Is Oppenheimer’s Focus on Ampreloxetine Quietly Redefining Theravance Biopharma’s (TBPH) Risk-Reward Profile?

- Oppenheimer recently initiated coverage on Theravance Biopharma with an Outperform rating, emphasizing the importance of the Phase 3 ampreloxetine readout expected in the first quarter of 2026 and the company’s virtual key opinion leader event on this program.

- The focus on ampreloxetine as a potential billion-dollar therapy in a rare neurogenic condition highlights how pivotal this single late-stage asset has become for Theravance’s future prospects and risk profile.

- We’ll now explore how Oppenheimer’s initiation and emphasis on ampreloxetine’s upcoming Phase 3 data reshape Theravance Biopharma’s broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Theravance Biopharma Investment Narrative Recap

To own Theravance Biopharma today, you effectively need to believe that ampreloxetine’s Phase 3 program will succeed and justify the company’s current dependence on a single late stage asset. Oppenheimer’s initiation does not change the fact that the Phase 3 readout in the first quarter of 2026 remains both the most important near term catalyst and the biggest risk, given the revenue concentration around YUPELRI and ampreloxetine.

Among recent updates, the August 25 announcement that the CYPRESS study is on track for topline data in the first quarter of 2026 ties directly into the ampreloxetine story. With orphan drug designation in the U.S. and a planned NDA filing contingent on CYPRESS outcomes, regulatory progress here will shape how meaningful that Phase 3 catalyst can be for Theravance’s revenue mix and earnings trajectory over time.

Yet while the upside from ampreloxetine is appealing, investors should be aware that...

Read the full narrative on Theravance Biopharma (it's free!)

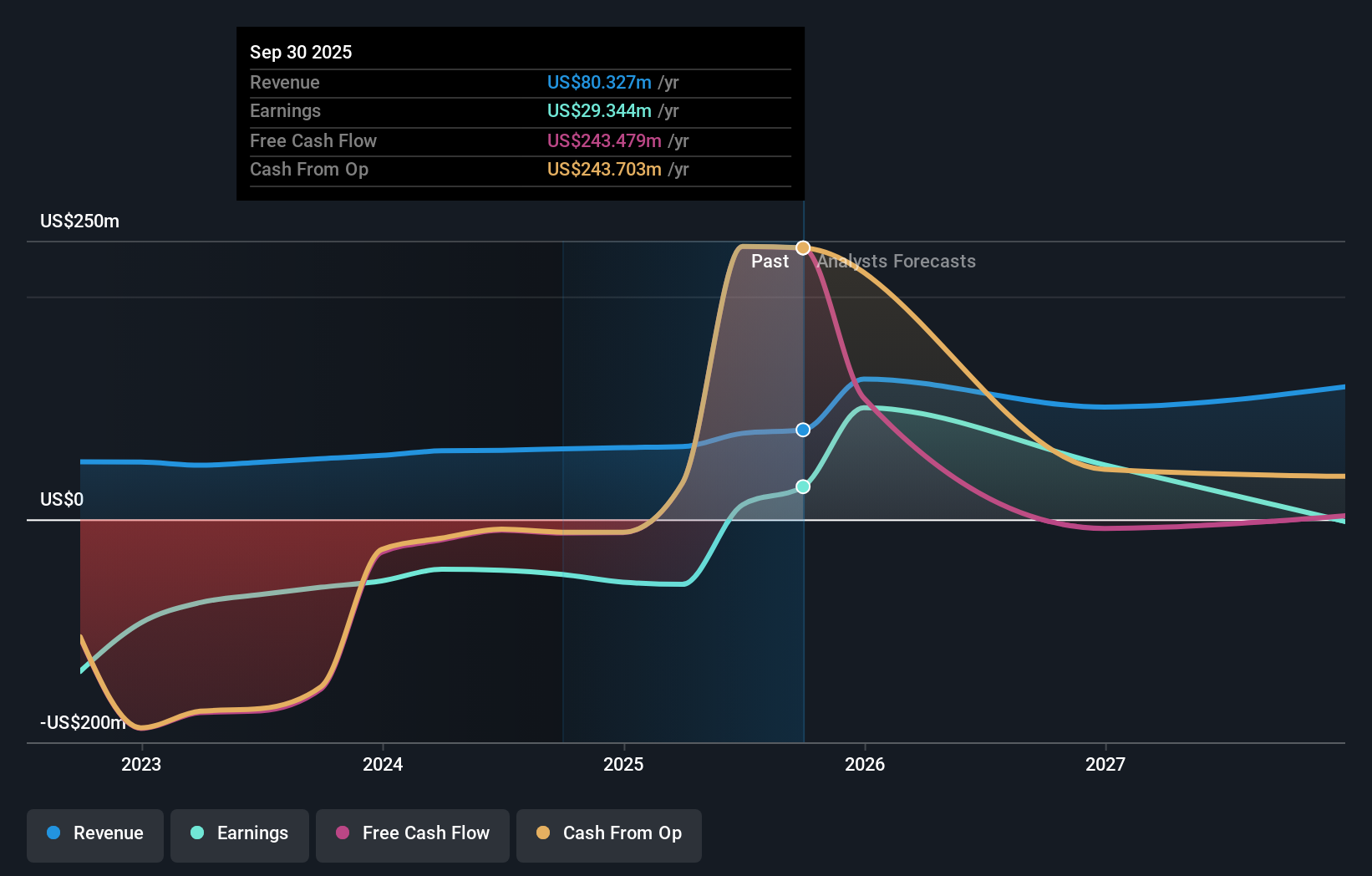

Theravance Biopharma's narrative projects $128.8 million revenue and $29.9 million earnings by 2028.

Uncover how Theravance Biopharma's forecasts yield a $26.67 fair value, a 45% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span a wide range, from about US$1.56 to US$26.67 per share, underscoring how differently people view Theravance’s prospects. Against this backdrop, the heavy reliance on ampreloxetine’s 2026 Phase 3 readout becomes a central issue for anyone weighing those contrasting opinions.

Explore 2 other fair value estimates on Theravance Biopharma - why the stock might be worth less than half the current price!

Build Your Own Theravance Biopharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Theravance Biopharma research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Theravance Biopharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Theravance Biopharma's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal