Stronger Quarter but Cautious Outlook Might Change The Case For Investing In Adtalem Global Education (ATGE)

- In its recent earnings report, Adtalem Global Education posted US$462.3 million in revenue, up 10.8% year on year and ahead of analyst estimates, while also beating earnings expectations.

- However, the company’s full-year revenue outlook only matched analyst forecasts and lagged peers’ guidance updates, tempering enthusiasm around the otherwise strong quarterly performance.

- Next, we’ll examine how Adtalem’s stronger-than-expected quarter but cautious full-year revenue guidance shapes its evolving investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Adtalem Global Education's Investment Narrative?

To own Adtalem Global Education, you really need to believe in the long-term demand for career-focused healthcare and professional education, backed by solid profitability and what has been a history of growing earnings. The latest quarter delivered on that story with better-than-expected revenue and earnings, yet the stock’s sharp pullback after management reiterated a more restrained full-year revenue outlook suggests investors were banking on a more upbeat trajectory. That guidance now becomes a central short term catalyst, as the market weighs whether this is simple prudence or an early sign of slower enrollment or pricing momentum. At the same time, the company’s continued use of buybacks and relatively low earnings multiple support the existing thesis, but the gap between strong recent results and cautious guidance is now one of the key risks to watch.

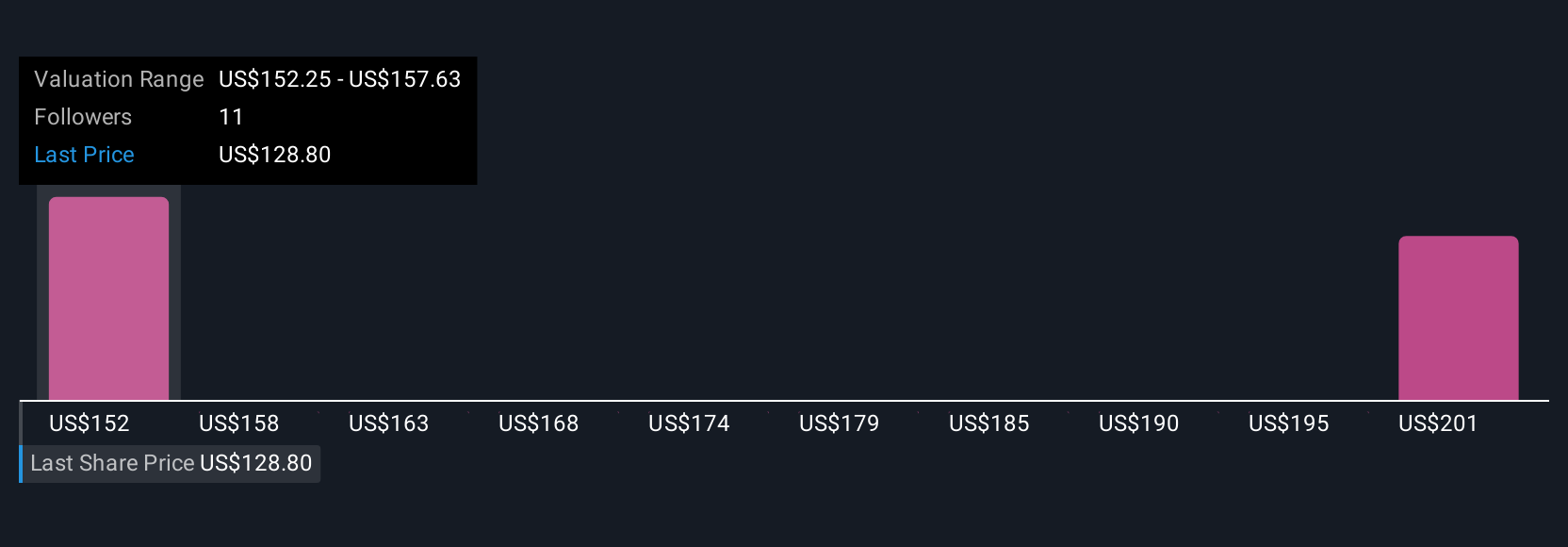

However, investors should pay close attention to what the softer revenue outlook might be signalling. Adtalem Global Education's shares have been on the rise but are still potentially undervalued by 48%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Adtalem Global Education - why the stock might be worth just $166.50!

Build Your Own Adtalem Global Education Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adtalem Global Education research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Adtalem Global Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adtalem Global Education's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal