Do Halozyme Therapeutics’ (HALO) Deals And Insider Sales Clarify Or Complicate Its Royalty Story?

- In recent months, Halozyme Therapeutics completed its US$750,000,000 acquisition of Elektrofi, expanded its ENHANZE-powered partnerships through a new collaboration with Merus, and saw insider share sales by its CEO and a director under pre-arranged plans.

- At the same time, Halozyme’s earnings estimates were revised upward, it was highlighted by Meridian Growth Fund and upgraded by Zacks, underscoring growing confidence in its royalty-driven business model.

- Against this backdrop of rising earnings estimates and platform expansion, we’ll examine how these developments might reshape Halozyme’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Halozyme Therapeutics Investment Narrative Recap

To own Halozyme, you need to believe its ENHANZE drug delivery platform can keep attracting high value partnerships and growing royalty revenue, despite regulatory and reimbursement pressure on biologic pricing. Recent news around rising earnings estimates, upgraded guidance and the Elektrofi deal appears to reinforce the near term earnings catalyst, while insider selling and ongoing concentration in a few major partnered drugs remain key risks that do not seem materially altered by these updates.

The most relevant recent development is Halozyme’s US$750,000,000 acquisition of Elektrofi, which could broaden its subcutaneous delivery capabilities alongside ENHANZE and support future partnership momentum. That said, with revenue still highly dependent on a small set of blockbuster collaborations, any slowdown or competitive challenge to these core programs could quickly outweigh the upside from new platforms and licenses.

Yet investors should also be aware that concentration in a handful of royalty streams means...

Read the full narrative on Halozyme Therapeutics (it's free!)

Halozyme Therapeutics' narrative projects $2.0 billion revenue and $1.1 billion earnings by 2028.

Uncover how Halozyme Therapeutics' forecasts yield a $76.00 fair value, a 18% upside to its current price.

Exploring Other Perspectives

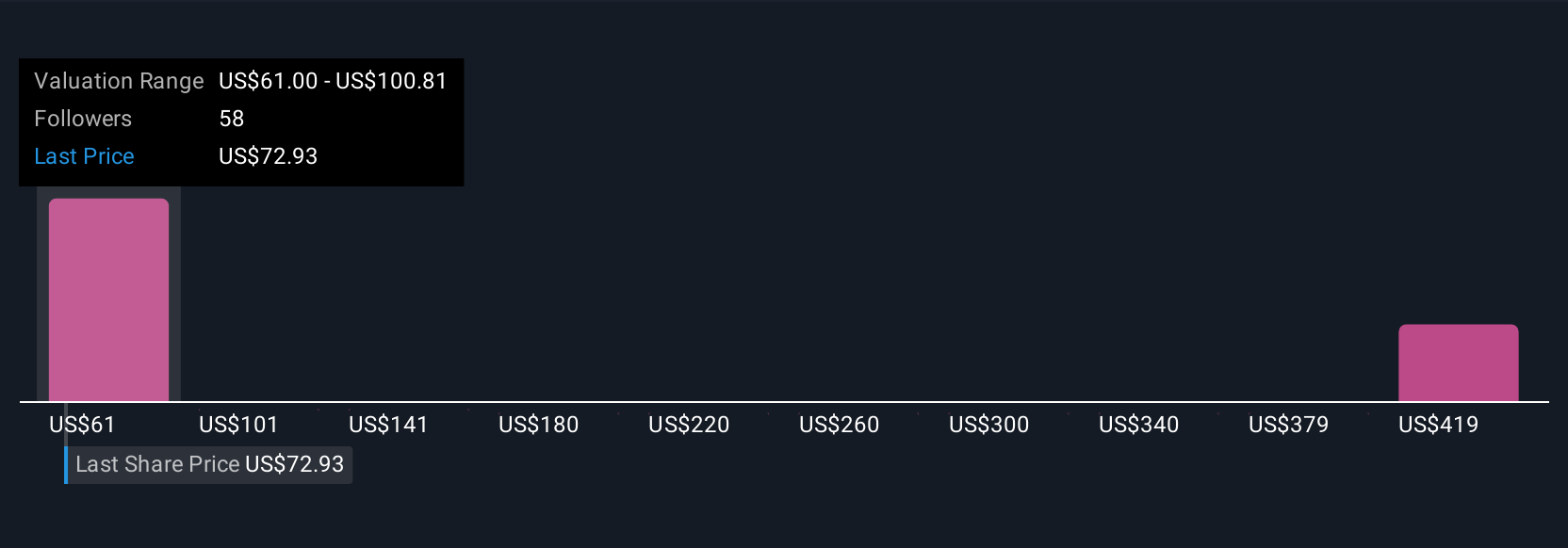

Eight members of the Simply Wall St Community value Halozyme between US$70 and about US$201 per share, showing how far opinions can spread. When you set that against the company’s reliance on a few large ENHANZE partnerships, it underlines why many investors look at both upside potential and the risk of partner or product setbacks.

Explore 8 other fair value estimates on Halozyme Therapeutics - why the stock might be worth just $70.33!

Build Your Own Halozyme Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Halozyme Therapeutics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Halozyme Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Halozyme Therapeutics' overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal