Is It Too Late To Consider CommScope After Its 278% Rally In 2025?

- Wondering if CommScope Holding Company is still a bargain after its huge run up, or if you have already missed the boat? This breakdown is designed to help you figure out what the current share price really implies.

- The stock has slipped a modest 0.1% over the last week, but that comes after a powerful 21.0% jump over the past month and an eye catching 278.1% gain year to date, with a 264.0% return over the last year that has clearly reset market expectations.

- Behind those moves, investors have been reacting to a mix of restructuring updates and balance sheet focused announcements, including progress on cost cutting and debt reduction that has eased some of the market's earlier pessimism. At the same time, sector wide rotation back into select telecom infrastructure names has added fuel, as traders look for turnaround candidates with operating leverage.

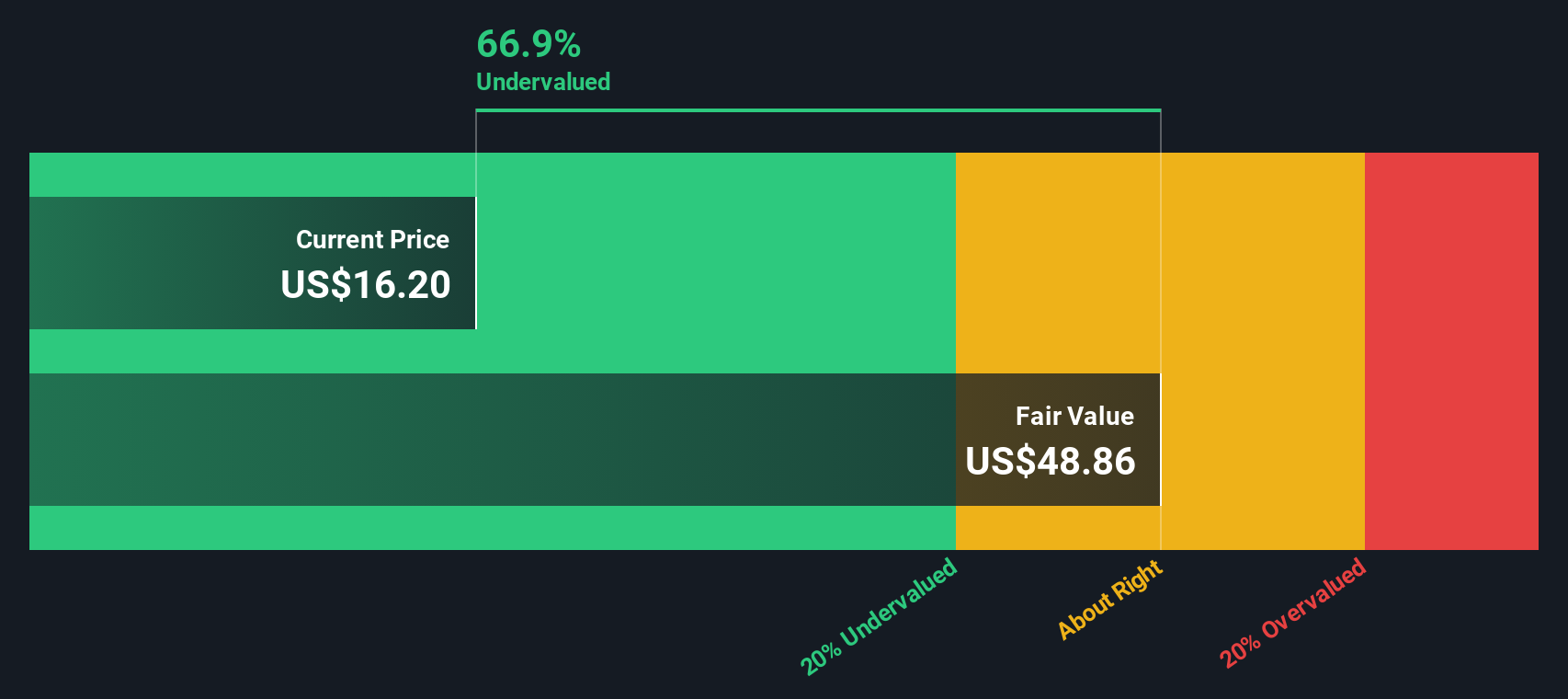

- Despite that backdrop, CommScope Holding Company currently scores a 5/6 valuation check, suggesting it still screens as undervalued on most of our metrics. Next, we will unpack what the main valuation models say and then finish by looking at a more complete way to judge whether the current price really makes sense.

Approach 1: CommScope Holding Company Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth by projecting its future cash flows and then discounting them back to today in dollar terms. For CommScope Holding Company, the model uses a 2 Stage Free Cash Flow to Equity approach built on cash flow projections rather than earnings multiples.

CommScope generated last twelve month free cash flow of about $259.5 Million, and analyst and internal projections see this rising steadily to roughly $1.59 Billion in 2035. Key interim estimates include around $713 Million in 2026 and $881 Million in 2027, with later years extrapolated by Simply Wall St based on earlier growth rates. These future cash flows in dollar terms are discounted back to today to arrive at an estimated intrinsic value of about $53.73 per share.

Compared with the current share price, this implies the stock is roughly 63.7% undervalued based on the DCF model. This suggests the market is still pricing in a much more cautious outlook than the cash flow projections assume.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CommScope Holding Company is undervalued by 63.7%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: CommScope Holding Company Price vs Earnings

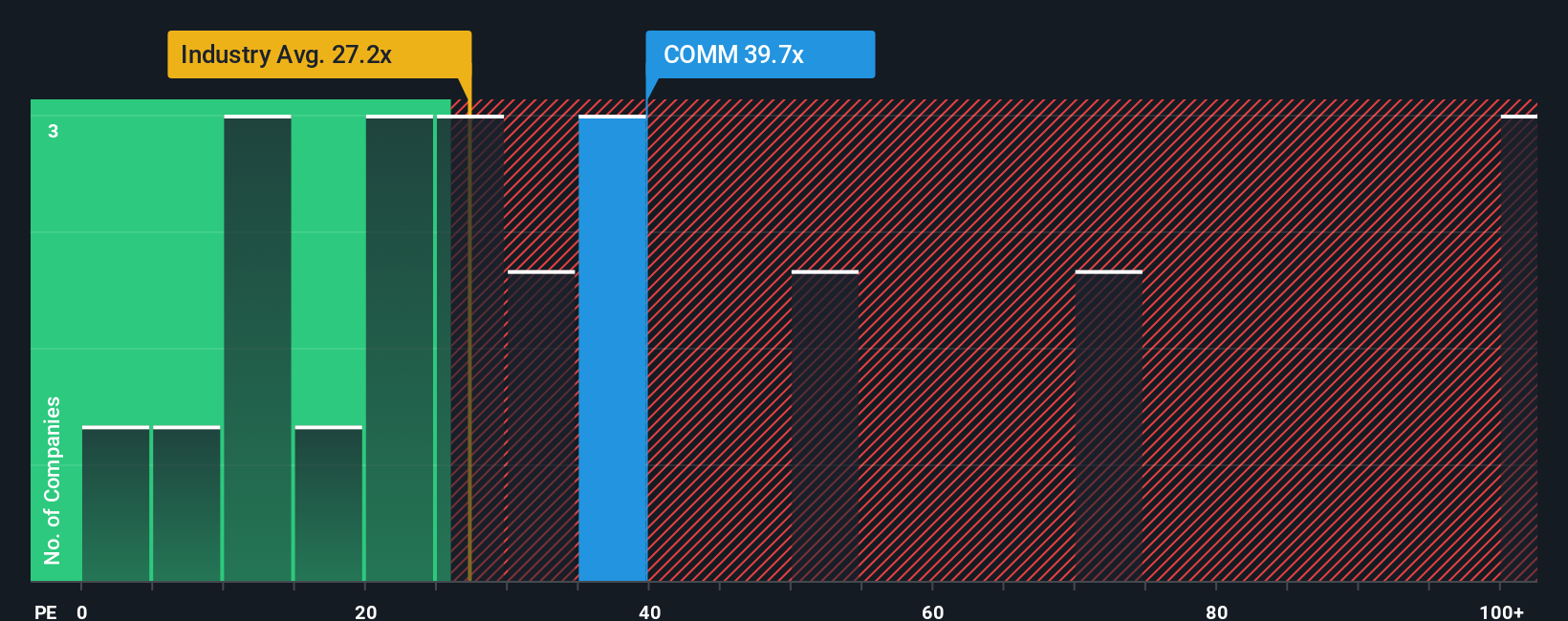

For companies that are generating positive profits, the price to earnings (PE) ratio is a useful shorthand for how much investors are willing to pay for each dollar of current earnings. What counts as a normal or fair PE generally depends on how fast those earnings are expected to grow and how risky or volatile the business is, with faster growing and more resilient companies typically justifying higher multiples.

CommScope is currently trading on a PE of about 14.8x, which sits well below both the broader Communications industry average of roughly 32.1x and the peer group average near 25.7x. Rather than relying only on those broad comparisons, Simply Wall St also calculates a Fair Ratio of 15.1x, an estimate of the PE that would be appropriate given CommScope’s specific growth outlook, profitability profile, size and risk factors.

This Fair Ratio framework is more tailored than simple peer or industry checks because it adjusts for the company’s own fundamentals and risk characteristics, instead of assuming it should trade in line with generic averages. With CommScope’s current PE of 14.8x sitting below the Fair Ratio of 15.1x, the shares still screen as modestly undervalued on this earnings based view.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CommScope Holding Company Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company’s future with a set of numbers for revenue, earnings, margins and fair value.

A Narrative is essentially your story about CommScope Holding Company, written in financial terms, where you outline what you think will happen to its business and then translate that view into a forecast and a fair value estimate.

This matters because Narratives link three pieces together: the company’s story, a quantified forecast, and a fair value, so you can clearly see how your assumptions relate to a potential buy, hold, or sell conclusion.

On Simply Wall St, Narratives live in the Community page and are designed to be accessible, guided tools that millions of investors already use to test what they believe about a company against the current share price.

They also stay live and dynamic, automatically updating when new information such as earnings, news, or major announcements comes in, so your CommScope view never goes stale.

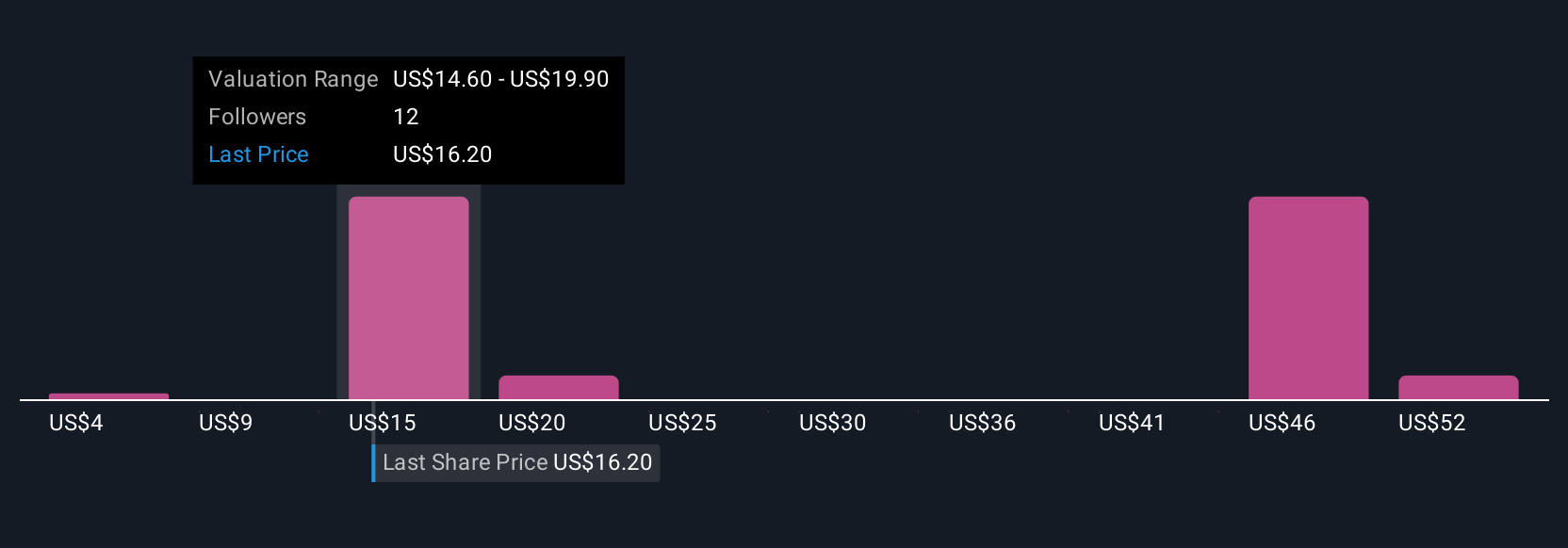

For example, one CommScope Narrative might assume strong adoption of DOCSIS 4.0 and Wi Fi 7, resulting in a higher fair value near $22.67. A more cautious Narrative could instead focus on post divestiture cyclicality and competitive pressure, resulting in a meaningfully lower fair value and a very different assessment of whether today’s price looks attractive.

Do you think there's more to the story for CommScope Holding Company? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal