Seagate (STX): Assessing Valuation After AI-Driven Storage Demand and Mozaic Efficiency Gains

Seagate Technology Holdings (STX) is back in the spotlight as AI driven demand for high capacity storage and cloud expansion collides with record Mozaic powered efficiency gains. This is easing short interest and reshaping expectations around its growth runway.

See our latest analysis for Seagate Technology Holdings.

Despite a choppy past week, Seagate’s share price has climbed 37.47% over the last 90 days and its three year total shareholder return of 425.54% signals powerful, still building momentum around the AI storage story.

If Seagate’s run has you rethinking where the next leg of tech growth could come from, it is worth exploring high growth tech and AI stocks as potential future winners.

With revenue and earnings growth accelerating alongside a still meaningful discount to analyst targets, the key question now is whether Seagate is genuinely undervalued or if the market is already pricing in years of AI fueled expansion.

Most Popular Narrative: 9.9% Undervalued

With Seagate closing at $258.67 against a narrative fair value near $287, the current price embeds a noticeable gap in expectations that hinges on a bold earnings roadmap.

Analysts expect earnings to reach $2.5 billion (and earnings per share of $11.7) by about September 2028, up from $1.5 billion today. The analysts are largely in agreement about this estimate.

Curious how this narrative stretches earnings, margins, and valuation multiples over the next few years without looking extreme on paper? The assumptions behind that fair value pivot on a mix of accelerating revenue, thicker profit margins, and a future earnings multiple that still sits below many growth heavyweights. Want to see exactly how those moving parts stack up to justify the gap to fair value, and what would have to go right for it to hold?

Result: Fair Value of $287.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, cyclical demand swings, intensifying SSD competition, and potential global tax changes could quickly challenge the upbeat earnings and valuation narrative.

Find out about the key risks to this Seagate Technology Holdings narrative.

Another Angle on Valuation

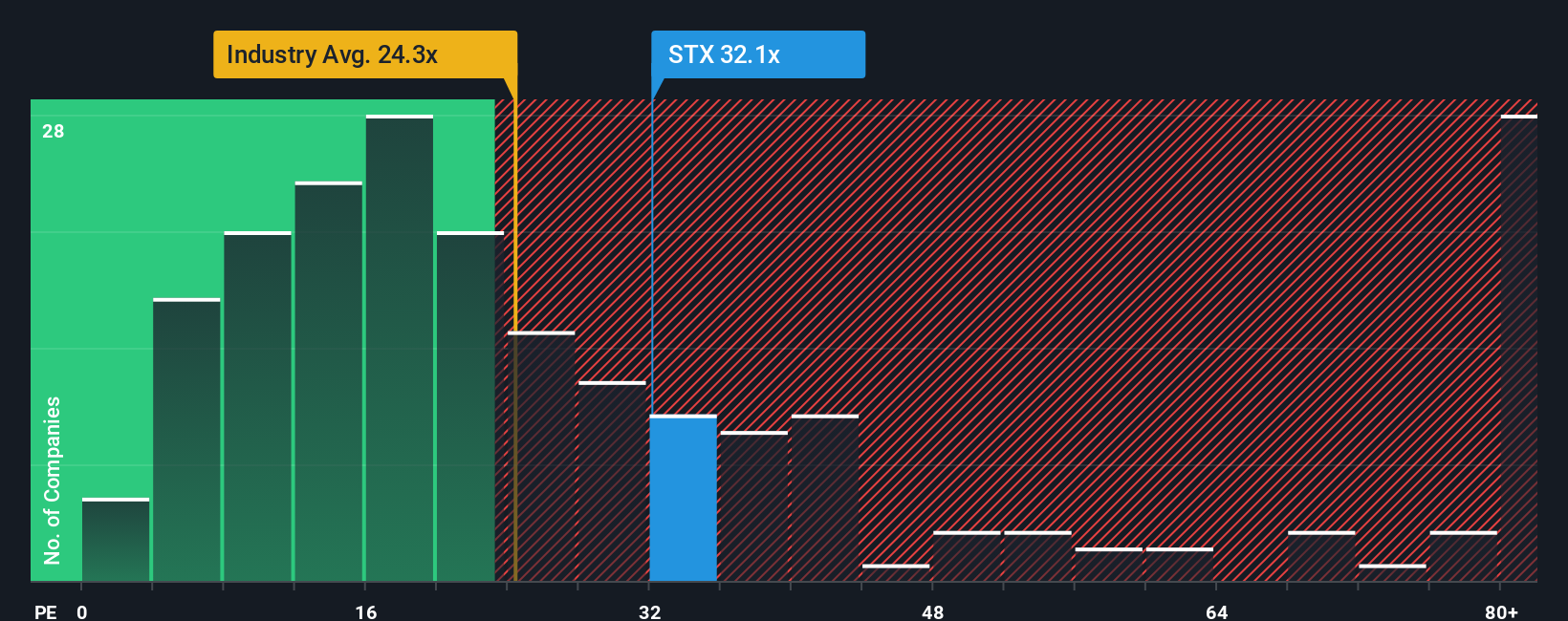

Seagate might look 9.9% undervalued on narrative fair value, but its 32.9x earnings multiple is rich versus the global tech sector at 22.6x and peers at 18.2x. The fair ratio of 35.8x leaves room on paper, but also raises the risk of a sharp rerating if growth cools, or sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Seagate Technology Holdings Narrative

If this framework does not quite match your view, or you simply want to dig into the data yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Seagate Technology Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment opportunities?

Before you move on, use the Simply Wall St Screener to uncover fresh, data backed ideas that could reshape your portfolio and sharpen your edge.

- Capture mispriced potential by targeting value rich businesses through these 920 undervalued stocks based on cash flows that the market has not fully recognised yet.

- Ride powerful secular trends in automation and smart infrastructure by narrowing in on these 25 AI penny stocks with meaningful upside drivers.

- Strengthen your income stream and reduce guesswork by focusing on reliable payers inside these 14 dividend stocks with yields > 3% that already clear a 3% yield hurdle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal