NS Tool's (TSE:6157) Dividend Will Be ¥15.00

The board of NS Tool Co., Ltd. (TSE:6157) has announced that it will pay a dividend on the 25th of June, with investors receiving ¥15.00 per share. The dividend yield will be 3.5% based on this payment which is still above the industry average.

NS Tool's Future Dividend Projections Appear Well Covered By Earnings

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Prior to this announcement, NS Tool's dividend was comfortably covered by both cash flow and earnings. This means that a large portion of its earnings are being retained to grow the business.

If the trend of the last few years continues, EPS will grow by 4.7% over the next 12 months. If the dividend continues along recent trends, we estimate the payout ratio will be 62%, which is in the range that makes us comfortable with the sustainability of the dividend.

View our latest analysis for NS Tool

Dividend Volatility

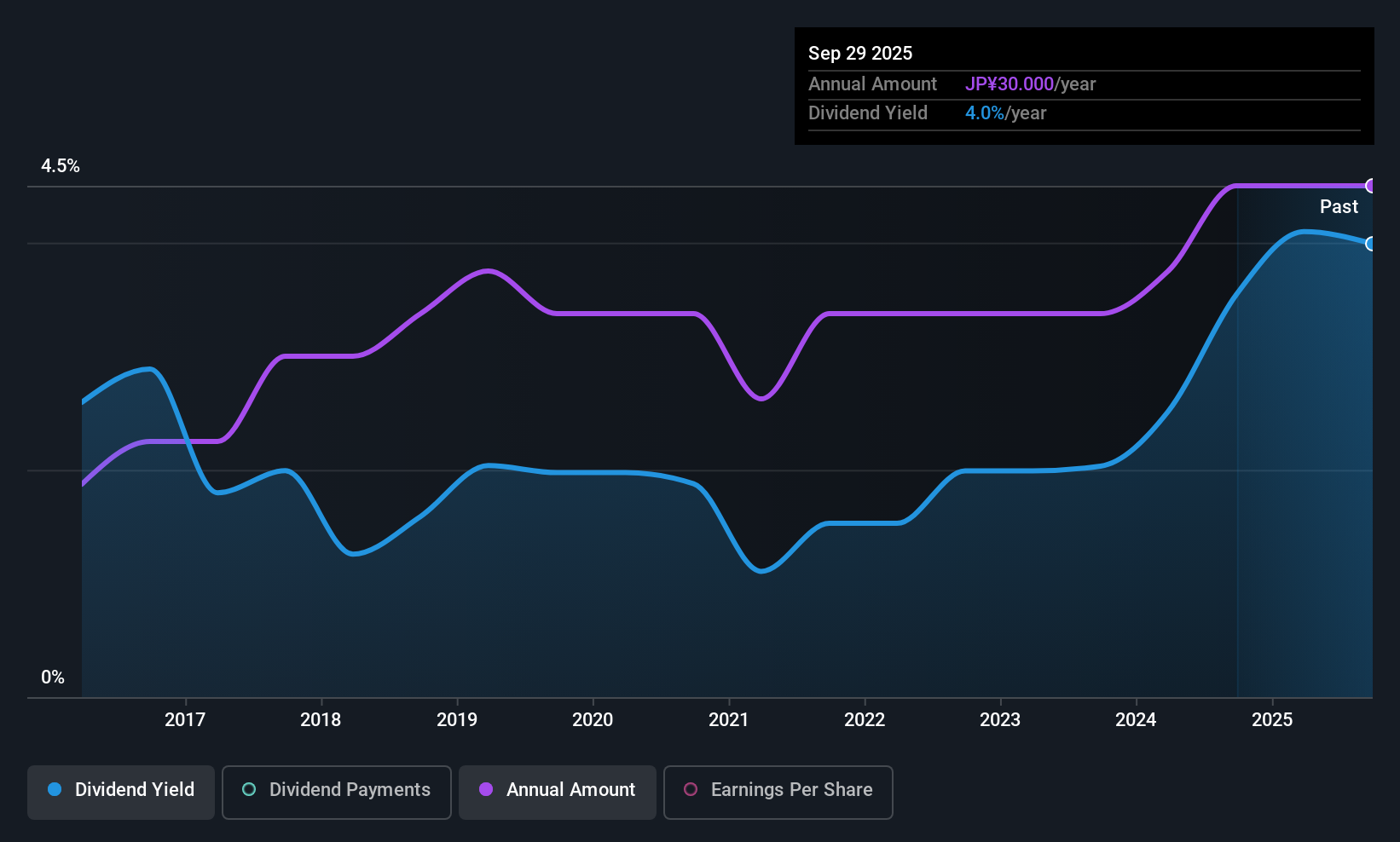

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from an annual total of ¥10.00 in 2015 to the most recent total annual payment of ¥30.00. This implies that the company grew its distributions at a yearly rate of about 12% over that duration. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

The Dividend's Growth Prospects Are Limited

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. However, NS Tool has only grown its earnings per share at 4.7% per annum over the past five years. Growth of 4.7% may indicate that the company has limited investment opportunity so it is returning its earnings to shareholders instead. This could mean the dividend doesn't have the growth potential we look for going into the future.

In Summary

Overall, we think NS Tool is a solid choice as a dividend stock, even though the dividend wasn't raised this year. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come across 2 warning signs for NS Tool you should be aware of, and 1 of them can't be ignored. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal