We Think TriStar Gold (CVE:TSG) Can Afford To Drive Business Growth

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So, the natural question for TriStar Gold (CVE:TSG) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Does TriStar Gold Have A Long Cash Runway?

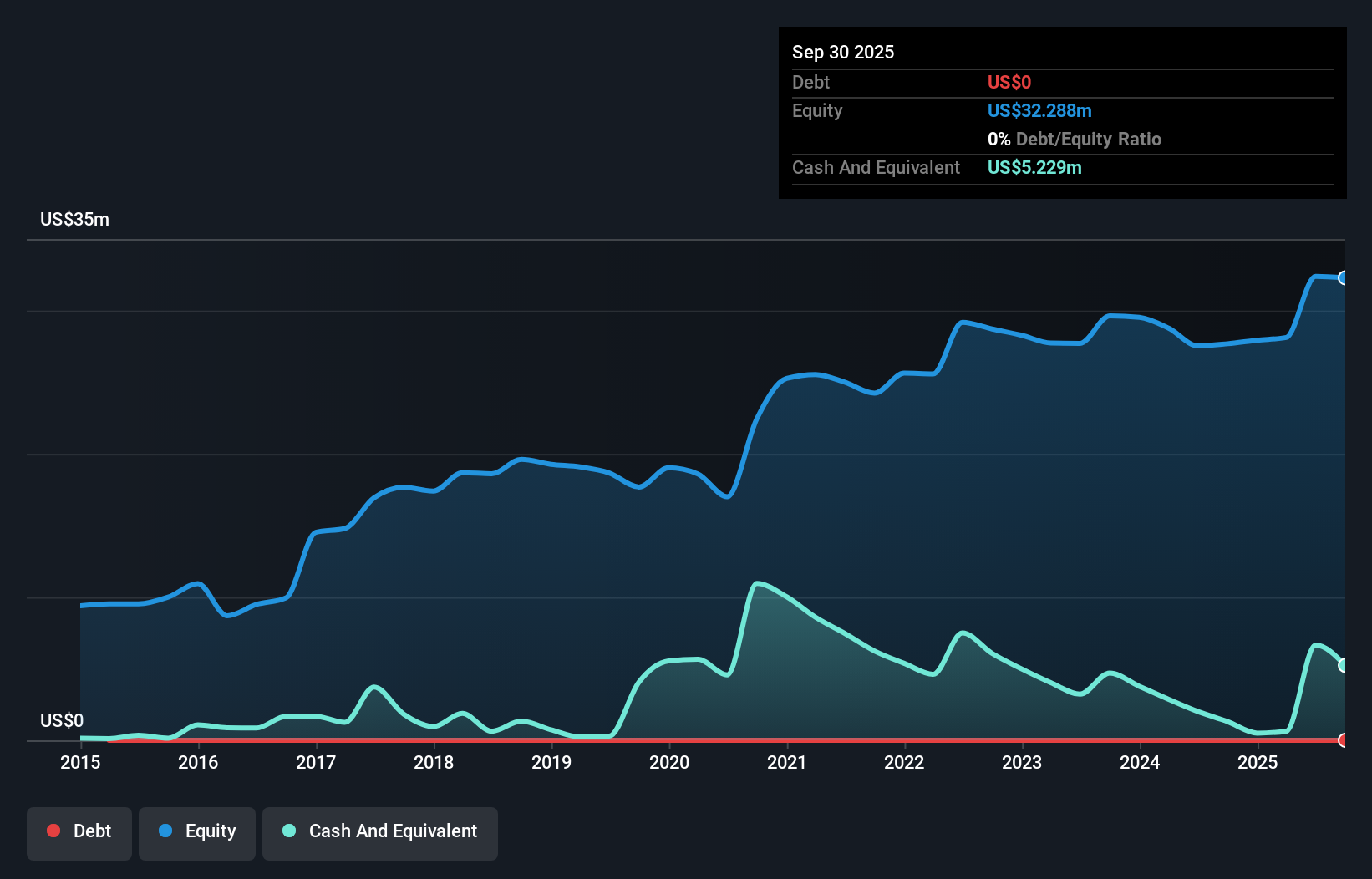

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at September 2025, TriStar Gold had cash of US$5.2m and no debt. Importantly, its cash burn was US$3.5m over the trailing twelve months. So it had a cash runway of approximately 18 months from September 2025. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. You can see how its cash balance has changed over time in the image below.

View our latest analysis for TriStar Gold

How Is TriStar Gold's Cash Burn Changing Over Time?

TriStar Gold didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Cash burn was pretty flat over the last year, which suggests that management are holding spending steady while the business advances its strategy. Admittedly, we're a bit cautious of TriStar Gold due to its lack of significant operating revenues. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

Can TriStar Gold Raise More Cash Easily?

While its cash burn is only increasing slightly, TriStar Gold shareholders should still consider the potential need for further cash, down the track. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of US$45m, TriStar Gold's US$3.5m in cash burn equates to about 7.7% of its market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

How Risky Is TriStar Gold's Cash Burn Situation?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought TriStar Gold's cash burn relative to its market cap was relatively promising. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. On another note, TriStar Gold has 4 warning signs (and 2 which make us uncomfortable) we think you should know about.

Of course TriStar Gold may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal