Why Serve Robotics Stock Lost 22% in November

Key Points

Serve reported another quarter with less than $1 million in revenue.

Concerns about an AI bubble seemed to weigh on the stock.

Serve expects revenue to surge next year.

Shares of Serve Robotics (Nasdaq: SERV) were falling last month as the maker of restaurant delivery robots posted an underwhelming third-quarter earnings report. Additionally, the broader sell-off driven by fears of an AI bubble also seemed to weigh on the stock. Serve, whose robots can be seen rolling down the sidewalk, is still a speculative stock as it's bringing in less than $1 million in quarterly revenue.

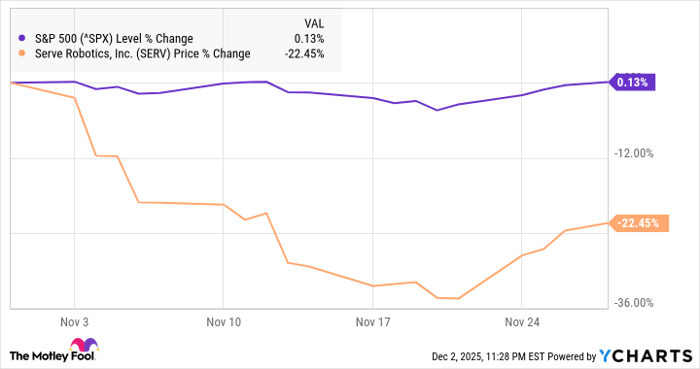

According to data from S&P Global Market Intelligence, the stock finished the month down 22%. As you can see from the chart below, the stock dipped through the first three weeks of the month before a late recovery in the last week of November.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Serve takes a step back

The big news in the quarter for Serve Robotics was its third-quarter earnings report.

The company showed off solid momentum with delivery volume up 66% on a quarter-over-quarter and 300% from the quarter a year ago. Revenue reached $687,000, which was up 209% from the quarter a year ago, though that was slightly below estimates at $691,000.

At this point, investors are paying more attention to the company's long-term potential to establish itself in the restaurant industry, rather than quarterly results, and it has made progress there. Serve launched in the Chicago market, its first in the Midwest; it entered a multi-year partnership with DoorDash for deliveries across the U.S. It also expects revenue to 10x next year based on preliminary projections, which would reach roughly $30 million.

That projection shows Serve is ramping its business quickly, though $30 million in annual sales is still small for a publicly traded company.

On the bottom line, the losses continued with a generally accepted accounting principle (GAAP) net loss of $33 million, widening from $20.9 million, and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss of $25 million.

As of its Nov. 12 earnings report, the company had $310 million in liquidity.

Image source: Serve Robotics.

What's next for Serve Robotics

Serve is making progress with its growth strategy, adding new markets and expanding in existing ones like Dallas and Los Angeles. Its coverage area has expanded to 1 million households, and it is delivering from more than 3,600 restaurants in the U.S.

The company still has a large growth opportunity in front of it, but this remains a high-risk stock. Still, its tailwinds are growing with partnerships with new restaurants and DoorDash.

Next year should be a big test for the company, and investors should get a better sense of its long-term growth potential.

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends DoorDash. The Motley Fool has a disclosure policy.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal