The Bull Case For Mondelez International (MDLZ) Could Change Following Outlook Cut And Recall News - Learn Why

- In recent days, Mondelez International cut its 2025 outlook amid margin pressure from high cocoa costs and softer volumes, while also issuing a limited voluntary recall of certain RITZ Peanut Butter Cracker Sandwiches due to mislabeling risks for people with peanut allergies.

- At the same time, the company is leaning into brand-building efforts, including a RITZ Big Game advertising push and the launch of Lotus Biscoff in India, underscoring its focus on long-term growth and geographic expansion despite near-term headwinds.

- We’ll now examine how Mondelez’s lowered 2025 outlook, especially pressure from elevated cocoa costs, reshapes its pre-existing investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Mondelez International Investment Narrative Recap

To hold Mondelez, you generally need to believe in the resilience of its global snacking brands and their pricing power across cycles. The cut to the 2025 outlook and cocoa driven margin pressure directly affects the near term earnings catalyst, while the limited RITZ recall does not appear material to the broader business risk profile at this stage.

The most relevant recent development here is management’s lowered 2025 guidance, which explicitly ties weaker adjusted EPS to elevated cocoa costs and softer volumes. That same cost pressure already sat at the center of the investment risk case, so this update largely formalizes what was a key concern and keeps input inflation firmly in focus for anyone watching near term profitability.

Yet investors should also be aware that persistent cocoa driven margin pressure could...

Read the full narrative on Mondelez International (it's free!)

Mondelez International's narrative projects $42.7 billion revenue and $4.7 billion earnings by 2028. This requires 4.8% yearly revenue growth and about a $1.1 billion earnings increase from $3.6 billion today.

Uncover how Mondelez International's forecasts yield a $69.02 fair value, a 23% upside to its current price.

Exploring Other Perspectives

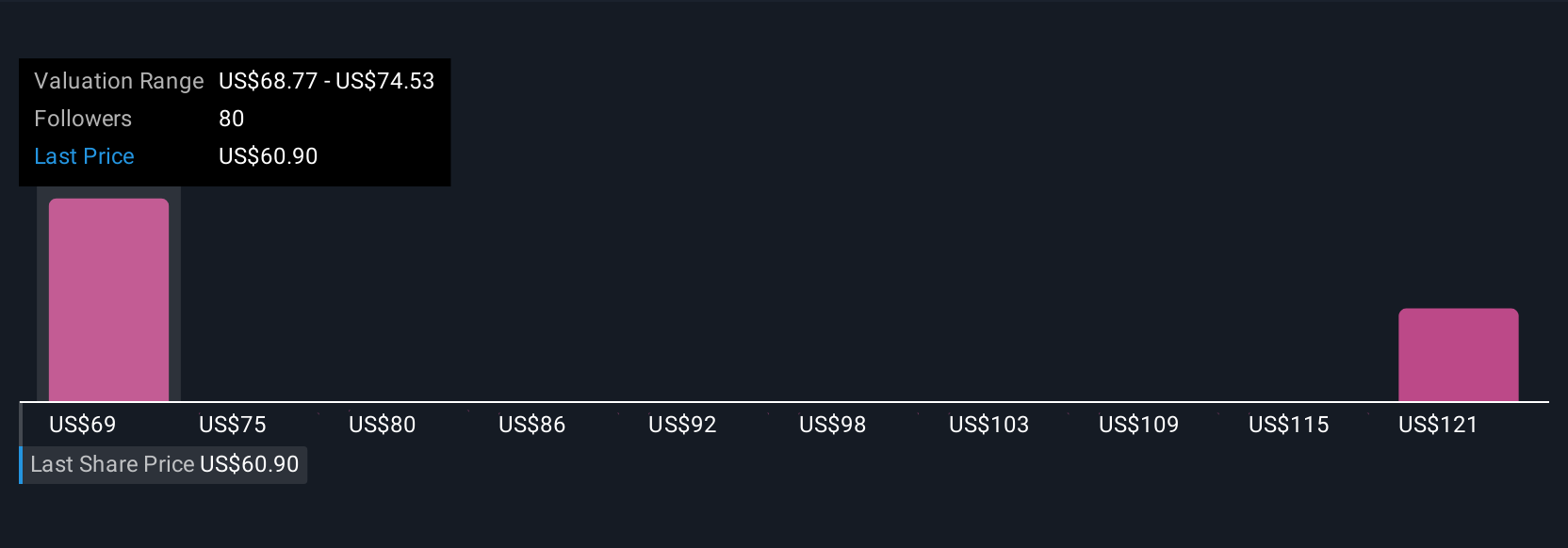

Four members of the Simply Wall St Community value Mondelez between US$69 and US$114 per share, showing a wide spread of opinions. Set these views against the recent 2025 outlook cut, where higher cocoa prices are already weighing on earnings and could influence how you interpret that range.

Explore 4 other fair value estimates on Mondelez International - why the stock might be worth just $69.02!

Build Your Own Mondelez International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mondelez International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Mondelez International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mondelez International's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal