Masimo (MASI) valuation after leadership change, non-healthcare divestiture, and new credit facility reshapes strategy

Masimo (MASI) just pulled a meaningful two step move for investors: installing a new CEO, divesting its Non Healthcare business, and locking in a fresh multi year credit facility to reshape its balance sheet.

See our latest analysis for Masimo.

Despite this reset, Masimo’s recent share price return has been soft, with the year-to-date slide and a one-year total shareholder return of around negative 17 percent suggesting sentiment is still catching up to the strategic overhaul and fresh credit support.

If Masimo’s pivot has you rethinking your healthcare exposure, it could be worth exploring other potential opportunities across healthcare stocks to see how peers stack up on growth, resilience, and execution.

With shares still down sharply over the past year but trading at a sizable discount to analyst targets and intrinsic value estimates, is Masimo now a mispriced turnaround story, or is the market already baking in its next leg of growth?

Most Popular Narrative Narrative: 22.4% Undervalued

Based on the most followed narrative, Masimo’s fair value of $183.13 sits well above the last close at $142.19. This frames a valuation built on operating leverage rather than rapid top line expansion.

Strategic operational efficiencies and ongoing tariff mitigation efforts have resulted in substantial operating margin expansion and are expected to further reduce cost pressures, directly benefiting net margins and supporting EPS growth both in the near and medium term.

Curious how falling revenue, rising margins, and a rich future earnings multiple can still add up to upside in this narrative? The full breakdown reveals the exact growth path, profit inflection, and discount rate that underpin this fair value call, and why some see Masimo priced for a very different future than today.

Result: Fair Value of $183.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this trajectory still hinges on easing tariff pressures and on Masimo proving it can convert early stage monitoring markets into sustained, profitable growth.

Find out about the key risks to this Masimo narrative.

Another Angle On Value

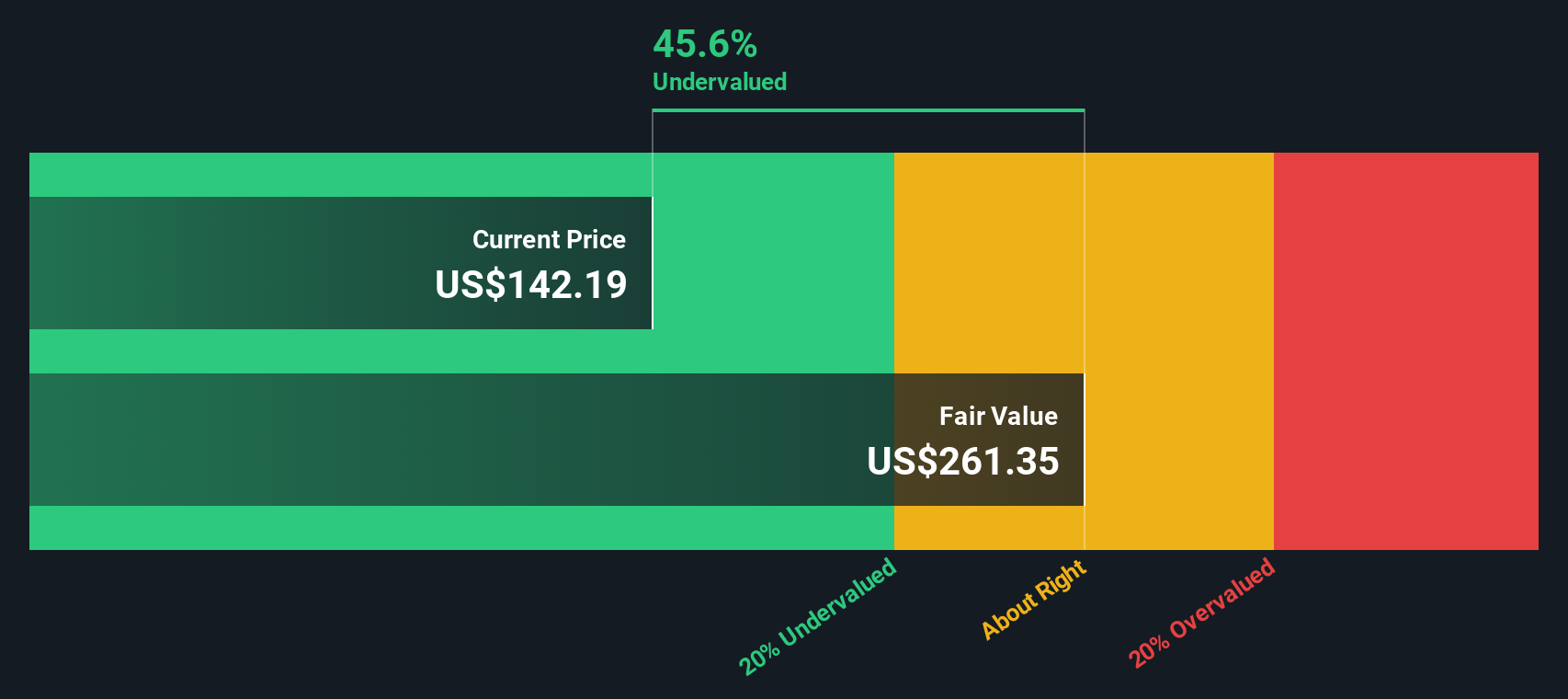

While the narrative fair value of $183.13 points to upside, our DCF model goes further, suggesting Masimo’s shares are trading about 45.6 percent below an estimated fair value of $261.35. If cash flows really evolve as forecast, is the market underpricing a deeper turnaround?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Masimo Narrative

If you are not fully aligned with this outlook, or simply want to dig into the assumptions yourself, you can build a custom view in minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Masimo.

Ready for your next investing moves?

Masimo might be your starting point, but you will only spot the strongest opportunities if you actively scan the wider market using targeted stock screens today.

- Capture growth potential early by reviewing these 24 AI penny stocks that could ride the next powerful wave of innovation.

- Strengthen your portfolio’s cash flow by filtering for income opportunities through these 14 dividend stocks with yields > 3%.

- Position ahead of shifting valuations using these 925 undervalued stocks based on cash flows to pinpoint companies the market may be mispricing right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal