Stronger Q3 Beat and Gen2X Launch Might Change The Case For Investing In Impinj (PI)

- In late 2025, Impinj reported third-quarter results that exceeded market expectations, with earnings per share of US$0.58 and revenue of US$96.1 million, while also unveiling new Gen2X RFID innovations aimed at combating counterfeiting and improving tag targeting at its Solutions Developers Conference 2025.

- These results build on several years of strong revenue and earnings growth, reinforcing the view that Impinj’s product innovation and operating leverage are increasingly central to its long-term RFID platform opportunity.

- We’ll now examine how the stronger-than-expected third-quarter earnings and Gen2X product launch could reshape Impinj’s existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Impinj Investment Narrative Recap

To own Impinj, you need to believe in long-term RAIN RFID adoption across retail, logistics and other industries, and in the company’s ability to convert that into profitable platform economics. The Q3 earnings beat and Gen2X launch support that thesis but do not materially change the near term picture, where macro uncertainty and customer concentration still look like the key swing factors for results.

The most relevant recent development here is the Gen2X product introduction, which directly targets customer pain points such as counterfeiting and stray reads. If brands and logistics providers view these capabilities as meaningful improvements in accuracy and security, Gen2X could help accelerate deployments in Impinj’s core verticals and newer areas like industrial and healthcare, potentially reinforcing its role as a go to RFID platform partner.

Yet despite the strong quarter, investors should still be aware that heavy reliance on a handful of large retail and logistics customers...

Read the full narrative on Impinj (it's free!)

Impinj's narrative projects $630.4 million revenue and $91.2 million earnings by 2028.

Uncover how Impinj's forecasts yield a $241.11 fair value, a 47% upside to its current price.

Exploring Other Perspectives

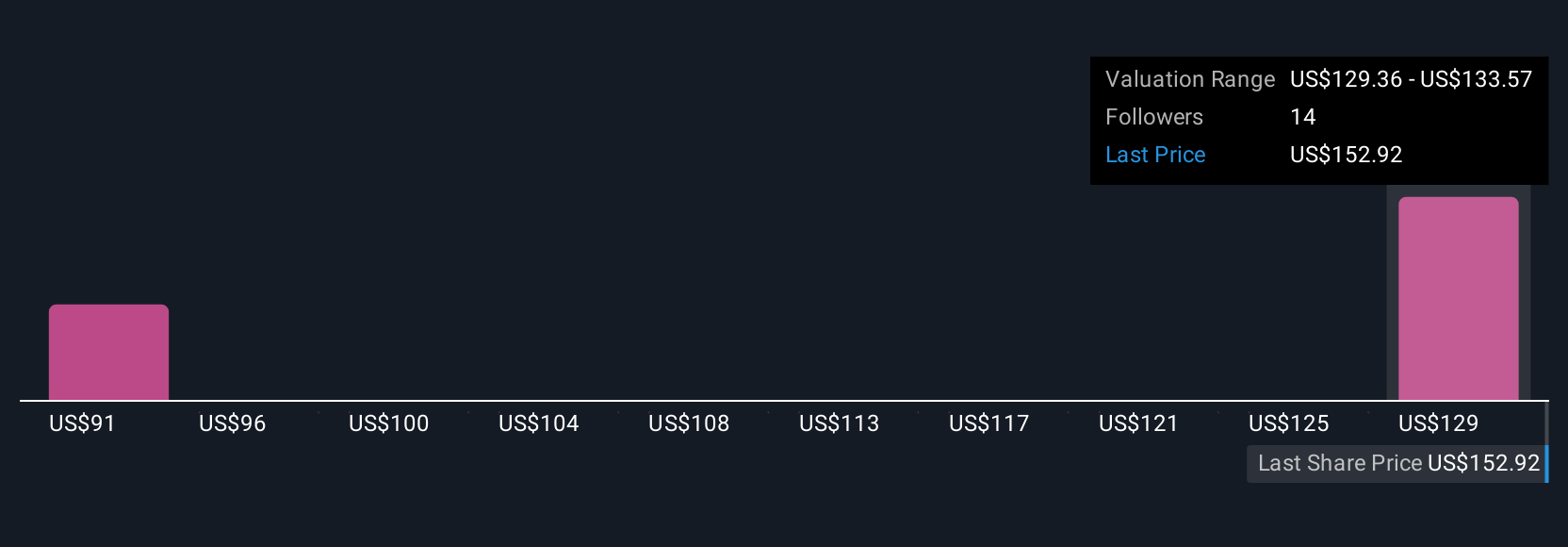

Two Simply Wall St Community fair value estimates for Impinj range from US$174.87 to US$241.11, highlighting very different views on upside potential. You might weigh those against the risk that growth remains heavily tied to a few key retail and logistics customers, which could amplify revenue swings and affect how those valuations play out.

Explore 2 other fair value estimates on Impinj - why the stock might be worth as much as 47% more than the current price!

Build Your Own Impinj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Impinj research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Impinj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Impinj's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal