Assessing Netflix (NFLX) Valuation After Recent Share Price Pullback

Netflix (NFLX) has slipped about 5% over the past month and roughly 16% in the past 3 months, a pullback that has some investors revisiting whether the stock’s recent run still makes sense.

See our latest analysis for Netflix.

Zooming out, Netflix’s recent pullback comes after a strong run, with a year to date share price return still in positive territory and a three year total shareholder return above 200%. This suggests that long term momentum remains intact even as near term optimism cools.

If streaming’s latest pause has you thinking about where growth could show up next, it might be worth exploring high growth tech and AI stocks as potential next wave beneficiaries.

With shares down recently but still trading below Wall Street targets and many growth levers intact, investors face a key question: Is Netflix undervalued after the pullback, or is the market already pricing in its next chapter of expansion?

Most Popular Narrative: 22.8% Undervalued

Against a last close of $103.96, the most followed narrative points to a fair value well above that level, framing Netflix as materially mispriced.

Enhanced user experience from a major UI/UX refresh, combined with advanced personalization and recommendation features leveraging generative AI improves member engagement and content discovery, which is likely to increase retention rates and viewing time, leading to higher revenue and better operating margins.

Want to see what kind of revenue, margin expansion, and earnings trajectory this story is built on? The assumptions hide a surprisingly aggressive profitability ramp and premium future multiple that only make sense once you see them laid out.

Result: Fair Value of $134.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising content costs and intensifying competition could pressure margins and subscriber growth, challenging the bullish case if engagement and pricing power disappoint.

Find out about the key risks to this Netflix narrative.

Another Lens on Value

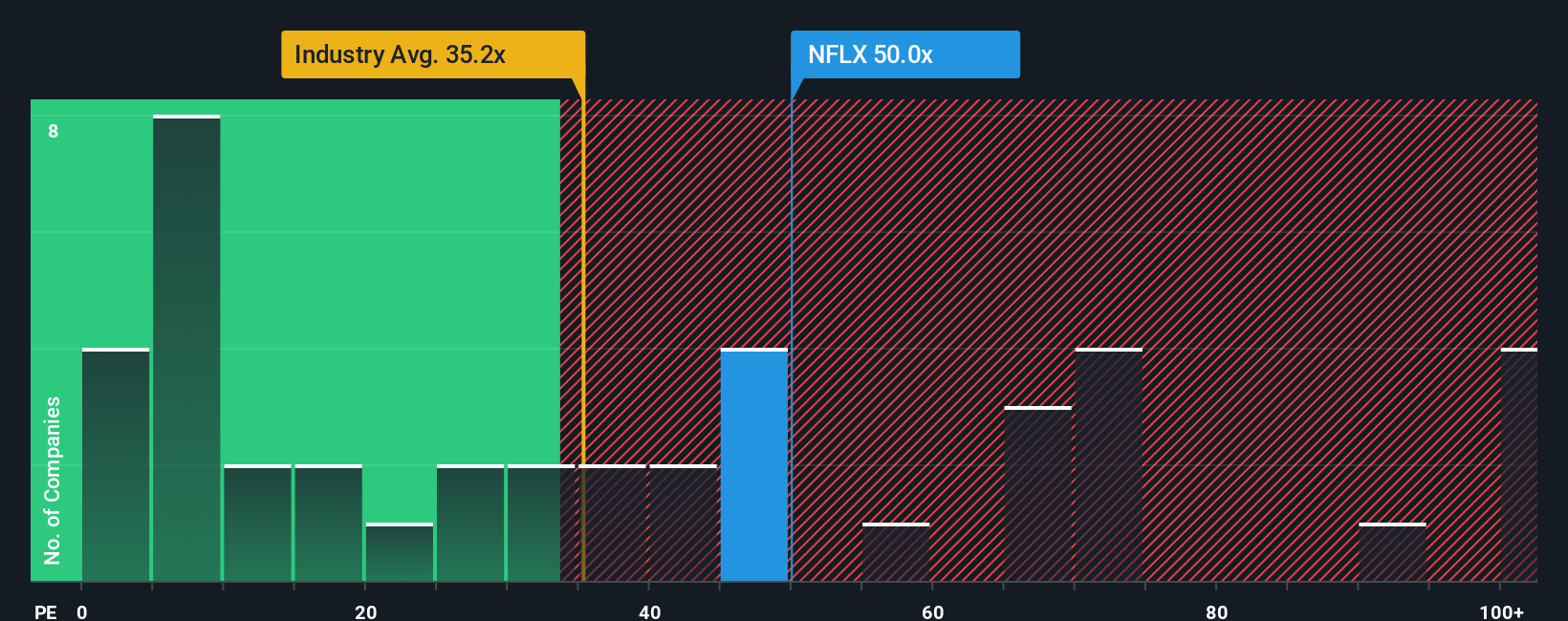

On earnings, Netflix looks less clear cut. The stock trades at about 42.2 times earnings versus a fair ratio of 33.6 and a US Entertainment average of 20.9. This suggests investors are already paying up for quality. Is that premium a cushion, or a future drag on returns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Netflix Narrative

If your view diverges or you prefer digging into the numbers yourself, you can build a personalized Netflix story in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Netflix.

Looking for more investment ideas?

If you stop with Netflix, you could miss out on other powerful opportunities. Use the Simply Wall Street Screener to uncover what the market is overlooking.

- Capture early momentum by targeting fast moving names in these 3570 penny stocks with strong financials before broader investors catch on.

- Position yourself for the next wave of innovation by focusing on companies within these 25 AI penny stocks transforming entire industries.

- Lock in potential bargains by zeroing in on these 919 undervalued stocks based on cash flows that markets may be mispricing right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal