Waterdrop (NYSE:WDH) Margin Gain Reinforces Bullish Profitability Narrative

Waterdrop (NYSE:WDH) has followed up its latest quarter with solid headline numbers, as Q2 2025 revenue came in at about CNY 838 million and basic EPS landed at roughly CNY 0.39, which sets the stage for another year of profitability momentum. The company has seen revenue move from roughly CNY 676 million in Q2 2024 to about CNY 838 million in Q2 2025, while basic EPS has climbed from around CNY 0.24 to CNY 0.39 over the same period. This gives investors a cleaner, more scalable earnings profile as margins continue to firm up.

See our full analysis for Waterdrop.With the latest numbers on the table, the next step is to see how this earnings trajectory lines up with the major narratives investors have been debating around Waterdrop, and where the data might start to shift those stories.

See what the community is saying about Waterdrop

Margins Lift Net Income Power

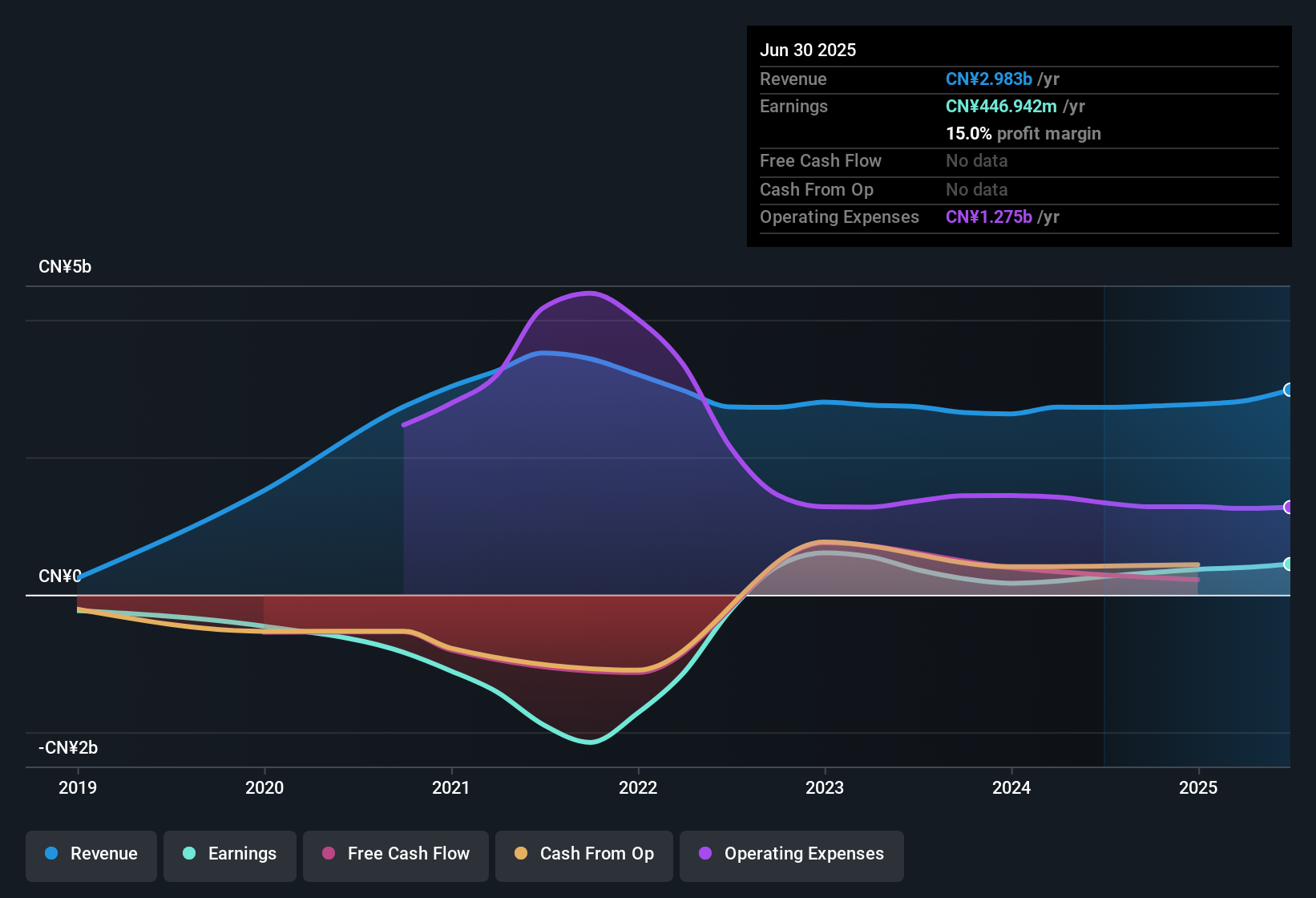

- Over the last 12 months, net profit margin sat at 15 percent compared with 9.7 percent a year earlier, alongside trailing net income of about CNY 446.9 million on roughly CNY 2.98 billion of revenue.

- Bulls see Waterdrop's push into AI driven tools and more inclusive insurance products as a way to keep strengthening profitability, yet the margin data also has to cover:

- Revenue rising about 12.4 percent per year on a trailing basis while earnings jumped 68.8 percent suggests recent efficiency gains are already embedded in the 15 percent margin.

- Analysts still model margins easing slightly from 14 percent to about 13.4 percent over three years, so bullish expectations for AI driven cost savings must at least offset that gentle squeeze.

Low 10.7x P/E Versus Peers

- The trailing price to earnings multiple of 10.7 times sits below both the peer average of 36.2 times and the broader US insurance industry at 13.1 times, even after earnings have grown about 68.8 percent over the past year.

- Consensus narrative notes that strategic expansion and tech investment should support growth, and the current valuation leaves room if that plays out:

- Analysts expect earnings to grow around 24.2 percent per year with revenue near 12.4 percent per year, which is faster than the referenced 10.5 percent US market revenue growth rate.

- At a share price of $1.88 and a DCF fair value of roughly $3.02, the quantitative work flags meaningful upside if those growth and margin assumptions are delivered.

AI Spending Versus Insurance Slowdown

- The DCF fair value of about $3.02 sits well above the current $1.88 share price, while trailing revenue growth of 12.4 percent per year and net income of roughly CNY 446.9 million frame how much performance is already in the model.

- Bears argue that heavier AI and tech spending plus softer insurance trends could pressure profitability, and the numbers give both support and pushback to that view:

- On one hand, analysts assume profit margins dip modestly from 14 percent to 13.4 percent even as earnings are projected to reach about CNY 547.5 million, so part of the expected growth already bakes in higher operating costs.

- On the other, trailing margins have moved to 15 percent and earnings quality is described as high, which challenges the idea that increased AI investment has so far been a drag on profitability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Waterdrop on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers through a different lens and turn that view into a concise narrative in just a few minutes by acting now, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Waterdrop.

Explore Alternatives

While Waterdrop screens attractively on earnings growth and valuation, the narrative still flags risk of margin slippage as AI and tech spending ramps ahead of revenue.

If that trade off makes you uneasy, use our stable growth stocks screener (2071 results) to quickly focus on businesses with steadier, more predictable revenue and earnings paths through different market environments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal