Does LegalZoom’s Expanded Defy Partnership Deepen Its Second-Chance Brand Moat For Investors In LZ?

- LegalZoom.com, Inc. recently renewed and expanded its partnership with Defy Ventures, funding the nationwide growth of mental well-being and post-release entrepreneurship programs that have already supported about 8,000 formerly incarcerated individuals.

- The partnership also deepens LegalZoom’s in-kind product support and employee volunteering for Defy graduates starting businesses, strengthening the company’s connection to entrepreneurship and second-chance economic opportunity.

- We’ll now explore how this expanded support for Defy’s national entrepreneurship and well-being programs could influence LegalZoom’s long-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

LegalZoom.com Investment Narrative Recap

To own LegalZoom, you have to believe it can stay central to small business formation while defending pricing power in a world of cheaper, often AI-driven legal options. The Defy Ventures expansion mainly reinforces brand equity and mission alignment, but it does not materially change the near term focus on improving subscription retention and managing cost pressures from more hands-on “do-it-for-me” services.

The most relevant recent announcement here is LegalZoom’s integration into OpenAI’s ChatGPT agent, which directly addresses the risk that generative AI could undercut its core document services. By embedding its products inside a leading AI platform, LegalZoom is trying to keep its offerings visible and convenient at the moment users are considering low cost, DIY legal tools, which ties closely to its growth and retention catalysts.

Yet even as partnerships broaden LegalZoom’s reach, investors should still be aware of the risk that rapidly advancing AI could...

Read the full narrative on LegalZoom.com (it's free!)

LegalZoom.com's narrative projects $876.4 million revenue and $72.3 million earnings by 2028.

Uncover how LegalZoom.com's forecasts yield a $12.36 fair value, a 30% upside to its current price.

Exploring Other Perspectives

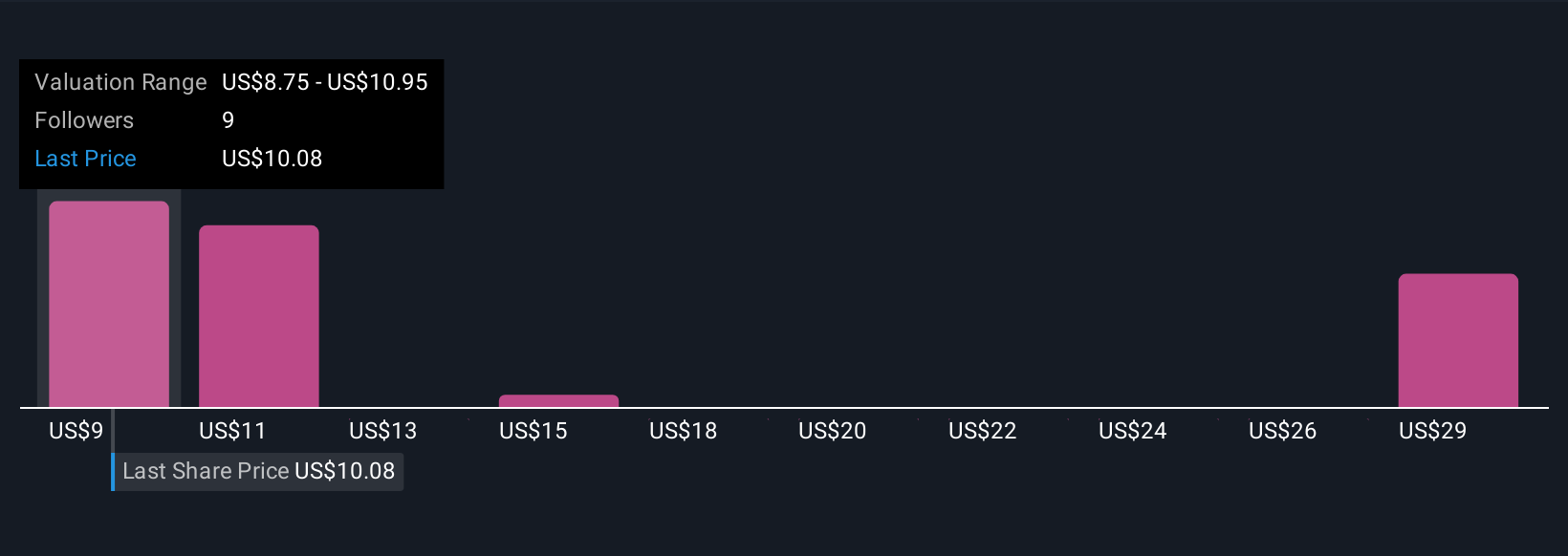

Four members of the Simply Wall St Community currently value LegalZoom between US$8.75 and about US$28.97 per share, showing very different expectations. As you weigh those views, it is worth setting them against the risk that AI driven commoditization of legal services could pressure LegalZoom’s core business over time and reshape how its growth story plays out.

Explore 4 other fair value estimates on LegalZoom.com - why the stock might be worth over 3x more than the current price!

Build Your Own LegalZoom.com Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LegalZoom.com research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LegalZoom.com research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LegalZoom.com's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal