Does Furukawa Electric’s (TSE:5801) Asset Sale Signal a Deeper Shift in Capital Allocation Priorities?

- Furukawa Electric Co., Ltd. previously announced that it had sold part of its investment securities, booking an extraordinary income gain of ¥16,000,000,000 that is already reflected in its earnings forecast for the fiscal year ending March 31, 2026.

- The move highlights management’s focus on improving asset efficiency and strengthening the balance sheet by reallocating capital away from non-core investment holdings.

- Next, we’ll examine how this large one-off gain from selling investment securities shapes Furukawa Electric’s broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Furukawa Electric's Investment Narrative?

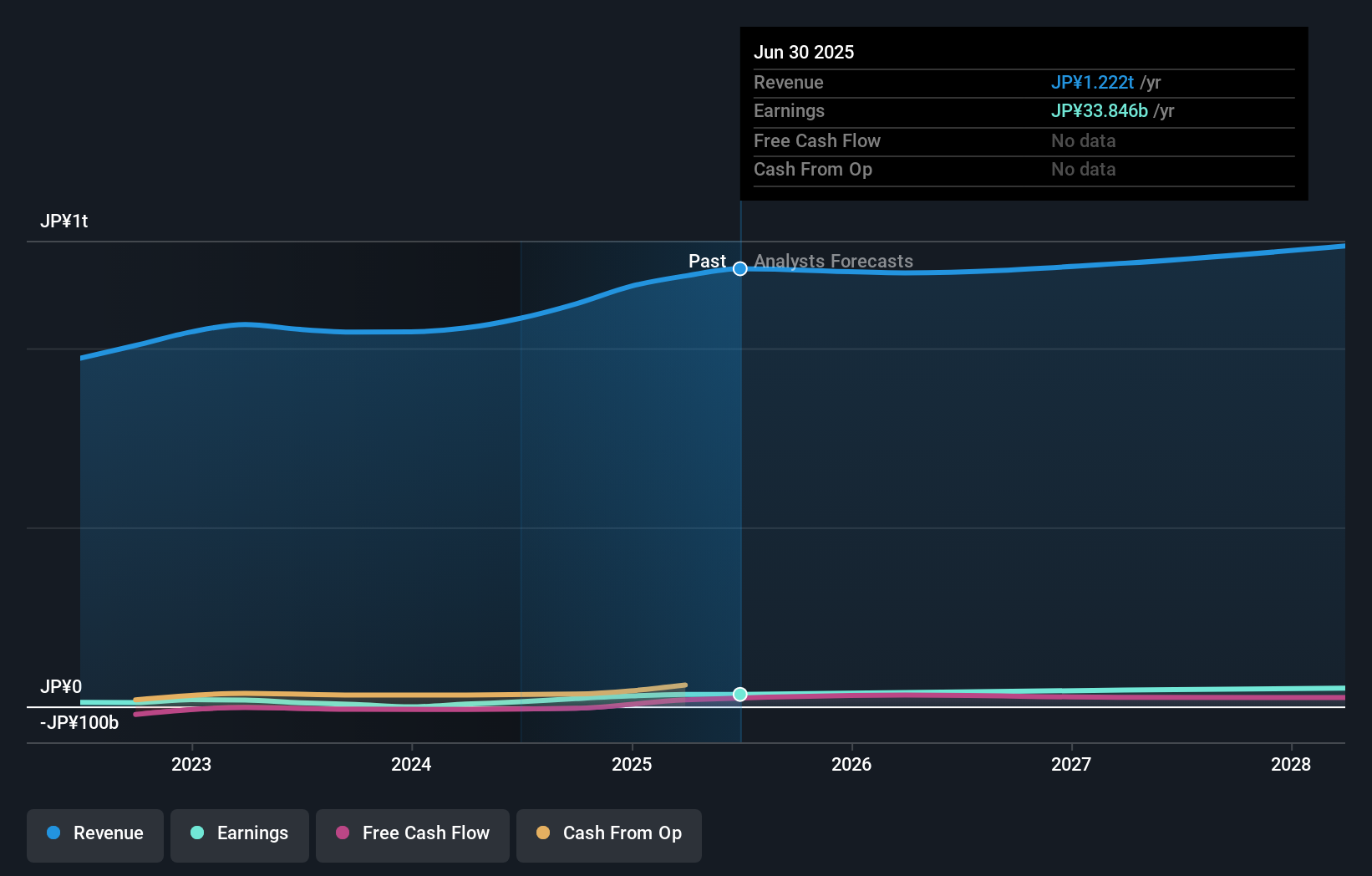

To own Furukawa Electric, you really need to believe in a steady, incremental earnings story rather than a breakneck growth one: modest revenue expansion, improving margins and tighter capital discipline. The recent ¥16,000,000,000 gain from selling investment securities fits that story neatly, reinforcing the shift toward higher asset efficiency and a cleaner balance sheet, but it is a one-off and does not change the underlying reliance on the core electrical and electronics businesses. Near term, investor attention still centers on execution against FY2026 guidance, integration of Fujitsu Optical Components, and Furukawa’s role in semiconductor-related projects like the JOINT3 consortium. The new board structure and relatively short board tenure keep governance firmly on the risk list, alongside high earnings multiples and volatile recent share price moves.

However, investors should also be aware of Furukawa Electric’s elevated valuation and governance transition risks. Furukawa Electric's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Furukawa Electric - why the stock might be worth as much as ¥10055!

Build Your Own Furukawa Electric Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Furukawa Electric research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Furukawa Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Furukawa Electric's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal