How Topgolf Callaway’s 100th U.S. Venue and New Promotions At Topgolf Callaway Brands (MODG) Has Changed Its Investment Story

- Topgolf Callaway Brands recently opened its 100th U.S. venue and 112th global location in New Braunfels, Texas, featuring 62 climate-controlled bays, a full-service bar and restaurant, and a range of tech-enabled games.

- The milestone venue, supported by a promotional campaign offering a chance at one year of free play, underscores Topgolf’s push to deepen customer engagement and expand its experiential footprint.

- Now we’ll examine how reaching the 100th U.S. venue milestone, alongside the promotional push, may influence Topgolf Callaway’s investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Topgolf Callaway Brands Investment Narrative Recap

To own Topgolf Callaway, you need to believe its mix of experiential venues and golf brands can eventually translate rising traffic into consistent profits, despite recent losses and discount-driven comps pressure. The 100th U.S. venue adds to the long term experiential story, but does not materially change the near term focus on improving pricing power and managing tariff and margin headwinds.

The most relevant recent development alongside this opening is management raising 2025 revenue guidance for the Topgolf segment to US$1.77 billion to US$1.79 billion after Q3 outperformance. Together, higher traffic, new venues and upgraded sales expectations highlight how quickly Topgolf is building scale, while putting more attention on whether that growth can offset promotional activity and cost inflation over time.

Yet while venue growth and higher guidance are encouraging, investors should still watch how sustained discounting at Topgolf could weigh on...

Read the full narrative on Topgolf Callaway Brands (it's free!)

Topgolf Callaway Brands' narrative projects $4.1 billion revenue and $209.7 million earnings by 2028.

Uncover how Topgolf Callaway Brands' forecasts yield a $11.72 fair value, a 5% downside to its current price.

Exploring Other Perspectives

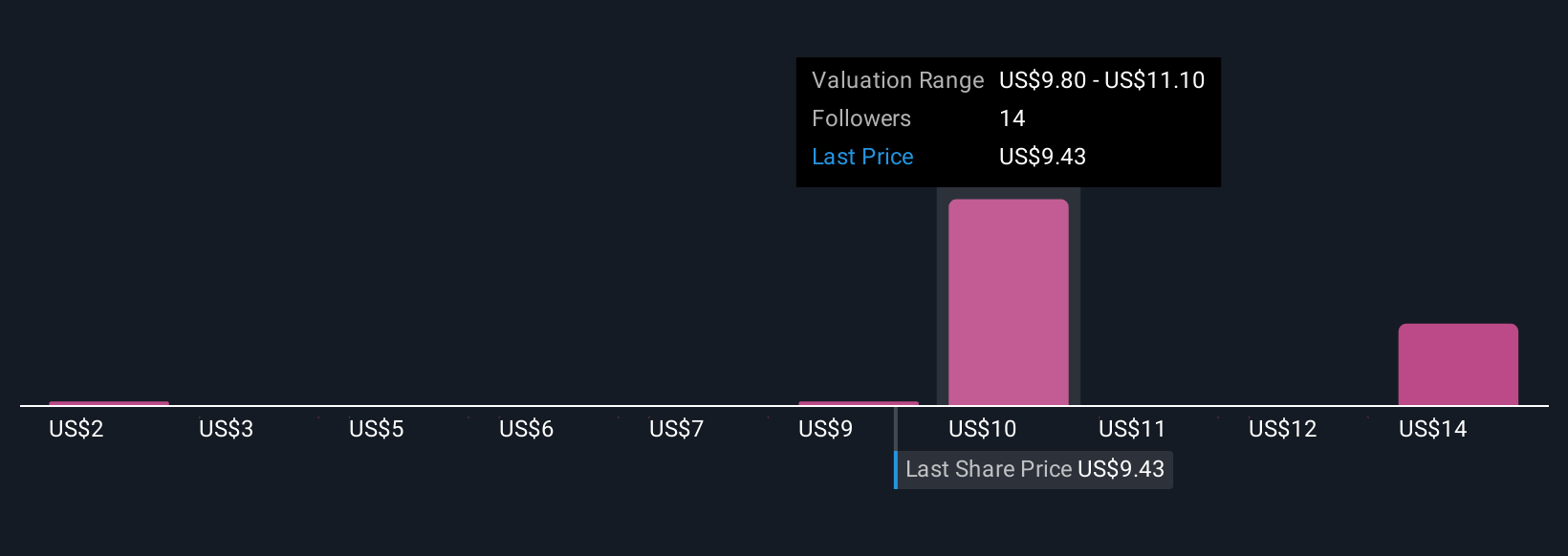

Four fair value estimates from the Simply Wall St Community span a wide band from US$2 to about US$110 per share, reflecting sharply different expectations. When you set those views against Topgolf’s reliance on value promotions to drive traffic, it underlines why many investors are weighing revenue growth against the risk of weaker long term margins.

Explore 4 other fair value estimates on Topgolf Callaway Brands - why the stock might be worth less than half the current price!

Build Your Own Topgolf Callaway Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Topgolf Callaway Brands research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Topgolf Callaway Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Topgolf Callaway Brands' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal