IPO News | Anke Innovation (300866.SZ) reports that the Hong Kong Stock Exchange ranks second in the world in the field of mobile charging products

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange disclosure on December 2, Anke Innovation Technology Co., Ltd. (hereinafter: Anke Innovation (300866.SZ)) submitted the Hong Kong Stock Exchange main board, with CICC, Goldman Sachs, and J.P. Morgan as co-sponsors. According to the prospectus, Anke Innovation is the creator of the ultimate innovative products in the global smart hardware technology industry. It is committed to providing global consumers with multiple categories of trustworthy products and the ultimate user experience. The company's products cover the three major product lines — smart charging and energy storage, smart home, and innovation and smart video — with a wide range of products, covering mobile charging, consumer-grade energy storage, smart security, smart cleaning, creative printing, smart audio, and smart projection.

According to the prospectus, Anker Innovation uses the Anker brand as its starting point and continues to expand its product portfolio covering the fields of smart charging and energy storage, smart home, innovation, and smart video. The company currently operates three global brands, Anker, Eufy, and SoundCore, as well as two core sub-brands, Anker Solix and EufyMake. Through these brands, the company provides innovative and trustworthy products to users around the world, empowering a smarter lifestyle.

The company has a leading global market share in various major segments such as mobile charging, energy storage, smart home security and wireless headsets. Specifically, according to Frost & Sullivan's data, in terms of retail sales, since 2020, the company has been ranked second in the world in the field of mobile charging products, and is also the largest independent mobile charging brand in the global and North American markets. In 2024, the company's global mobile charging product market share in terms of retail sales was 5.0%.

Driven by the globalization strategy, the company continues to expand its business footprint, and its products have sold well in more than 180 countries and regions around the world. While gaining a leading position in core markets such as North America and Europe, the company not only consolidated mature markets, but also achieved rapid growth in emerging markets. As of September 30, 2025, the company has accumulated more than 200 million users worldwide.

Financial data

revenue

During the track record period, the company mainly generated revenue from sales of the following products and services: (i) smart charging and energy storage; (ii) smart home and innovation; (iii) smart video; and (iv) others. The company recorded revenue of approximately 14.251 billion yuan, 17.507 billion yuan, 24.71 billion yuan, and 21,019 billion yuan in 2022, 2023, 2024, and 2025 respectively for the nine months ended September 30.

Profit during the year/period

The company recorded losses of approximately 1.18 billion yuan, 1,694 billion yuan, 2,211 billion yuan and 1,969 billion yuan in 2022, 2023, 2024, and 2025 for the nine months ending September 30, respectively.

Gross profit and gross profit margin

In 2022, 2023, 2024, and the nine months ended 2024 and September 30, 2025, the company recorded gross profit of RMB 5.403 billion, RMB 7.480 billion, RMB 10.645 billion, RMB 7.115 billion and RMB 9.102 billion, respectively. In 2022, 2023, 2024, and the nine months ended 2024 and September 30, 2025, the company's gross margins were 37.9%, 42.7%, 43.1%, 43.3%, and 43.3%, respectively. During the track record period, the increase in gross margin was mainly driven by the increase in profit margins brought about by high-end products. For example, the gross margin of smart homes and innovative products, and smart AV products continued to increase during the record period.

Industry Overview

Intelligent hardware generally refers to hardware products that integrate sensors, chips, operating systems, and network communication modules on the basis of traditional hardware. Typical products include smartphones and accessories, personal computers and accessories, smart home devices, smart audiovisual devices, etc. The global smart hardware technology market is about 1.2 trillion US dollars in 2024.

According to the size of the market and the characteristics of consumer demand, the smart hardware technology market can be divided into small and medium-sized markets (also known as the shallow sea market) and large markets.

The large market for smart hardware technology covers smart phones, personal computers, smart TVs, etc., and the market size of each category generally exceeds 80 billion US dollars. Consumer demand in these markets is relatively mature. Overall, these large markets are in a mature stage of development and are mainly composed of products such as smartphones, laptops, and televisions. The market is dominated by giant companies, forming a relatively stable market pattern. At the same time, product update and iteration cycles are often relatively long.

The small to medium market refers to a market of less than 80 billion US dollars. Generally speaking, these markets have not been fully developed and have relatively high potential for growth. These small and medium-sized markets are characterized by diversification of product categories, and the size of each market segment is relatively small. Many of these market segments are still in the early stages or high growth stages and have the potential to expand rapidly. Products are innovating and iterating faster, and there are more diverse ways to create value. The competitive landscape is generally fragmented, and emerging players frequently enter the market and continue to create opportunities for development. The total size of these markets in 2024 is about 340 billion US dollars.

In 2024, the global mobile charging products market reached RMB 215.5 billion, with a compound annual growth rate of 11.8% from 2020 to 2024. By product category, the mobile power supply market reached RMB 152.6 billion in 2024, with a compound annual growth rate of 11.7% from 2020 to 2024. This is mainly due to growing consumer demand for portable and high-capacity charging solutions, frequent smartphone and wearable device updates, and deepening dependence on mobile devices for work, entertainment, and travel. Benefiting from the growing popularity of fast charging technology and multi-device ecosystems, the market size of chargers and accessories will reach RMB 62.9 billion in 2024.

Looking ahead, the global mobile charging market is expected to maintain a strong growth trend. The market size will reach RMB 346.7 billion by 2029, and the compound annual growth rate from 2024 to 2029 is 10.0%. Among them, the growth rate of mobile power banks is expected to surpass chargers and accessories. This is mainly due to increased consumer demand, improved mobile power performance, and enhanced portability.

Board of Directors and Executive Information

The Board consists of nine directors, including four executive directors, two non-executive directors and three independent non-executive directors. The term of office of directors is three years, and they can be re-elected. According to relevant Chinese laws and regulations, independent non-executive directors cannot be re-elected for more than six years.

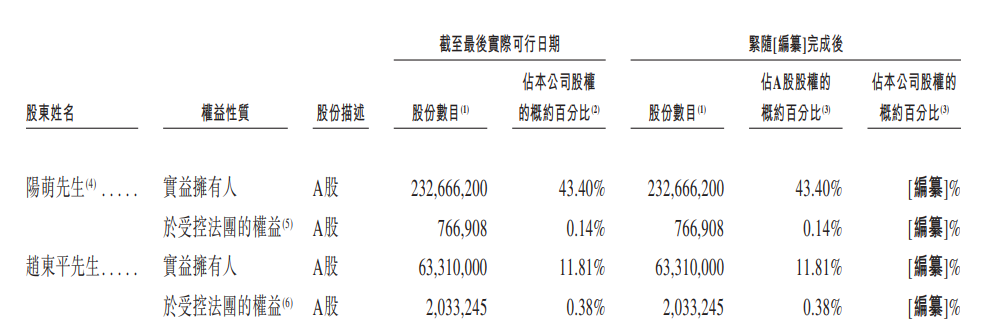

Shareholding structure

Mr. Yang and Ms. He held 43.40% and 3.64% of the company's shares respectively. Mr. Yang and Ms. He acted in concert. Therefore, Mr. Yang and Ms. He are the controlling shareholders of the company.

Intermediary team

Co-sponsors: China International Finance Hong Kong Securities Limited, Goldman Sachs (Asia) Limited, J.P. Morgan Securities (Far East) Limited

Compliance Advisor: Zibo Capital Co., Ltd.

Industry Advisor: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch

Company Legal Advisors: Hong Kong and US Law: Davis Polk & Wardwell; Related Chinese Law: Haiwen Law Firm; China Data Compliance Law: Haiwen Law Firm; UAE Law: Winson Partners and Legal Consultants; US Law Involving Certain Business Operations in the US: Shanze Partners PLLC; Related to UK Law: Addleshaw Goddard LLP; relating to Japanese law: TMI Associates; relating to Hong Kong regulatory matters: Li Weibin Law Firm

Reporting Accountant: KPMG

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal