Flutter Entertainment (NYSE:FLUT): Reassessing Valuation After Strong Q3 Earnings and iGaming Growth Reignite Optimism

Flutter Entertainment (NYSE:FLUT) jumped after third quarter results topped expectations, with investors latching onto standout iGaming growth, the upcoming FanDuel Predict launch, and acquisitions that signal management is still playing offense.

See our latest analysis for Flutter Entertainment.

The latest earnings pop has only partly reset the picture. A 1 week share price return of 6.2 percent still sits against a 90 day share price return of negative 29.3 percent and a 3 year total shareholder return of 44.7 percent, suggesting long term momentum is intact even as near term volatility reflects shifting views on regulation and growth.

If Flutter’s rebound has you thinking about what else could surprise on the upside, this is a good moment to scan fast growing stocks with high insider ownership.

With the shares still trading at a steep discount to analyst targets even after the bounce, is Flutter an underappreciated compounder following a painful reset, or is the market already factoring in its next phase of growth?

Most Popular Narrative: 31.3% Undervalued

Against a last close of $208.12, the most widely followed narrative points to fair value near $303, implying substantial upside if its assumptions land.

Structural cost efficiencies, evidenced by reduced sales and marketing as a percentage of revenue and successful renegotiation of market access agreements (e.g., Boyd), should drive higher net margins and enhanced free cash flow, supporting shareholder returns through buybacks.

Want to see what kind of revenue expansion, margin lift, and earnings power has to materialize to justify that upside gap? The narrative lays out a surprisingly ambitious glide path for growth, profitability, and valuation multiples that you may not expect from a betting and gaming group.

Result: Fair Value of $303.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat scenario could be derailed if rising UK tax burdens and slower than expected integration of recent acquisitions squeeze margins harder than modeled.

Find out about the key risks to this Flutter Entertainment narrative.

Another Angle on Valuation

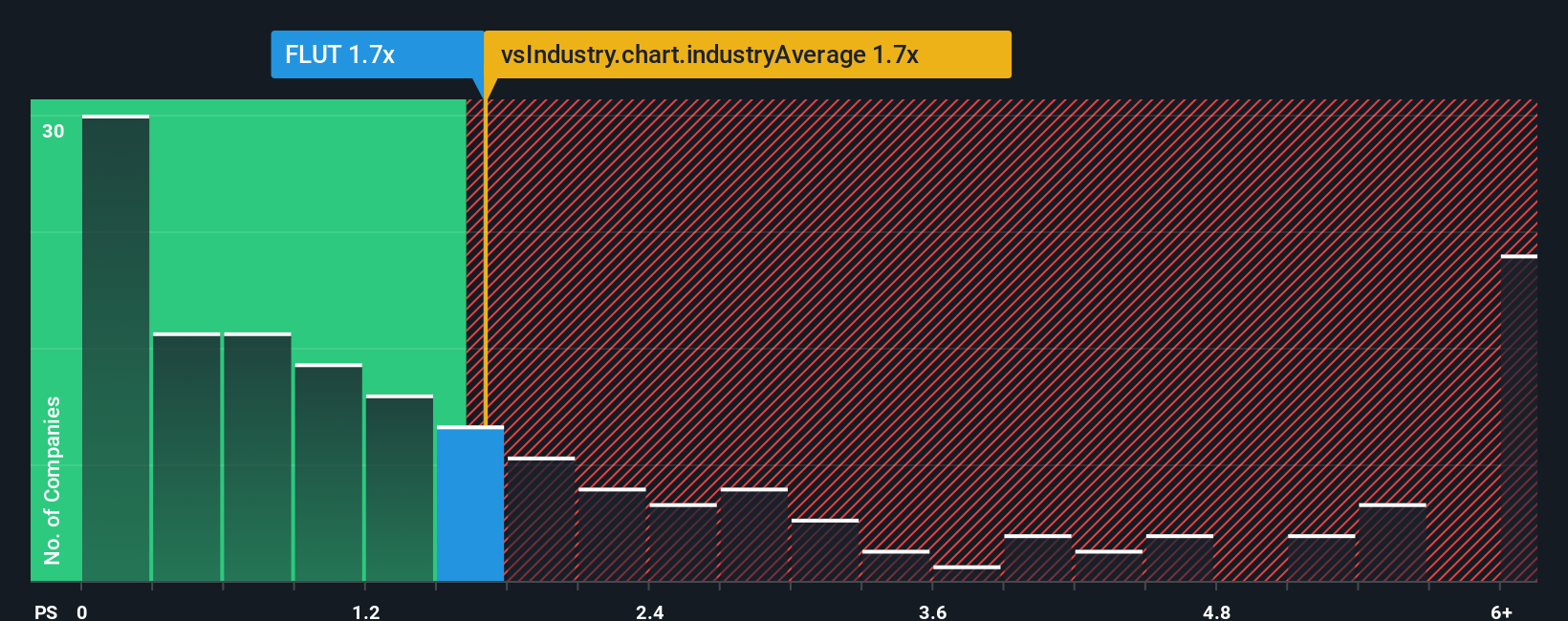

Analysts see Flutter as inexpensive based on future earnings and growth, but its current 2.4x price-to-sales ratio sits slightly above peers at 2.3x and well above the US hospitality average of 1.6x. The fair ratio of 3.8x points to potential upside while also highlighting meaningful multiple risk if sentiment weakens.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Flutter Entertainment Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a full narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Flutter Entertainment.

Looking for more investment ideas beyond Flutter?

Do not stop at a single opportunity when the market is full of potential. Use the Simply Wall St Screener to uncover fresh angles and hidden winners.

- Capture potential long term upside by targeting these 925 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Consider the innovation wave by reviewing these 24 AI penny stocks positioned at the forefront of intelligent automation and data driven business models.

- Support your income strategy with these 14 dividend stocks with yields > 3% that may strengthen returns through consistent cash distributions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal