Box (BOX) Margins Hit 16%, Reinforcing Bullish Profitability Narrative Despite Growth Concerns

Box (BOX) just posted its Q3 2026 numbers, with revenue at $301.1 million and basic EPS of $0.08, setting the stage against a year where trailing-12-month revenue reached about $1.2 billion and basic EPS came in at $1.28. Over the past few quarters the company has seen revenue move from $275.9 million in Q3 2025 to $301.1 million in Q3 2026, while quarterly basic EPS shifted from $0.05 to $0.08, as trailing net profit margins climbed from 11% to 16% and put profitability more firmly in focus for investors interpreting this earnings print.

See our full analysis for Box.With the latest results on the table, the next step is to see how these revenue, EPS, and margin trends line up with the big narratives investors have been debating around Box, and where the numbers start to push back on those storylines.

See what the community is saying about Box

Margins climb to 16 percent on trailing basis

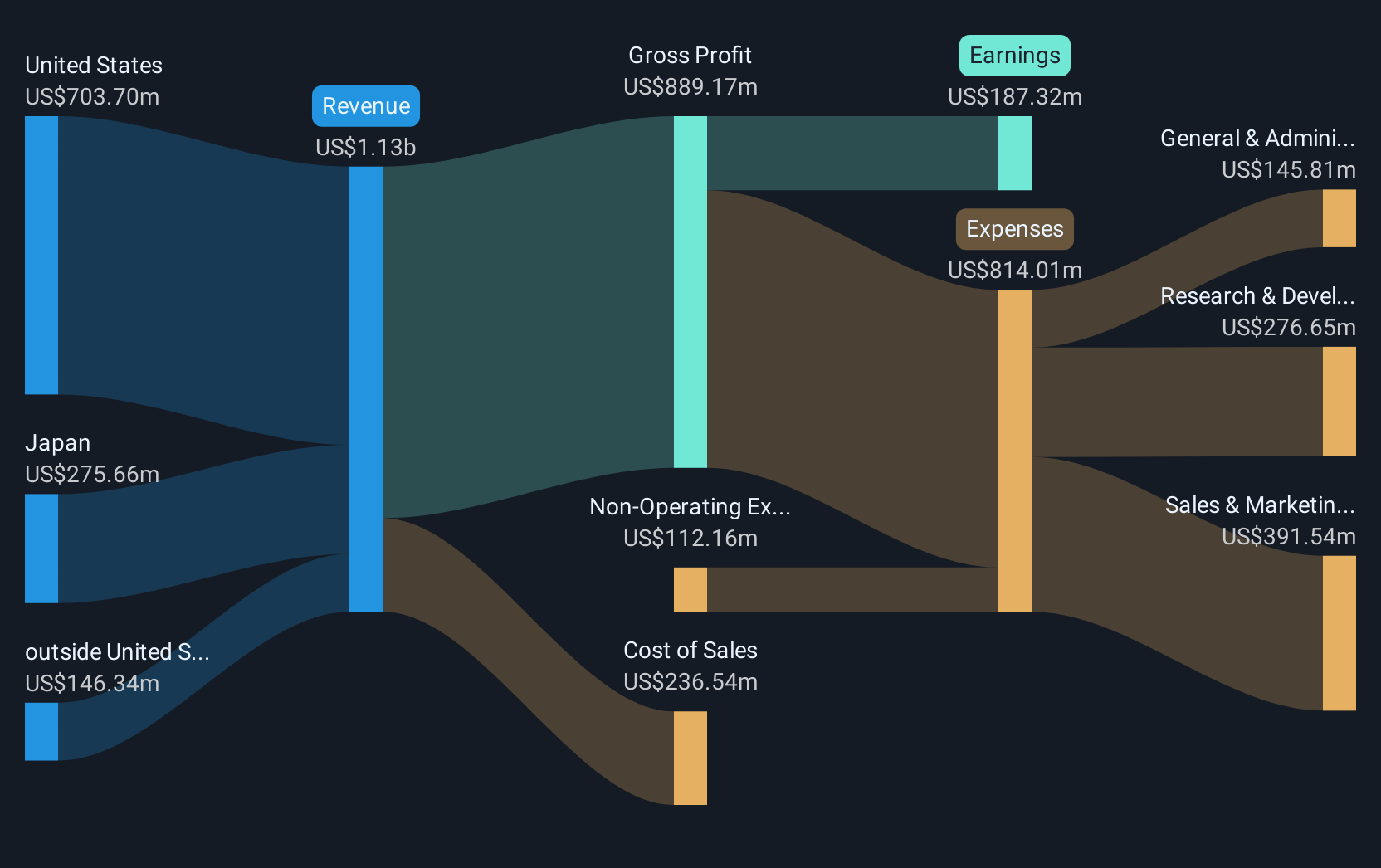

- On a trailing 12 month view, net income excluding extra items was $184.7 million on $1.15 billion of revenue, which works out to a 16 percent net margin versus 11 percent a year earlier.

- Bulls point to Box’s AI powered content platform and security focus as drivers of better quality earnings, and that view lines up with margins improving alongside only mid single digit trailing revenue growth of about 9 percent, which suggests:

- Pricing and mix are doing some of the heavy lifting, as revenue rose from about $1.06 billion to $1.15 billion while margin moved up by 5 percentage points.

- Higher margin software and workflow automation features can justify this shift, since they do not require revenue growth anywhere near the 57.1 percent earnings growth seen over the same period.

Earnings growth strong, but forecasts point down

- Trailing 12 month earnings grew 57.1 percent year over year to $184.7 million, yet analysts now expect earnings to decline by an average of 14.2 percent per year over the next three years.

- Bears argue that rising competition and pricing pressure will eat into that earnings base, and the current numbers leave room for that concern because:

- The recent 9 percent revenue growth rate already sits below the 10.5 percent US market growth cited, so faster growing rivals could intensify competitive pressure.

- If earnings do fall from today’s $184.7 million level while revenue only grows around 10.3 percent annually as assumed, the current 16 percent margin becomes harder to sustain against larger, integrated cloud suites.

Valuation shows gap to DCF fair value

- At a share price of $32.18 and trailing EPS of $1.28, Box trades on a price to earnings ratio of about 25 times, below peers at 55.5 times and the US software average of 32 times, and also below a DCF fair value of $47.25.

- Consensus narrative sees AI driven workflow adoption supporting growth, and the current valuation creates a tension with that story because:

- If revenue does grow around 10.3 percent annually and earnings reach about $191.0 million by 2028 as assumed, today’s discount to the $47.25 DCF fair value implies investors are heavily discounting that longer term path.

- At the same time, the forecast 14.2 percent annual earnings decline over the next three years helps explain why the multiple is at a discount to peers, even after a 57.1 percent lift in trailing earnings.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Box on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from another angle and turn that viewpoint into a concise narrative in just a few minutes, Do it your way.

A great starting point for your Box research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite Box’s margin gains and recent earnings strength, the outlook of declining profits and below market revenue growth raises questions about the durability of its story.

If those growth concerns leave you uneasy, shift your focus to stable growth stocks screener (2071 results) today to find companies already proving they can compound earnings and revenue more reliably through cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal