Is DIGITAL PLUS (TSE:3691) Using Too Much Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that DIGITAL PLUS, Inc. (TSE:3691) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

What Is DIGITAL PLUS's Net Debt?

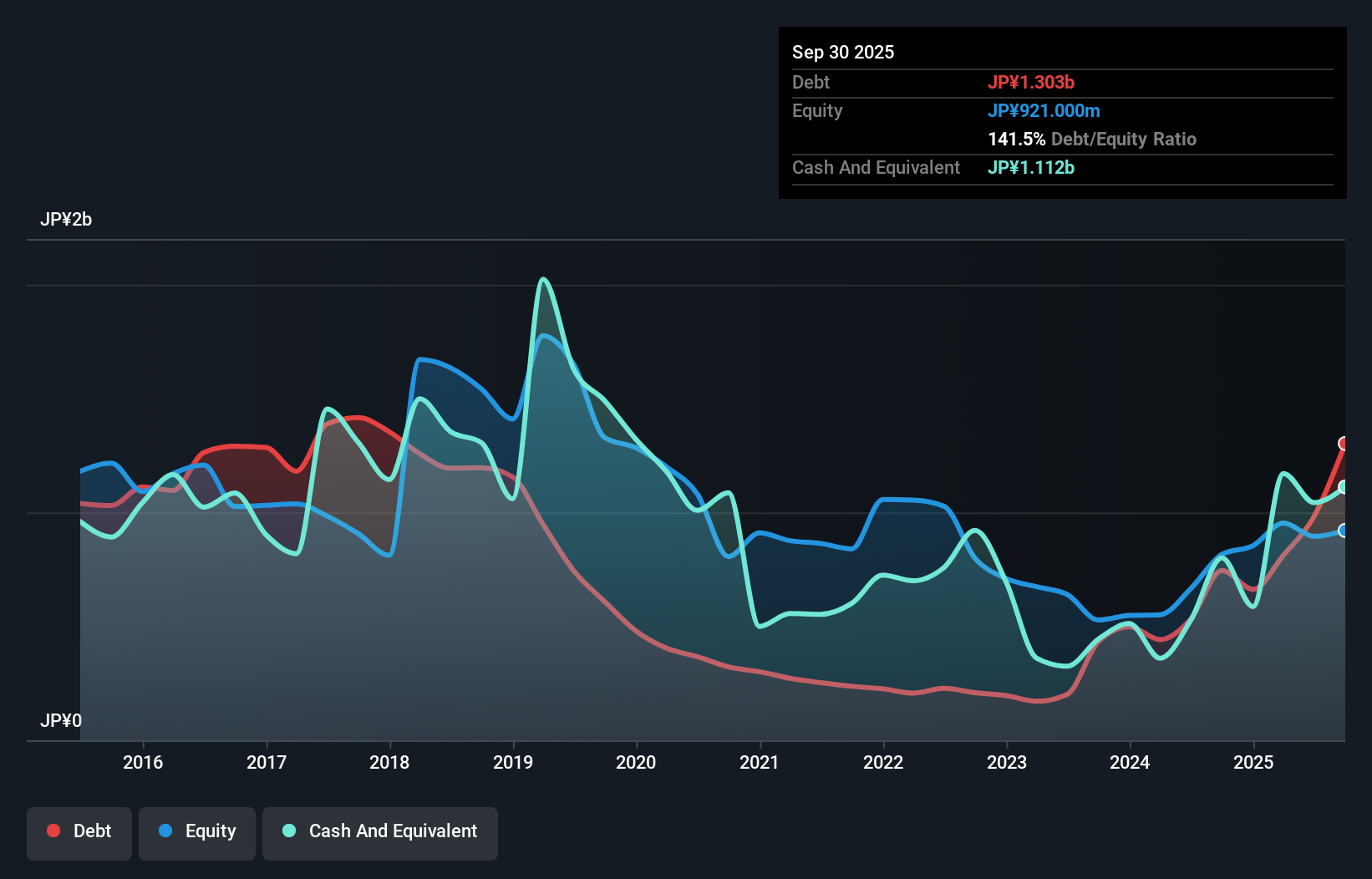

The image below, which you can click on for greater detail, shows that at September 2025 DIGITAL PLUS had debt of JP¥1.30b, up from JP¥745.0m in one year. However, it also had JP¥1.11b in cash, and so its net debt is JP¥191.0m.

A Look At DIGITAL PLUS' Liabilities

According to the last reported balance sheet, DIGITAL PLUS had liabilities of JP¥2.23b due within 12 months, and liabilities of JP¥178.0m due beyond 12 months. On the other hand, it had cash of JP¥1.11b and JP¥1.32b worth of receivables due within a year. So these liquid assets roughly match the total liabilities.

This state of affairs indicates that DIGITAL PLUS' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the JP¥6.87b company is short on cash, but still worth keeping an eye on the balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. But it is DIGITAL PLUS's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

View our latest analysis for DIGITAL PLUS

In the last year DIGITAL PLUS wasn't profitable at an EBIT level, but managed to grow its revenue by 11%, to JP¥933m. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Importantly, DIGITAL PLUS had an earnings before interest and tax (EBIT) loss over the last year. To be specific the EBIT loss came in at JP¥4.0m. Looking on the brighter side, the business has adequate liquid assets, which give it time to grow and develop before its debt becomes a near-term issue. But we'd want to see some positive free cashflow before spending much time on trying to understand the stock. So it seems too risky for our taste. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example DIGITAL PLUS has 2 warning signs (and 1 which is potentially serious) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal