Did Robinhood’s (HOOD) Derivatives Push and Crypto Reliance Just Shift Its Core Investment Narrative?

- Recently, Robinhood Markets outlined plans to launch a futures and derivatives exchange and clearinghouse via a joint venture that will acquire CFTC-licensed MIAXdx, enabling it to expand into prediction markets with Susquehanna International Group as a core liquidity provider from day one.

- At the same time, Robinhood’s heavy reliance on cryptocurrency trading, now the main driver of its transaction-based revenue, has made its business increasingly sensitive to sharp crypto price swings and regulatory actions such as China’s renewed crackdown on stablecoins.

- We’ll now examine how Robinhood’s growing dependence on crypto trading fees reshapes its investment narrative amid shifting regulatory and market conditions.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Robinhood Markets Investment Narrative Recap

To own Robinhood, you need to believe it can turn its fast-growing, trading-heavy platform into a broader financial services business without losing profitability. The new futures and derivatives venture could be a long term growth lever, but in the near term the main catalyst remains crypto trading momentum, while the biggest risk is that regulatory shocks or sharp drawdowns in digital assets choke off Robinhood’s transaction-based revenue.

The most relevant update here is Robinhood’s plan to launch a CFTC-licensed futures and derivatives exchange and clearinghouse via acquiring MIAXdx, with Susquehanna as a day-one liquidity provider. This move directly intersects with the company’s existing dependence on options and crypto trading, tying its next growth leg to more complex, potentially more scrutinized products that could amplify both revenue opportunity and sensitivity to market stress.

Yet investors should be aware that if regulators slow or reverse progress on tokenization, staking or broader crypto rules, then...

Read the full narrative on Robinhood Markets (it's free!)

Robinhood Markets’ narrative projects $5.3 billion revenue and $1.8 billion earnings by 2028. This requires 14.0% yearly revenue growth with earnings remaining flat from $1.8 billion today.

Uncover how Robinhood Markets' forecasts yield a $151.14 fair value, a 20% upside to its current price.

Exploring Other Perspectives

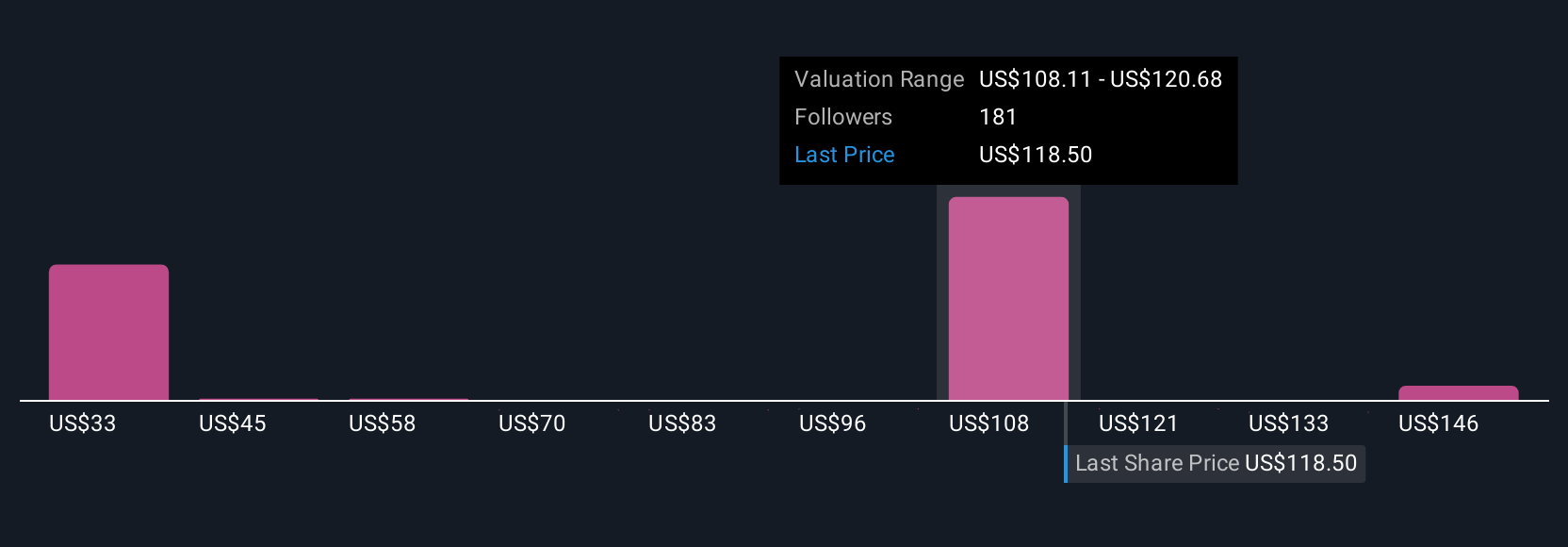

Across 43 fair value estimates from the Simply Wall St Community, Robinhood’s perceived worth spans roughly US$42 to US$158 per share, reflecting sharply different expectations. You should weigh these views against the risk that any delay or reversal in crypto and tokenization regulation could slow product expansion and affect how the business performs.

Explore 43 other fair value estimates on Robinhood Markets - why the stock might be worth less than half the current price!

Build Your Own Robinhood Markets Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Robinhood Markets research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Robinhood Markets research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Robinhood Markets' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal