Credo Technology (CRDO) EPS Surge Reinforces Bullish Profitability Narrative Despite Lofty Valuation

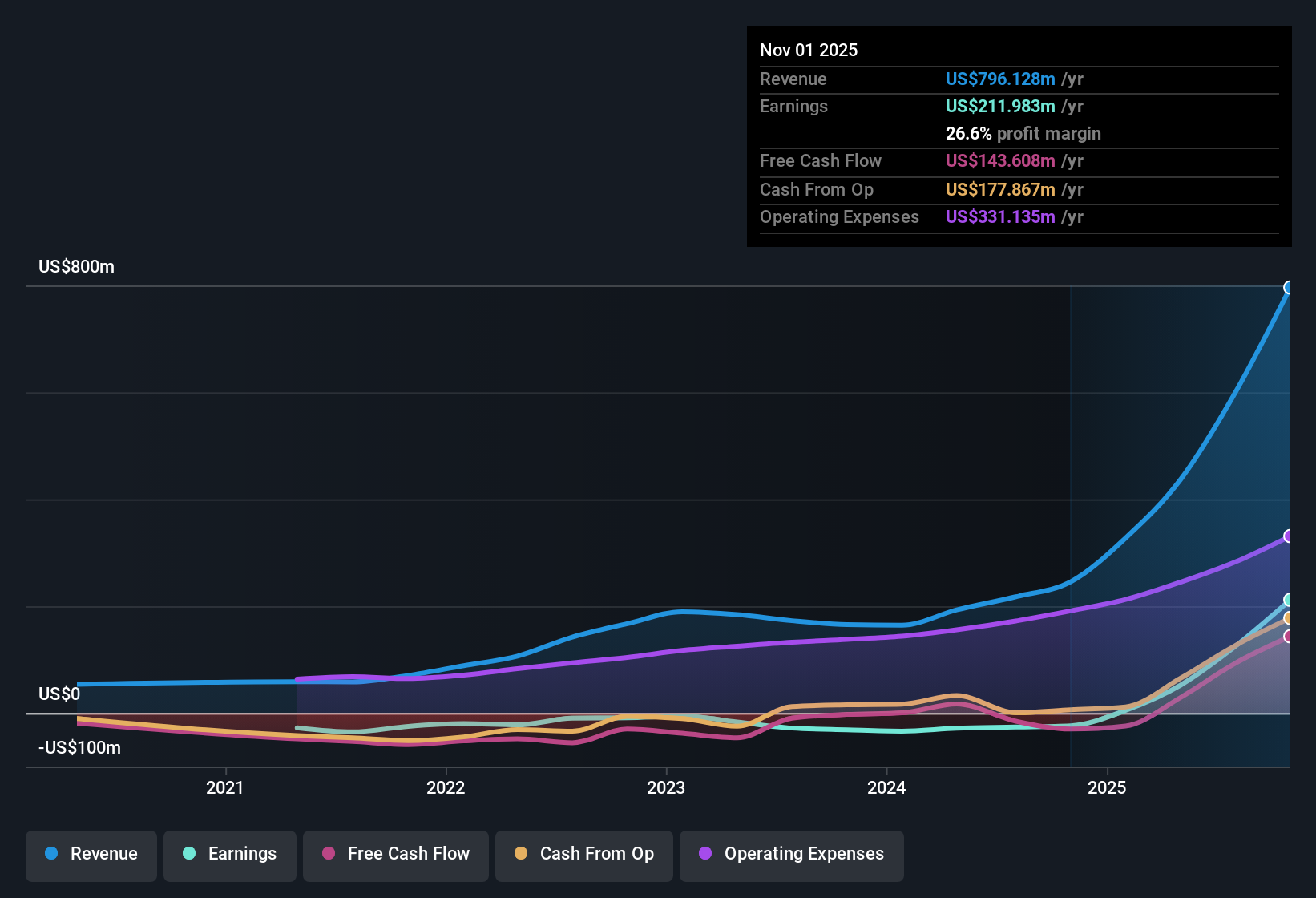

Credo Technology Group Holding (CRDO) just posted Q2 2026 results with revenue of about $268 million and basic EPS of $0.47, alongside trailing twelve month revenue of roughly $796 million and EPS of $1.24 that underscore how the business is scaling. The company has seen revenue move from $72 million in Q2 2025 to $268 million in Q2 2026, while basic EPS shifted from a loss of $0.03 to a positive $0.47 over the same period. This sets up a story where expanding profitability and thicker margins are front and center for investors parsing this print.

See our full analysis for Credo Technology Group Holding.With the latest numbers on the table, the next step is to line this earnings trajectory up against the dominant bull and bear narratives to see which story the margins now support and which assumptions need to be revisited.

See what the community is saying about Credo Technology Group Holding

Five-quarter revenue climb to $268 million

- Total revenue rose from $59.7 million in Q1 2025 to $268.0 million in Q2 2026, with trailing twelve month revenue reaching $796.1 million by this quarter.

- Consensus narrative points to AI driven infrastructure buildouts and high speed connectivity demand as key drivers of this surge. However,

- reliance on a handful of large cloud customers means this $796.1 million revenue base is still exposed if hyperscaler spending slows or shifts in house.

- expectations for ongoing protocol upgrades and new architectures are embedded in these growth numbers, so any delay in adoption could make this recent revenue ramp harder to repeat.

From losses to $82.6 million net income

- Net income moved from a loss of $9.5 million in Q1 2025 to $82.6 million in Q2 2026, driving trailing twelve month profit to $212.0 million and EPS to $1.24.

- Bulls argue that secular demand for high speed, energy efficient interconnects will sustain and even expand these profits over several years. At the same time,

- the strong operating leverage implied by moving from negative to $212.0 million of trailing profit could fade if revenue growth normalizes while R and D and other operating costs stay elevated.

- competition and potential commoditization of AEC and optical solutions could limit how much further margins can expand from today’s newly profitable base.

42.9x sales against slowing risk

- The stock trades at 42.9x trailing sales with a share price of $189.19, far above both the semiconductor industry average of 5.4x and peers at 15.8x, and well above a DCF fair value of $76.55.

- Bears highlight that such a premium multiple assumes analysts’ forecast of roughly 24.2 percent annual revenue growth and about 28 percent earnings growth. However,

- the same concerns about pulled forward AI demand and hyperscaler concentration mean any moderation in that growth path could leave a wide gap between $189.19 and the $76.55 DCF fair value.

- recent share price volatility and insider selling reinforce the view that expectations embedded in the 42.9x sales multiple may already be stretched.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Credo Technology Group Holding on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the numbers that others might be missing? Build and publish your own angle in just a few minutes, then Do it your way.

A great starting point for your Credo Technology Group Holding research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Explore Alternatives

Credo’s rapid climb in revenue and profits sits on a narrow base of hyperscaler demand and a rich 42.9x sales multiple. This valuation could unwind if growth cools.

If that premium and concentration risk feels too sharp, use our these 917 undervalued stocks based on cash flows to quickly focus on companies where valuations better reflect sustainable fundamentals and downside appears less extreme.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal