Why Investors Shouldn't Be Surprised By One Stop Systems, Inc.'s (NASDAQ:OSS) 31% Share Price Surge

One Stop Systems, Inc. (NASDAQ:OSS) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. The annual gain comes to 156% following the latest surge, making investors sit up and take notice.

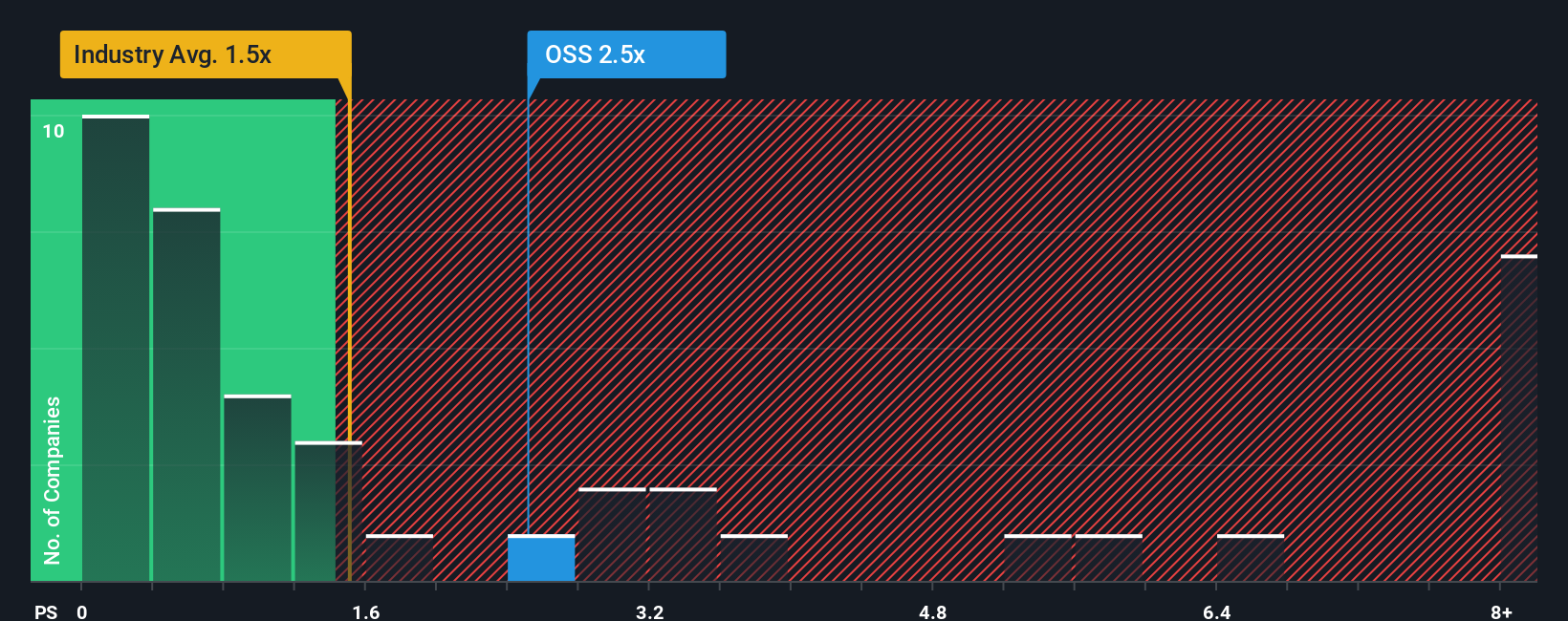

After such a large jump in price, you could be forgiven for thinking One Stop Systems is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.5x, considering almost half the companies in the United States' Tech industry have P/S ratios below 1.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for One Stop Systems

How One Stop Systems Has Been Performing

One Stop Systems certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on One Stop Systems.Do Revenue Forecasts Match The High P/S Ratio?

One Stop Systems' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. Still, lamentably revenue has fallen 16% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 15% over the next year. That's shaping up to be materially higher than the 10% growth forecast for the broader industry.

With this in mind, it's not hard to understand why One Stop Systems' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The large bounce in One Stop Systems' shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of One Stop Systems' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 2 warning signs for One Stop Systems that you need to take into consideration.

If these risks are making you reconsider your opinion on One Stop Systems, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal