Tripadvisor (TRIP): Assessing Valuation After New Rewards Perks and Strong Winter Travel Trends

Tripadvisor (TRIP) just paired upbeat winter travel data with fresh perks in its Tripadvisor Rewards program, including a $50 activity credit and extra Trip Cash on app bookings, which together could quietly strengthen demand and loyalty.

See our latest analysis for Tripadvisor.

Despite these loyalty perks and solid winter demand, Tripadvisor’s 1 year total shareholder return of 4.88 percent and 3 year total shareholder return of negative 14.21 percent show only modest progress, while recent 90 day share price weakness suggests momentum has been fading for now.

If this kind of travel rebound has you thinking more broadly about the market, it could be a smart time to explore fast growing stocks with high insider ownership.

With shares still trading at a steep discount to some intrinsic value estimates despite improving growth and loyalty tailwinds, investors now face a pivotal question: is Tripadvisor a quietly undervalued reopening play, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 15.9% Undervalued

Compared to Tripadvisor’s last close at $15.27, the most popular narrative points to a higher fair value, framing today’s price as a potential discount.

The accelerated adoption of app usage, launched rewards program, and personalized, AI-powered recommendations are driving deeper user engagement and shifting customers away from paid channels to higher-ARPU, repeat users, which is likely improving net margins and stabilizing future earnings as reliance on costly third-party acquisition declines.

Curious how this engagement flywheel translates into a richer valuation story, from steady revenue compounding to a leaner profit profile over time, without relying on heroic assumptions?

Result: Fair Value of $18.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent organic traffic declines and intensifying competition from Google and travel super apps could compress margins and undermine those optimistic growth assumptions.

Find out about the key risks to this Tripadvisor narrative.

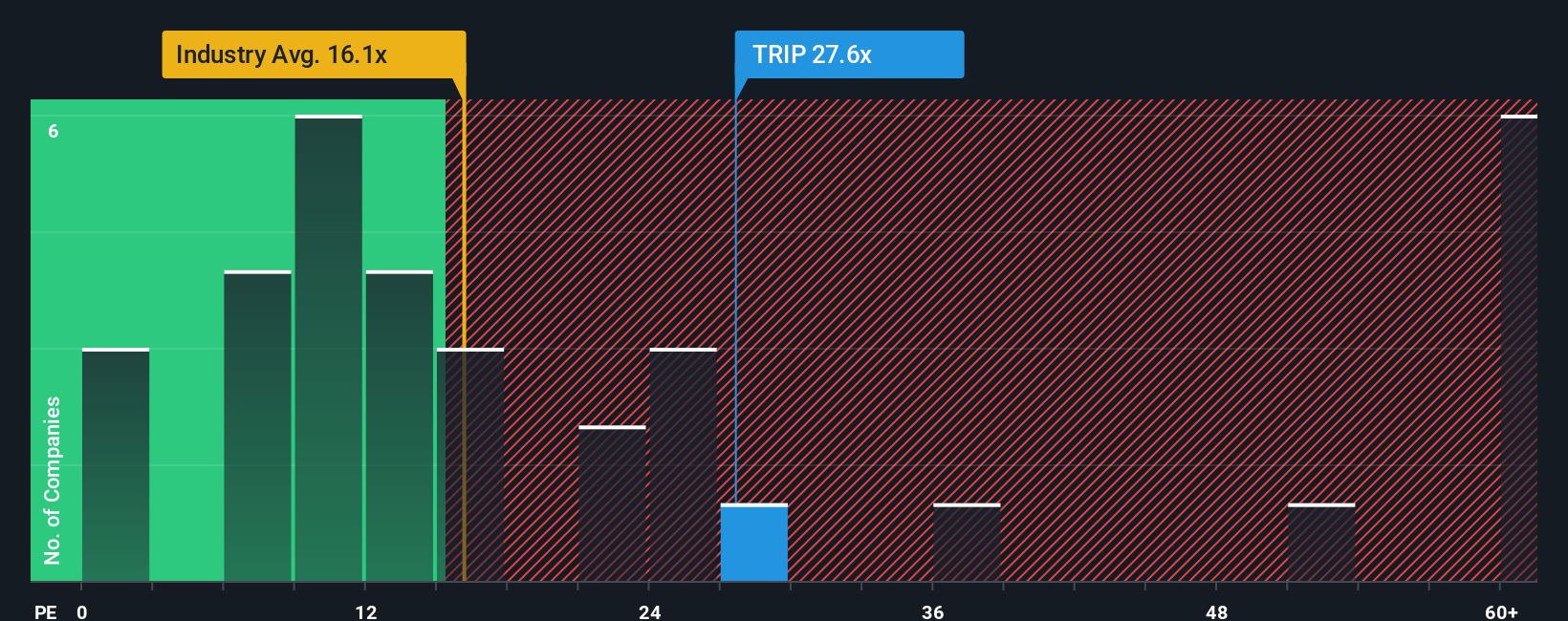

Another Angle on Value: Earnings Multiple Tells a Tougher Story

While the narrative suggests Tripadvisor is 15.9 percent undervalued, its current price to earnings ratio of 22.6 times appears expensive versus the industry at 16.4 times, peers at 19.6 times, and even a fair ratio of 20.6 times. This points to downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tripadvisor Narrative

If you see the story playing out differently, or just want to dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Tripadvisor research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next edge by scanning targeted stock ideas on Simply Wall St so you never leave great opportunities on the table.

- Capitalize on potential market mispricings by zeroing in on these 919 undervalued stocks based on cash flows that may be trading below their intrinsic worth.

- Ride powerful secular themes by focusing on these 25 AI penny stocks positioned to benefit from advances in artificial intelligence.

- Strengthen your income stream by targeting these 14 dividend stocks with yields > 3% that can help support cash returns in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal