American Eagle (AEO) Q3: Margin Slippage Tests Bullish Earnings Growth Narrative

American Eagle Outfitters (AEO) just posted its Q3 2026 scorecard, with revenue of about $1.4 billion and EPS of $0.54 on net income of $91 million, supported by 4% same store sales growth. The company has seen quarterly revenue move from roughly $1.3 billion in Q3 2025 to $1.4 billion in Q3 2026, while EPS stepped up from $0.42 to $0.54 over the same period. This sets the stage for investors to weigh high forecast earnings growth against subtly pressured margins.

See our full analysis for American Eagle Outfitters.With the headline numbers on the table, the next step is to see how this latest print lines up with the prevailing stories around American Eagle, from bullish growth hopes to concerns about margin resilience.

See what the community is saying about American Eagle Outfitters

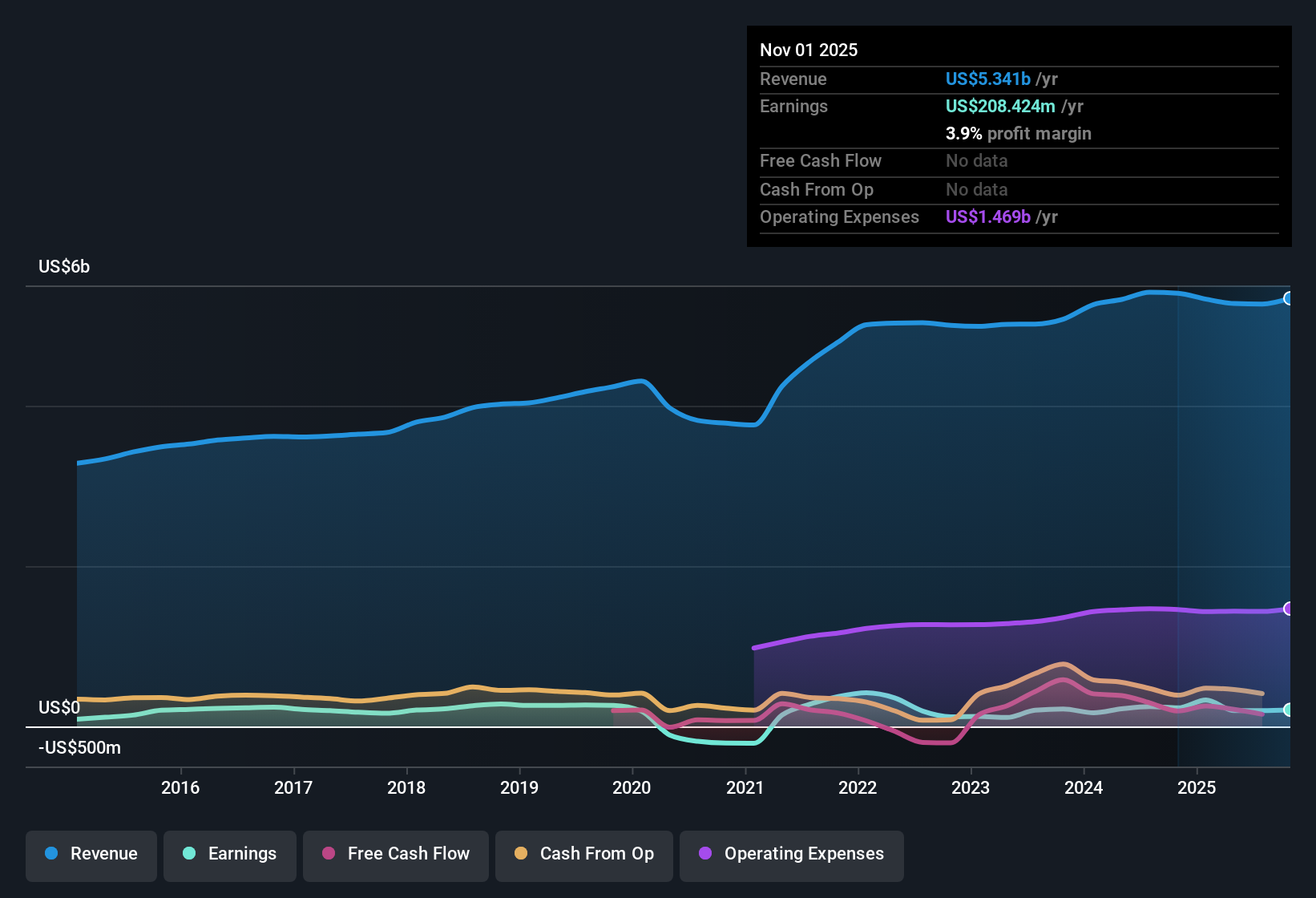

Margins Ease Back To 3.9%

- Net profit margin over the last year sits at 3.9%, down from 4.3% the prior year, even as trailing twelve month revenue holds around $5.3 billion.

- Consensus narrative expects margin improvement from operational efficiencies. However, the latest 3.9% margin versus last year’s 4.3% highlights that:

- Investments in digital platforms and supply chain have not yet shown up as higher reported profitability across the trailing twelve months.

- Planned margin gains need to offset pressures like increased markdowns and operating costs that the narrative itself flags as risks.

Earnings Growth Outpaces Sales

- Analysts see earnings growing about 25.6% per year over the next three years, despite revenue projections of only 3.6% per year, both measured against a trailing revenue base of roughly $5.3 billion.

- What is notable for the bullish view is how much of that 25.6% earnings growth depends on better margins and buybacks rather than fast top line expansion:

- The consensus narrative assumes profit margins rise from 3.7% to 6.0%, while recent reported margin is 3.9%, only slightly above today’s assumed starting point.

- Analysts also expect shares outstanding to shrink 7.0% per year, meaning EPS growth leans heavily on financial discipline alongside modest 2.2% to 3.6% revenue growth.

Premium Valuation Despite Slower Sales

- The stock trades at $23.97, above the $21.74 DCF fair value and on a 19.5x P/E, compared with 18.7x for peers and 17.9x for the US Specialty Retail industry.

- Bears point to this premium as risky given the slower revenue profile and recent margin slippage:

- Revenue is expected to grow roughly 3.6% per year, well below the 10.5% US market pace, so the company is not a top line growth outlier.

- With margins at 3.9% versus 4.3% last year and valuation already above DCF fair value, any further pressure on profitability would make the 19.5x multiple harder to defend.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for American Eagle Outfitters on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the numbers that others might be missing? Turn that insight into your own narrative in just a few minutes: Do it your way.

A great starting point for your American Eagle Outfitters research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

American Eagle’s premium valuation rests on modest sales growth and pressured margins. This leaves little room for disappointment if profitability or demand softens further.

If that trade off feels too tight, use our these 915 undervalued stocks based on cash flows to quickly pivot toward ideas where earnings, growth and valuation look better aligned for potential upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal