IPO News | Ziguang Co., Ltd. (000938.SZ) reports that the Hong Kong Stock Exchange is the third-largest supplier in China's digital infrastructure market

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on December 3, Ziguang Co., Ltd. (Ziguang Shares for short) submitted to the main board of the Hong Kong Stock Exchange, with CITIC Construction Investment International, BNP Paribas, and CMB International as co-sponsors.

According to the prospectus, Ziguang Co., Ltd. (000938.SZ) is a digital solution provider. The solutions include ICT infrastructure products (covering computing, storage, connectivity, and security) as well as cloud services and system integration, which are mainly used in scenarios such as artificial intelligence training and reasoning and big data processing. Over the track record period, more than 90% of the company's revenue came from mainland China, while less than 10% of its revenue came from overseas.

According to Frost & Sullivan, in 2024, the company was the third-largest supplier in China's digital infrastructure market, with a market share of 8.6% in terms of revenue. The Chinese digital infrastructure market is a segment of the Chinese digital solutions market. In terms of revenue, in 2024, the company ranked in the top ten digital solutions market in China.

The solutions provided by the company can help customers from all walks of life accelerate their digital and intelligent transformation. The core business is:

Digital solutions: Design, develop and supply ICT infrastructure products, including computing, storage, connectivity and security products, which can be provided as stand-alone products or as tailored turnkey solutions to meet customers' specific requirements; provide cloud services and system integration services to complement the infrastructure product portfolio to meet the specific needs of customers.

ICT product distribution: In addition to self-developed products, the company also distributes ICT products purchased from domestic and foreign brands to Chinese customers.

As of June 30, 2025, the company's sales and service have covered more than 100 countries and regions around the world. It has established 32 overseas subsidiaries in Asia, Europe, Africa, and Latin America. The company's extensive sales network continues to expand, enabling the company to provide high-quality products and services to customers around the world.

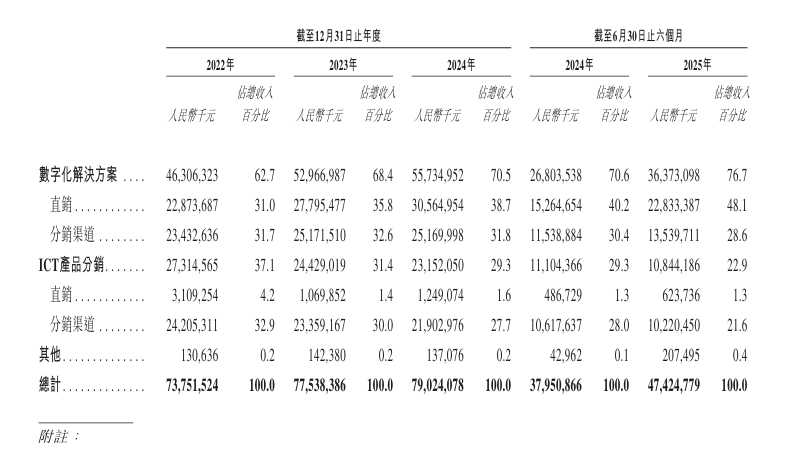

The company sells products and solutions through direct sales and distributors to effectively meet the needs of customers in different industries. The revenue contributions of the main sales channels by business segment during the track record period are shown in the figure below:

The company's customers are mainly located in China. The company's customer base through direct sales covers a wide range of industries, including internet, communications, government, finance, healthcare, education, transportation, manufacturing, utilities, energy, and construction. The company also uses distributors to expand geographical coverage and increase market penetration. As of June 30, 2025, the company has established a vast distribution network of more than 7,300 distributors.

Financial data

revenue

In 2022, 2023, 2024 and 2025 for the six months ended June 30, the company recorded revenue of $77.752 billion, $77.538 billion, $79.024 billion and $47.425 billion respectively.

profit

In 2022, 2023, 2024 and 2025 for the six months ended June 30, the company recorded year/period profits of $3,742 billion, $3,685 billion, $1,982 billion and $1,285 billion respectively.

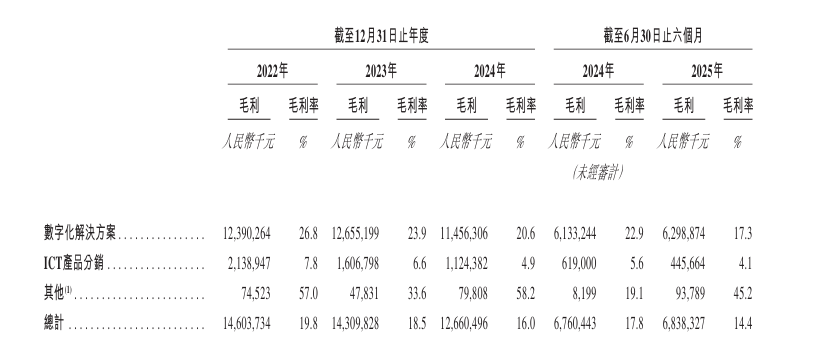

gross profit margin

In 2022, 2023, 2024 and 2025 for the six months ended June 30, the company's gross margins were 19.8%, 18.5%, 16% and 14.4%, respectively.

Industry Overview

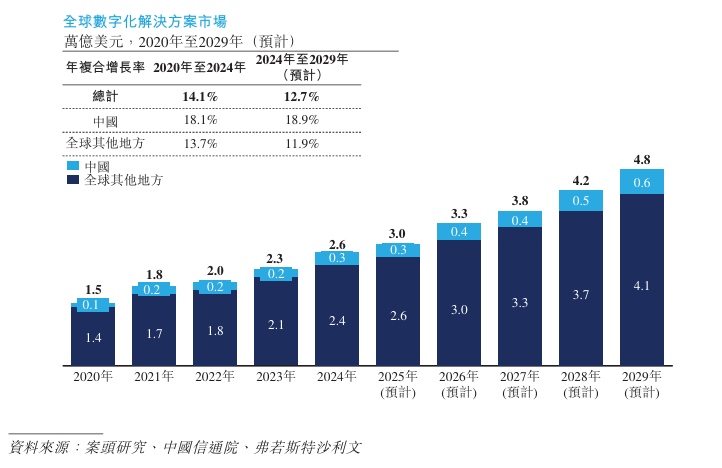

Overview of the global and Chinese digital solutions market

The digital solutions market refers to a range of digital products and services covering a wide range of technologies, products, platforms and services that provide enterprise-level customers with digital and AI capabilities to achieve efficiency improvement, innovative development, and value creation.

The global digital solutions market has maintained steady growth over the past five years, from US$1.5 trillion in 2020 to US$2.6 trillion in 2024, with a compound annual growth rate of 14.1% between 2020 and 2024. With the further development of the global digital economy, especially with the continuous innovation and application of emerging technologies, the global digital solutions market is expected to reach US$4.8 trillion in 2029, with a compound annual growth rate of 12.7% from 2024 to 2029.

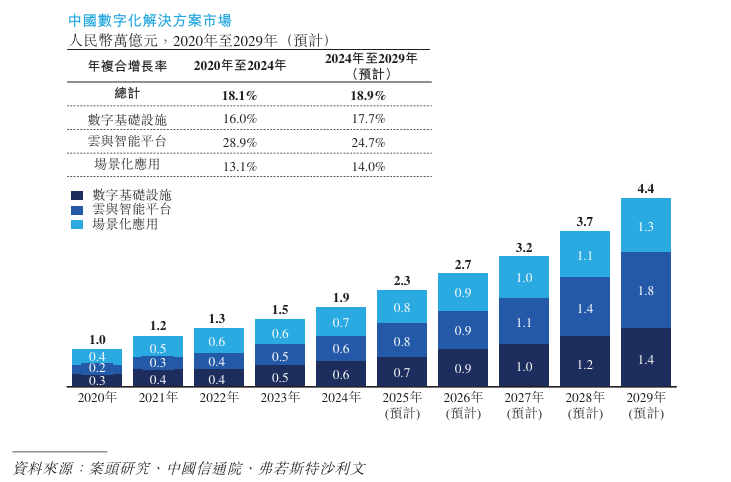

China's digital solutions market has maintained a steady growth trend. China's digital solutions market grew from RMB 1.0 trillion in 2020 to RMB 1.9 trillion in 2024, with a compound annual growth rate of 18.1%. China's digital solutions market is expected to reach RMB 4.4 trillion by 2029, with a compound annual growth rate of 18.9% between 2024 and 2029.

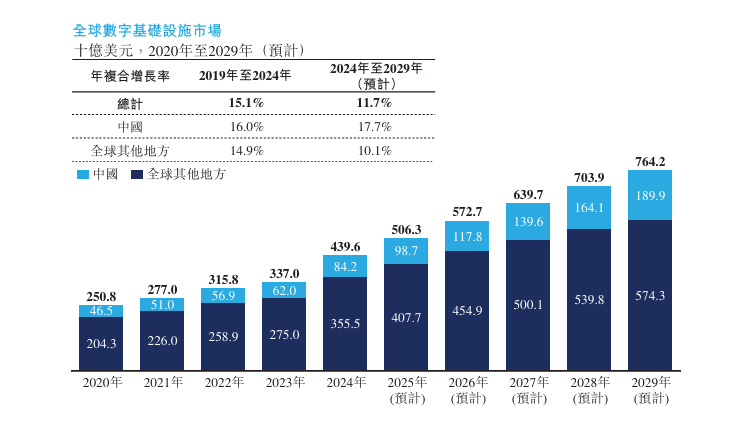

Overview of the global and Chinese digital infrastructure market

The global digital infrastructure market grew from US$250.8 billion in 2020 to US$439.6 billion in 2024, with a compound annual growth rate of 15.1% between 2020 and 2024. The global digital infrastructure market is expected to reach US$764.2 billion by 2029, with a compound annual growth rate of 11.7% between 2024 and 2029.

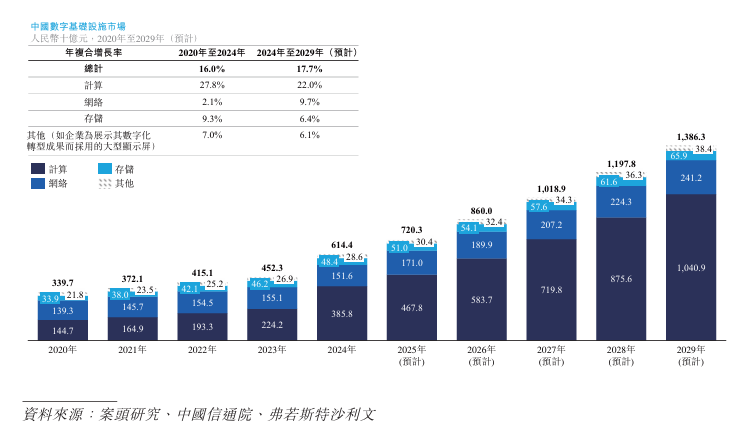

The size of China's digital infrastructure market grew from RMB 339.7 billion in 2020 to RMB 614.4 billion in 2024. The compound annual growth rate between 2020 and 2024 was higher than the global growth rate, reaching 16.0%. China's digital infrastructure market is expected to reach RMB 1,386.3 billion by 2029, with a compound annual growth rate of 17.7% between 2024 and 2029.

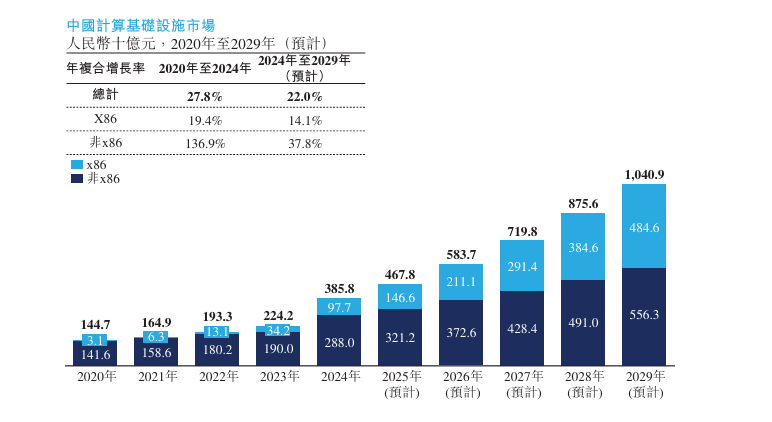

The computing infrastructure market is a segment of the digital infrastructure market. The number of companies in this market in China is less than 100. Benefiting from the increasing demand for computing power from emerging technologies such as artificial intelligence, big model training, and edge computing, enterprises and cloud service providers continue to increase their investment in related fields.

China's computing infrastructure market grew from RMB 144.7 billion in 2020 to RMB 385.8 billion in 2024, with a compound annual growth rate of 27.8% between 2020 and 2024, and is expected to reach RMB 1,409 billion by 2029, with a compound annual growth rate of 22.0%.

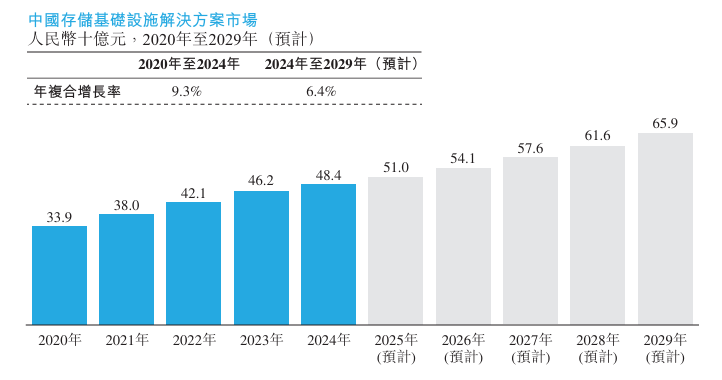

The storage infrastructure market is a segment of the digital infrastructure market, and the number of companies in this market in China is less than 100. China's storage infrastructure market grew from RMB 33.9 billion in 2020 to RMB 48.4 billion in 2024, with a compound annual growth rate of 9.3% between 2020 and 2024. The storage infrastructure market is expected to reach RMB 65.9 billion by 2029, with a compound annual growth rate of 6.4% between 2024 and 2029.

The network infrastructure market is a segment of the digital infrastructure market. The number of companies in this market in China is less than 100. With the development of 5G, industrial Internet, and data center connectivity, the demand for network architecture upgrades continues to grow, and the growth momentum is expected to gradually pick up.

China's network infrastructure market increased from RMB 139.3 billion in 2020 to RMB 151.6 billion in 2024, and is expected to reach RMB 241.2 billion in 2029. The network infrastructure market mainly includes products such as network switches, routers, and WLANs. The switch market grew from RMB 31.5 billion in 2020 to RMB 44.7 billion in 2024, with a compound annual growth rate of 9.1% between 2020 and 2024, and is expected to reach RMB 66.9 billion by 2029, with a compound annual growth rate of 8.4%.

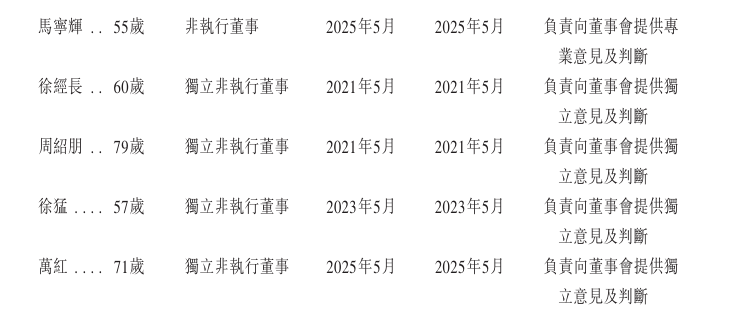

Board Information

The board of directors will be composed of nine directors, including 2 executive directors, 3 non-executive directors and 4 independent non-executive directors. The term of directors is three years, and they can be re-elected at the end of their term.

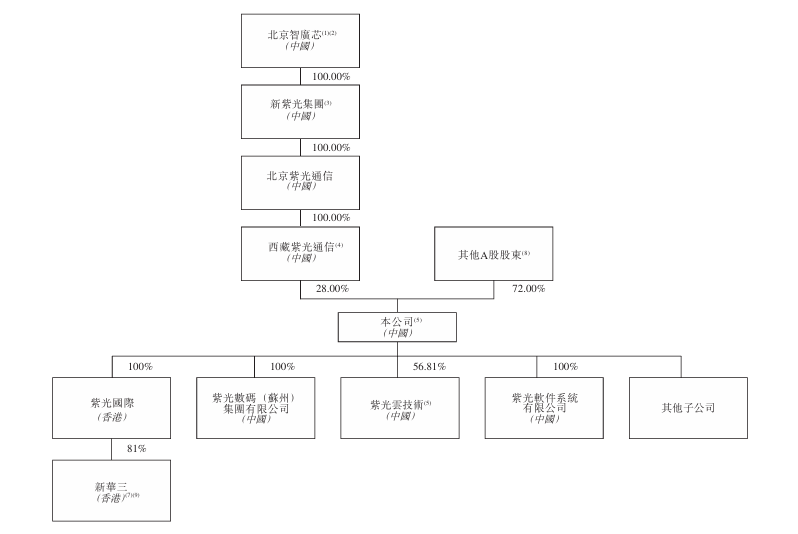

Shareholding structure

As of November 24, 2025, Tibet Ziguang Communications held 28.8% of the company's shares. Tibet Ziguang Communications is a wholly-owned subsidiary of Beijing Ziguang Communications, while Beijing Ziguang Communications is wholly owned by Beijing Ziguang Communications through its wholly-owned subsidiary Xinziguang Group. Therefore, according to securities and futures regulations, Beijing Ziguang Communications, New Ziguang Group, and Beijing Zhiguangxin are considered to have interests in A-shares held by Tibet Ziguang Communications.

Intermediary team

Co-sponsors: CITIC Construction Investment (International) Finance Co., Ltd., BNP Paribas Securities (Asia) Co., Ltd., CMB International Finance Co., Ltd.

Company Legal Advisers: Related to Hong Kong Law and US Law: Linklaters; Related Chinese Law: Beijing Jingtian Gongcheng Law Firm; Related International Sanctions Law and US Export Control Law: Hawking Lovell.

Legal adviser to the co-sponsors: Regarding Hong Kong law and US law: Pu Heng Law Firm (Hong Kong) Limited Liability Partnership; relating to Chinese law: Beijing Haiwen Law Firm.

Auditor and reporting accountant: Ernst & Young.

Industry consultant: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch.

Compliance Advisor: New Berry Finance Co., Ltd.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal