Critical Metals (CRML) Is Up 9.8% After Court Orders Fresh Review Of Koralpe Lithium Project

- Critical Metals Corp. recently announced that Austria’s Federal Administrative Court overturned a prior ruling on whether its Koralpe Lithium Mining project requires an environmental impact assessment, sending the case back to the Carinthian state government for a fresh, expert-driven review under European Union law.

- The decision introduces a key legal precedent question around how national project-size thresholds align with EU environmental rules, placing Critical Metals’ flagship lithium project under closer regulatory scrutiny.

- We’ll examine how this fresh environmental review requirement for the Koralpe project could reshape Critical Metals’ investment narrative and risk profile.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Critical Metals' Investment Narrative?

To own Critical Metals, you have to buy into a high-risk, early-stage story where future value rests on turning exploration assets like Tanbreez and Koralpe into permitted, funded projects. The business is still loss-making (over US$51,000,000 in annual losses on minimal revenue), reliant on fresh capital, and its share price has been volatile despite only a small positive total return over the past year. The latest Koralpe ruling fits straight into that thesis: it does not force an environmental impact assessment yet, but it hardens the regulatory path by pushing the project into a case-by-case EU-law review. In the near term, that could delay a key catalyst around permitting clarity and keep financing and dilution risk front and center for shareholders.

But there is one regulatory twist here that investors should not overlook. Upon reviewing our latest valuation report, Critical Metals' share price might be too optimistic.Exploring Other Perspectives

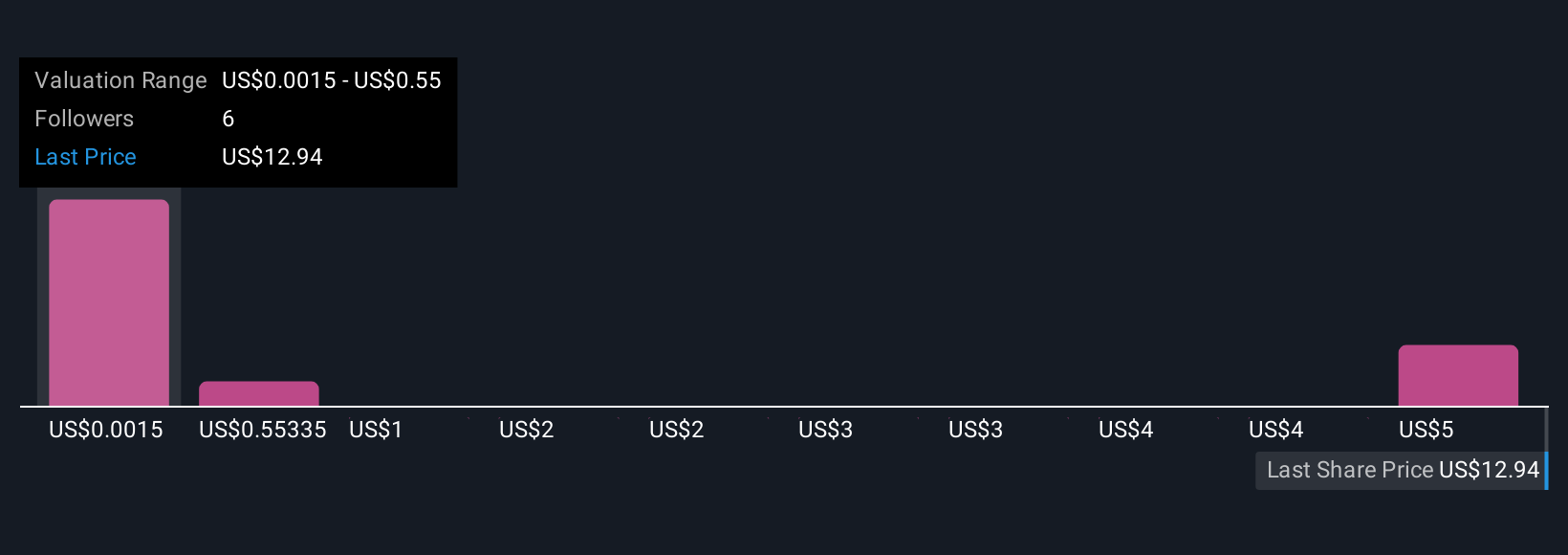

Explore 10 other fair value estimates on Critical Metals - why the stock might be worth as much as $5.52!

Build Your Own Critical Metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Critical Metals research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Critical Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Critical Metals' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal