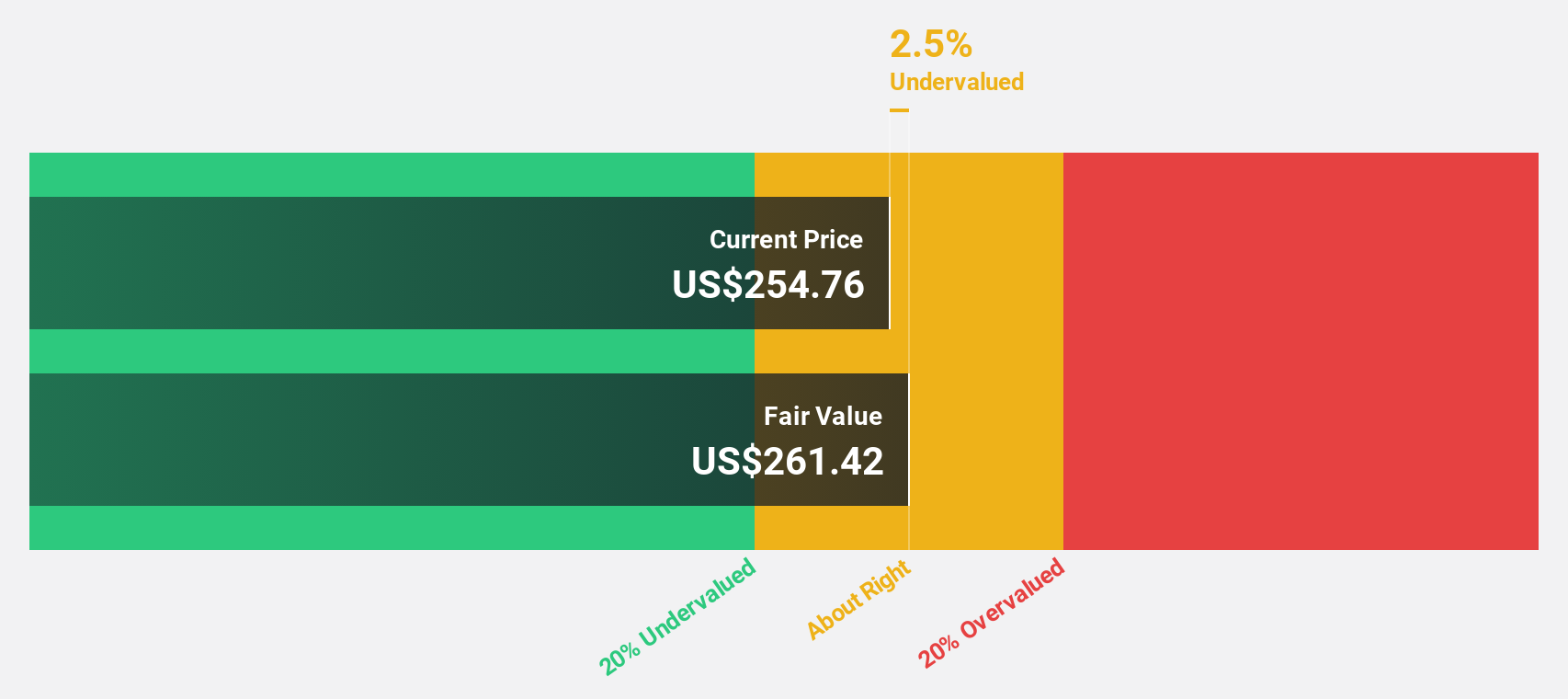

Take-Two Interactive Software (TTWO)

Overview: Take-Two Interactive Software, Inc. develops, publishes, and markets interactive entertainment solutions globally and has a market cap of approximately $45.61 billion.

Operations: The company generates revenue primarily from the sale of software titles, amounting to $6.22 billion.

Estimated Discount To Fair Value: 29.6%

Take-Two Interactive Software is trading at a substantial discount, with shares priced at US$244.95 compared to an estimated fair value of US$347.83. Recent earnings results show improved financial performance, with revenue rising significantly year-over-year and a reduced net loss, suggesting better cash flow management. The company has raised its earnings guidance for the fiscal year ending March 2026, reflecting confidence in future profitability amid expected robust revenue growth and high return on equity forecasts.

- In light of our recent growth report, it seems possible that Take-Two Interactive Software's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Take-Two Interactive Software's balance sheet health report.

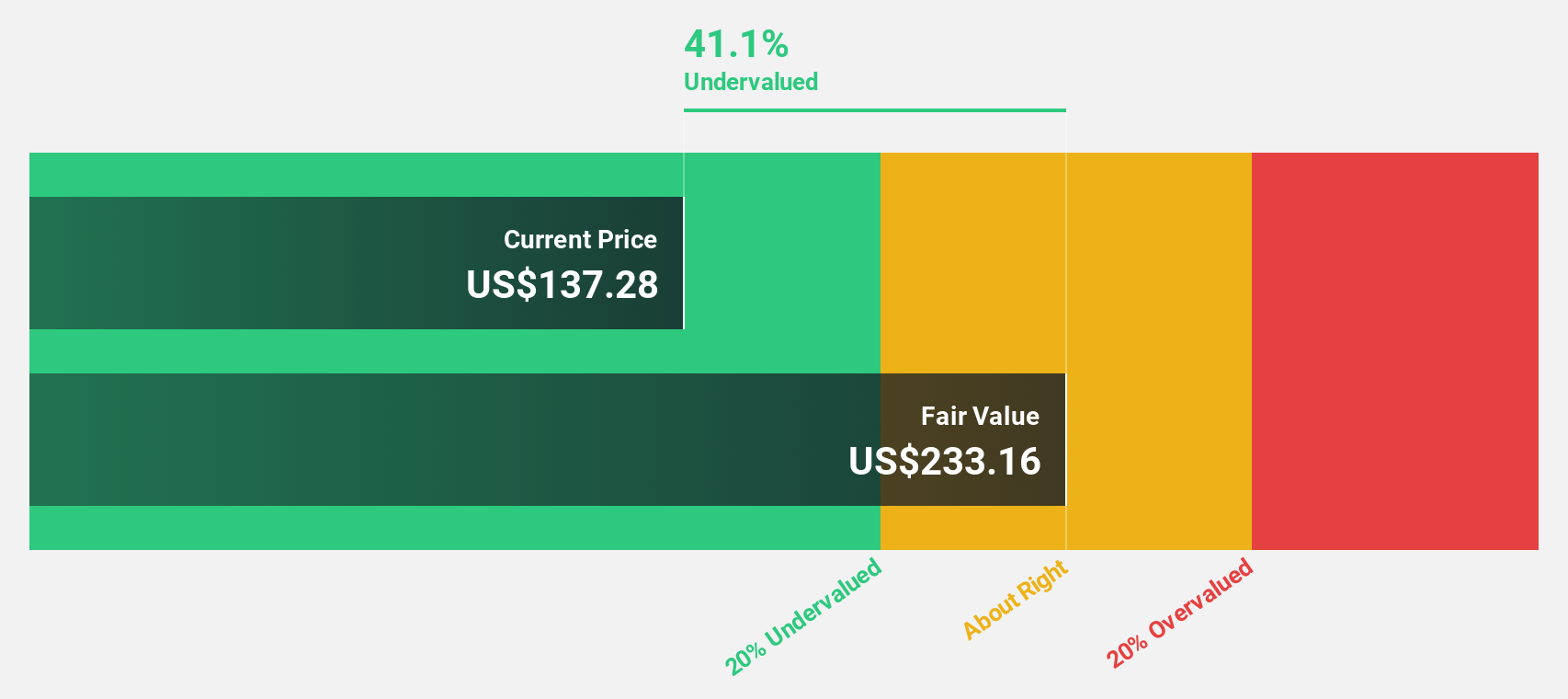

Jacobs Solutions (J)

Overview: Jacobs Solutions Inc. operates in infrastructure and advanced facilities, as well as consulting services across multiple regions including the United States, Europe, and Asia, with a market cap of $16.03 billion.

Operations: The company's revenue is derived from two main segments: Infrastructure & Advanced Facilities, which generated $10.76 billion, and PA Consulting, which contributed $1.27 billion.

Estimated Discount To Fair Value: 40.3%

Jacobs Solutions is trading at a significant discount, with its stock priced at US$138.73 compared to an estimated fair value of US$232.33, indicating undervaluation based on cash flows. Despite recent earnings showing a decline in net income and profit margins from the previous year, Jacobs' forecasted annual earnings growth of 20.4% outpaces the broader U.S. market's expected growth rate. The company's involvement in large-scale infrastructure projects further supports its long-term revenue potential and cash flow stability.

- Insights from our recent growth report point to a promising forecast for Jacobs Solutions' business outlook.

- Click here to discover the nuances of Jacobs Solutions with our detailed financial health report.

Summing It All Up

- Discover the full array of 208 Undervalued US Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal