Has Bank of America’s 106% Five Year Surge Left Much Upside in 2025?

- If you are wondering whether Bank of America is still good value after its big run, or if you might be late to the party, this breakdown will help you see where the real opportunity or risk might be hiding.

- The stock has climbed 20.1% year to date and 16.3% over the last year, adding to an impressive 106.4% gain over five years. This comes even though the last 30 days have been slightly soft at -0.5%, following a 1.4% rise in the past week.

- Recent price moves have been shaped by shifting expectations for interest rates and the broader banking sector, with investors reassessing how rising or stabilizing yields affect big banks like Bank of America. At the same time, ongoing headlines around credit quality, consumer spending, and regulatory scrutiny are keeping risk perception front and center for large financial institutions.

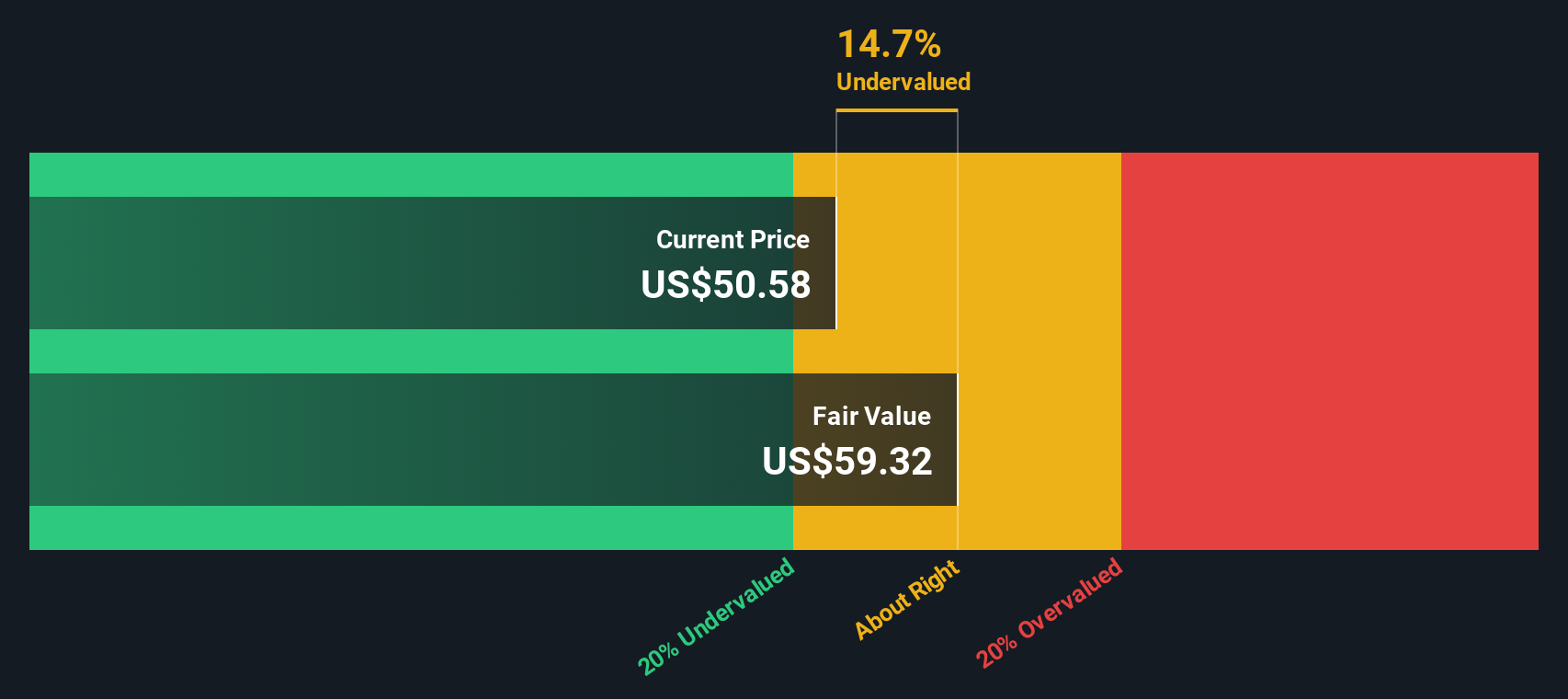

- Right now, Bank of America only scores a 2/6 valuation check for being undervalued, which might surprise investors given its strong long term returns. Next, we will unpack what different valuation methods say about the stock and then circle back with a more complete way to think about its true worth.

Bank of America scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Bank of America Excess Returns Analysis

The Excess Returns model looks at how much profit Bank of America can generate above the return that shareholders require, based on the bank’s equity base. Instead of focusing on short term earnings swings, it uses long term assumptions about profitability and growth.

For Bank of America, the model starts with a Book Value of $37.95 per share and a Stable EPS of $4.57 per share, grounded in weighted future Return on Equity estimates from 11 analysts. With an Average Return on Equity of 11.16% and a Stable Book Value forecast of $40.94 per share, the bank is expected to continue earning more than its Cost of Equity of $3.68 per share, generating an Excess Return of $0.89 per share.

Feeding these assumptions into the Excess Returns framework produces an intrinsic value estimate of about $56.57 per share. Compared with the current share price, this implies the stock is roughly 6.0% undervalued, which is close enough to call it broadly in line with fair value rather than a screaming bargain.

Result: ABOUT RIGHT

Bank of America is fairly valued according to our Excess Returns, but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

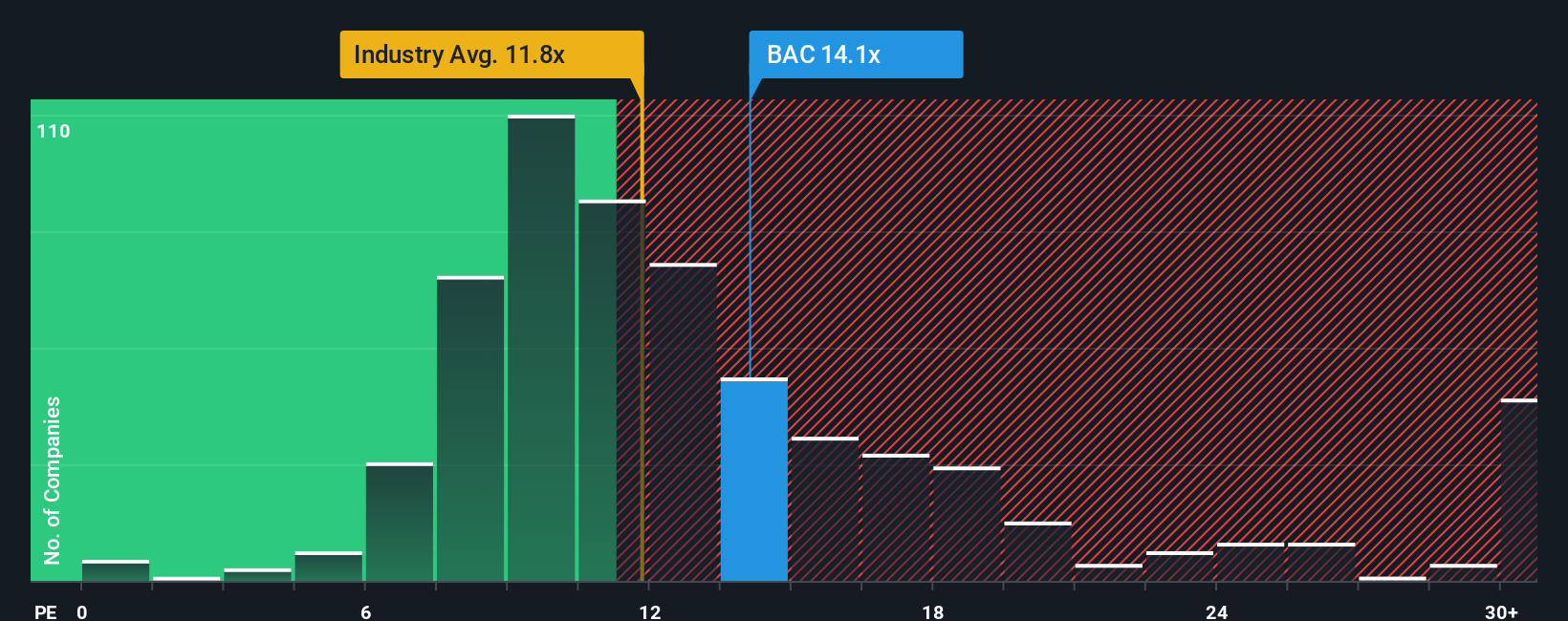

Approach 2: Bank of America Price vs Earnings

For a mature, consistently profitable bank like Bank of America, the price to earnings, or PE, ratio is a practical way to gauge valuation because it directly links what investors pay to the profits the business is generating today.

In general, faster growth and lower risk justify a higher PE, while slower or more uncertain earnings should trade on a discount. Bank of America currently trades at about 13.75x earnings, which is above the broader Banks industry average of roughly 11.48x and slightly ahead of its large bank peer average of about 13.36x. On the surface, that suggests investors are willing to pay a small premium for its scale and earnings profile.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE multiple would be reasonable given Bank of America’s earnings growth outlook, profitability, risk profile, industry positioning and market cap. On this basis, the stock’s Fair Ratio is 16.31x, meaning the current 13.75x multiple sits below what would be implied by its fundamentals. That indicates the shares may be modestly undervalued on a PE basis, even after their recent run.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bank of America Narrative

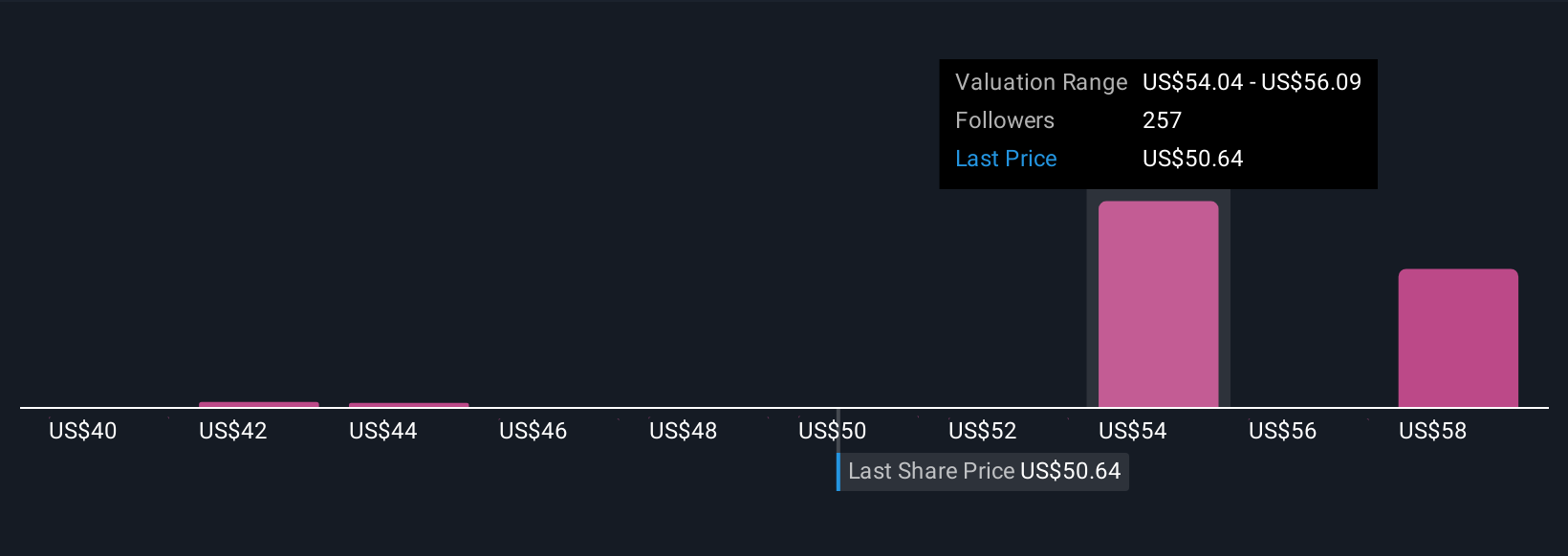

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple way to connect your view of Bank of America’s story with a concrete forecast and Fair Value, all inside Simply Wall St’s Community page that millions of investors use.

A Narrative is your own investment storyline, where you spell out what you expect for revenue, earnings and margins, then see how those assumptions translate into a Fair Value you can compare to today’s share price to help decide whether BAC looks like a buy, hold or sell.

Because Narratives on Simply Wall St are updated dynamically as new earnings, news or macro data arrives, they help you keep your thesis current rather than fixed in time. This makes it easier to see when the numbers no longer fit the story you had in mind.

For example, one BAC Narrative on the platform currently prices the stock at around $43 per share based on cautious growth and tighter margins. Another pins Fair Value closer to $59 using stronger revenue growth and a richer future PE multiple, showing how different but reasonable perspectives can coexist around the same company.

For Bank of America however we will make it really easy for you with previews of two leading Bank of America Narratives:

Fair Value: $58.90 per share

Implied Undervaluation vs Current Price: approximately 9.7%

Forecast Revenue Growth: 7.82%

- Analysts expect steady revenue growth, relatively stable profit margins, and continued digital and AI investment to support a fairly valued, slightly upside skewed outlook.

- Capital strength, ongoing share buybacks, and disciplined interest rate management are seen as key drivers of earnings per share and valuation resilience.

- Risks center on macro volatility, litigation costs, and competition for deposits, but the consensus view is that today’s price is close to, but modestly below, intrinsic value.

Fair Value: $43.34 per share

Implied Overvaluation vs Current Price: approximately 22.7%

Forecast Revenue Growth: 10.59%

- This narrative sees Bank of America as a high quality franchise, but argues that the current share price already prices in optimistic assumptions about rates, growth, and efficiency.

- It assumes modest net interest income and fee growth, disciplined cost control, and a more conservative future PE multiple that pulls fair value back toward the low to mid $40s.

- Key downside risks include a sharper economic slowdown, faster rate cuts, heavier regulation, or an acceleration of Buffett’s selling, any of which could compress margins and the valuation multiple.

Do you think there's more to the story for Bank of America? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal