The Bull Case For Clover Health Investments (CLOV) Could Change Following Profitability Target And Cost Pressures

- Recently, Clover Health Investments highlighted that it expects to achieve GAAP profitability in 2026, while continuing to face pressure from higher-than-anticipated medical costs this year.

- The company is leaning on its Clover Assistant technology, early diagnosis initiatives, and anticipated support from CMS Part D measures to help rein in medical expenses and improve its long-term operating profile.

- Next, we’ll examine how the push toward GAAP profitability and broader Clover Assistant adoption could reshape Clover Health’s investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Clover Health Investments Investment Narrative Recap

To own Clover Health today, you generally need to believe its technology led Medicare Advantage model can eventually translate into sustainable GAAP profitability, despite recent volatility in medical costs and continued GAAP net losses. The company’s 2026 profitability target sharpens the near term focus on medical cost control as the key catalyst, while elevated medical and pharmacy utilization, especially in Part D, remains the biggest risk. This latest update reinforces those priorities rather than materially changing them.

Among recent developments, the launch of Clover’s 2026 Medicare Advantage offerings, with broader PPO coverage and AI supported care through Clover Assistant, ties directly into that profitability story. Expanded access to its platform, coupled with LiveHealthy Rewards and care services like home visits and cancer support, is intended to deepen member engagement and potentially support lower benefit expense ratios over time, though the impact will depend on how medical utilization trends evolve.

Yet investors still need to weigh the risk that persistently higher medical and Part D drug costs could...

Read the full narrative on Clover Health Investments (it's free!)

Clover Health Investments' narrative projects $3.0 billion revenue and $10.7 million earnings by 2028. This requires 22.8% yearly revenue growth and a $52.8 million earnings increase from $-42.1 million today.

Uncover how Clover Health Investments' forecasts yield a $3.23 fair value, a 30% upside to its current price.

Exploring Other Perspectives

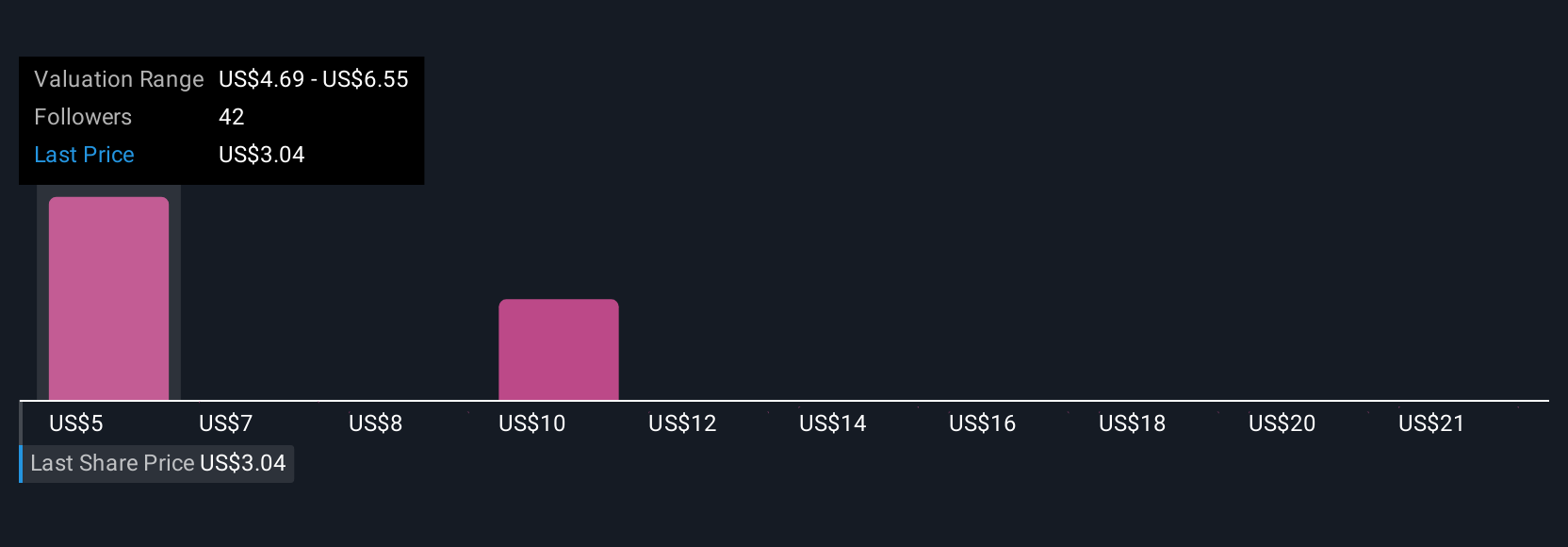

Eleven fair value estimates from the Simply Wall St Community span roughly US$3.23 to US$23.32 per share, showing just how far apart views can be. Against that backdrop, Clover’s focus on AI enabled cost control and a path to GAAP profitability highlights why you may want to consider several different scenarios for its future performance.

Explore 11 other fair value estimates on Clover Health Investments - why the stock might be worth just $3.23!

Build Your Own Clover Health Investments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clover Health Investments research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Clover Health Investments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clover Health Investments' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal