This ‘Strong Buy’ Penny Stock Just More Than Quadrupled on Clinical Trial Results. Should You Buy It Here?

Capricorn Therapeutics (CAPR) shares more than quadrupled on Dec. 3 after the biotech company announced late-stage HOPE-3 clinical trial results for deramiocel, its investigational treatment for Duchenne Muscular Dystrophy.

The positive results prompted notable short-seller Martin Shkreli to publicly acknowledge his “bad call” on CAPR, reversing his earlier prediction that the HOPE-3 trial would fail.

His admission underscores the binary nature of biotech investments, where successful clinical trials can completely invalidate bearish theses overnight.

Following the explosive rally, Capricorn Therapeutics stock is trading at more than 6x its price in late November.

Wall Street Sees Significant Further Upside in CAPR Stock

Wall Street firms continue to recommend owning CAPR shares after the positive HOPE-3 update.

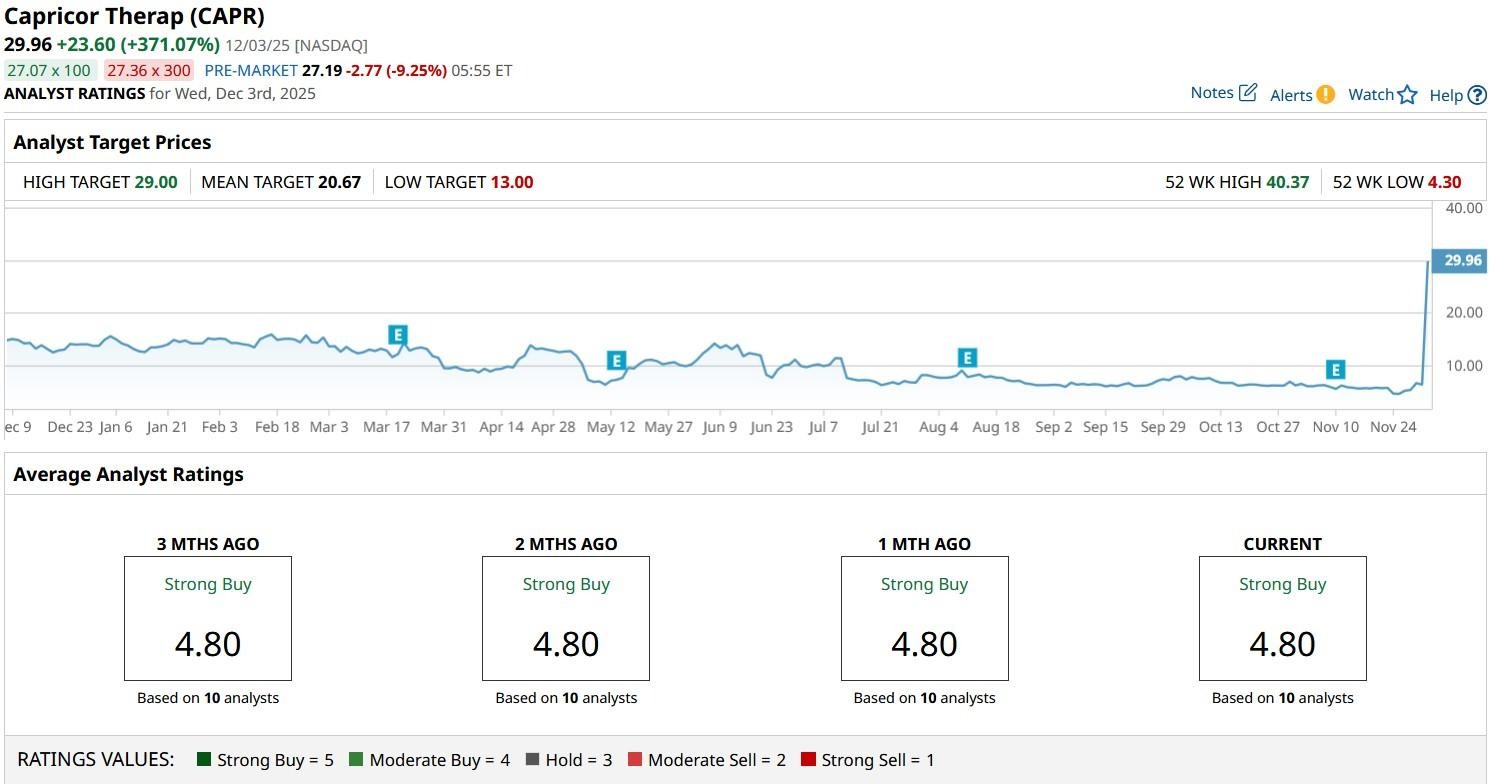

While the mean target on the biotech stock sits at about $21 currently, signaling potential downside of more than 30% from here, analysts have already started raising their price objectives following the deramiocel trial results.

Experts at Alliance Global Partners, for example, expect Capricorn Therapeutics to now hit $48 in 2026 on the back of HOPE-3 outcome that they described as “unequivocally and wholly positive.”

Their upwardly revised price target on the Nasdaq-listed firm indicates potential upside of another 60% from current levels.

Risks of Owning Capricorn Therapeutics Shares at Current Levels

Despite the clinical success and analysts’ optimism about what lies ahead for CAPR stock, caution is warranted in playing this biotech name at current levels.

Why? Primarily because its dramatic surge appears to have baked in a potential FDA approval and future clinical milestones already.

This leaves little room for regulatory disappointments and commercialization delays, turning the overall risk-reward profile less favorable at the current price.

Investors should also note that Capricorn Therapeutics closed the Dec. 3 session at roughly $30, versus its intraday high of a much higher $40, implying the surge was at least partly speculative in nature.

In short, the investment thesis hinges entirely on FDA approval timing and terms, while market competition and valuation concerns require that investors thoroughly evaluate their risk-appetite before investing in CAPR.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever. On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal