Taking a Fresh Look at nCino (NCNO) Valuation After Its Recent Share Price Rebound

nCino (NCNO) shares have been quietly grinding higher this week, even as the stock remains well below where it traded earlier this year. This has prompted a fresh look at how its growth story lines up with today’s valuation.

See our latest analysis for nCino.

The recent 4.54% 1 day share price return has only slightly eased what has been a tougher stretch for nCino, with the year to date share price return still negative and the 1 year total shareholder return down sharply. This suggests sentiment is cautiously rebuilding rather than fully turning.

If nCino has you rethinking where growth might come from next, it could be worth scouting other high potential names through high growth tech and AI stocks.

With shares still down heavily over the past year despite double digit revenue growth and a sizable discount to analyst targets, the key question now is whether nCino is quietly undervalued or if the market already reflects its next growth leg.

Most Popular Narrative: 28% Undervalued

With nCino last closing at $25.57 against a narrative fair value near the mid 30s, the current price implies a meaningful gap in expectations.

The accelerating adoption of AI-driven intelligent automation in banking is creating strong customer demand for nCino's Banking Advisor, which is already being adopted by 80+ customers and cited as a meaningful differentiator in winning deals, driving forward-looking uplift in subscription revenue and pricing power.

Want to see why this story leans on accelerating earnings, expanding margins, and a premium future multiple that rivals top tier software names? The full narrative unpacks how steady revenue growth, rising profitability, and a rich valuation multiple all combine into one aggressive fair value blueprint that the current share price has yet to reflect.

Result: Fair Value of $35.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and slower than expected international expansion could easily undercut the optimistic earnings and valuation blueprint embedded in this story.

Find out about the key risks to this nCino narrative.

Another View: Valuation Looks Rich on Sales

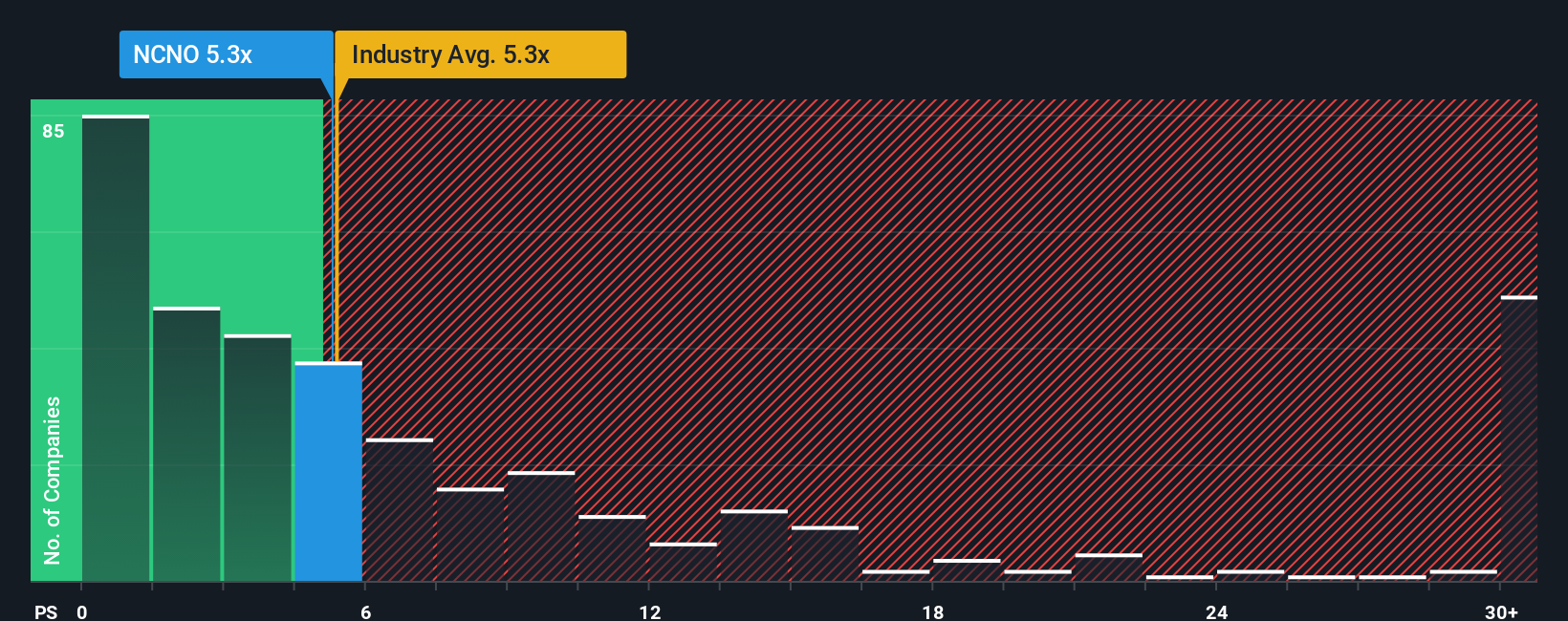

While narratives and analyst targets imply upside, nCino's current price tells a different story on sales. The stock trades at 5.2 times revenue, above both the US Software average of 4.8 times and peers at 5 times, and well above a fair ratio of 3.2 times. That premium may limit upside if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own nCino Narrative

If you are not fully aligned with this view, or simply want to dive into the numbers yourself, you can build a personalized nCino framework in just a few minutes: Do it your way.

A great starting point for your nCino research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want to stay ahead of the next wave of opportunities, use the Simply Wall Street Screener to uncover focused ideas before the crowd catches on.

- Capture potential turnaround stories by screening for quality small caps using these 3571 penny stocks with strong financials that may still have room to surprise the market.

- Position yourself for the next stage of digital transformation by filtering companies involved in AI innovation through these 25 AI penny stocks.

- Identify potentially attractive entry points by targeting stocks priced below their cash flow estimates with these 918 undervalued stocks based on cash flows before sentiment changes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal