Tougher UK and Dutch Rules Driving J.P. Morgan Downgrade Could Be A Game Changer For FDJ United (ENXTPA:FDJU)

- In recent days, J.P. Morgan issued a double downgrade on FDJ United to “underweight” from “overweight,” citing multiple tax hikes and significantly tougher online gambling regulations in the UK and Netherlands that have already weakened the company’s online betting and gaming performance.

- A particularly meaningful takeaway is that J.P. Morgan’s earnings forecasts for 2026–2027 now sit well below consensus, as the broker expects the regulatory changes to force a material reset of expectations for FDJ United’s online division.

- Against this backdrop of stricter UK and Dutch rules pressuring FDJ United’s online revenues, we’ll examine how the downgrade reshapes its investment narrative.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

FDJ United Investment Narrative Recap

To own FDJ United, you have to believe its mix of lotteries and online betting can still compound value despite regulatory headwinds. J.P. Morgan’s double downgrade directly hits the main near term catalyst, confidence in online growth, while also magnifying the key risk that tighter UK and Dutch rules could keep earnings expectations for the online division under pressure.

Against that backdrop, the company’s latest guidance for full year 2025, with revenue expected to exceed €3,700.0 million, becomes more important as a touchpoint for how resilient the broader group remains while online earnings forecasts are reset. I will be watching whether upcoming results and commentary help bridge the gap between FDJ United’s own targets for online betting and gaming and the more cautious assumptions now embedded in some analyst models.

Yet, behind the headline downgrade, investors should also be aware that further regulatory tightening could...

Read the full narrative on FDJ United (it's free!)

FDJ United’s narrative projects €4.2 billion revenue and €509.3 million earnings by 2028.

Uncover how FDJ United's forecasts yield a €33.93 fair value, a 47% upside to its current price.

Exploring Other Perspectives

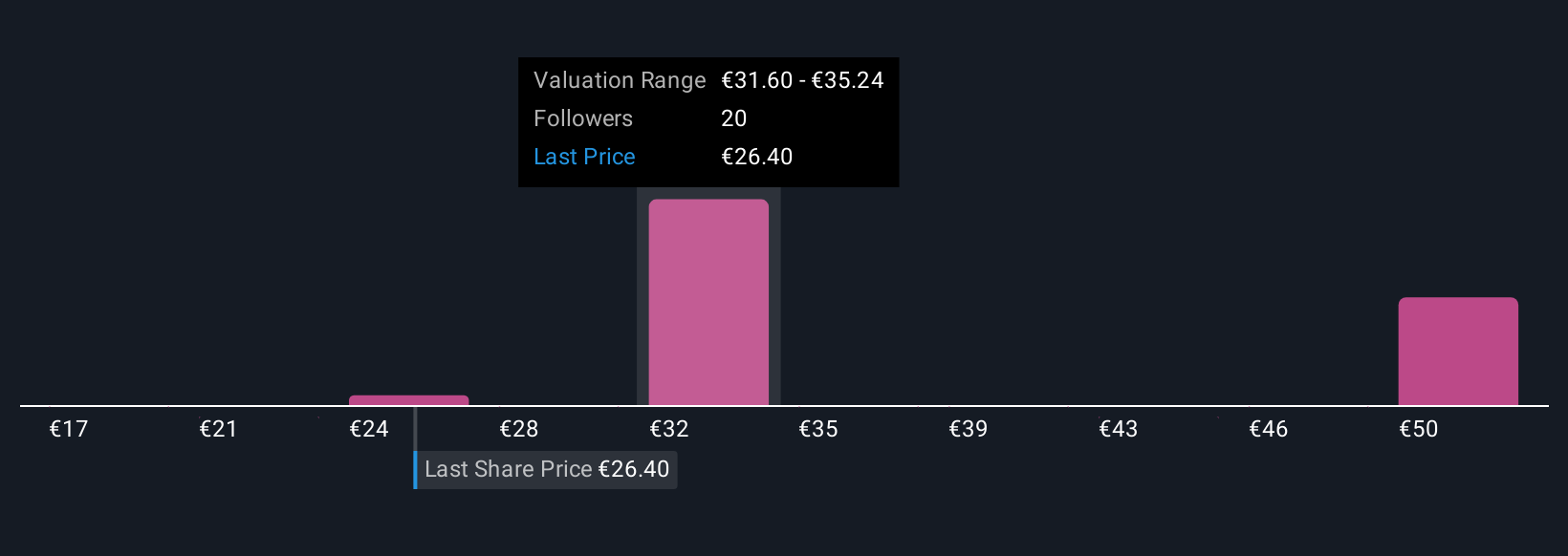

Ten members of the Simply Wall St Community value FDJ United between €24.53 and €54.06, highlighting very different expectations around future outcomes. Set that against the recent J.P. Morgan downgrade, which focuses squarely on regulatory risk to online revenue, and it becomes even more important to compare several independent views before forming your own.

Explore 10 other fair value estimates on FDJ United - why the stock might be worth over 2x more than the current price!

Build Your Own FDJ United Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FDJ United research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free FDJ United research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FDJ United's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal