How Investors Are Reacting To AIG’s Mixed Q3 2025 Results and Corebridge-Linked Losses

- In the past week, American International Group reported better-than-expected Q3 2025 adjusted earnings per share, but this was accompanied by weaker GAAP earnings, lower net investment income, and a drop in net premiums written.

- These results were also impacted by sizable realized and unrealized losses related to its Corebridge stake, contributing added pressure to the company's financial performance.

- We'll now consider how softer net investment income and premium trends may influence American International Group’s longer-term investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

American International Group Investment Narrative Recap

To be an AIG shareholder, you need to believe the company's focus on portfolio optimization, disciplined underwriting, and technology investments can drive steady margin improvement and support resilience despite fluctuations in premium income and investment returns. The recent Q3 results, featuring softer net investment income and a decline in net premiums written, do not appear to materially alter the current narrative, but they highlight the importance of margin management. The primary short-term catalyst is AIG’s ability to maintain underwriting discipline and expense control, while the main risk remains concentrated exposure in core insurance segments as revenue sources become less diversified following the Corebridge divestiture. A key recent announcement was the Q3 2025 share buyback, with AIG repurchasing over 15 million shares for US$1.23 billion. This continues the company's capital return strategy and could support share prices in the near term, particularly as investors focus on future earnings drivers such as ongoing expense savings from AIG’s transformation initiatives. In contrast, investors should also be aware of risks that may emerge from AIG’s reduced diversification, particularly if underwriting volatility increases...

Read the full narrative on American International Group (it's free!)

American International Group's narrative projects $31.3 billion in revenue and $3.8 billion in earnings by 2028. This requires 4.5% yearly revenue growth and a $0.5 billion earnings increase from $3.3 billion currently.

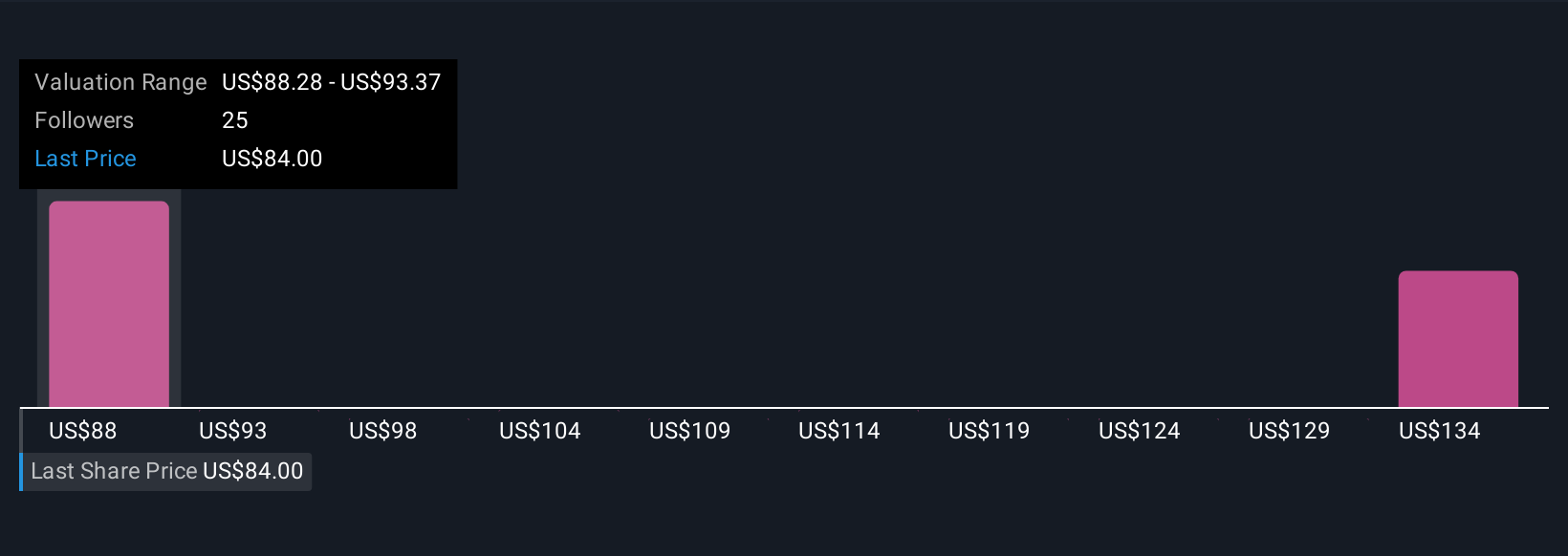

Uncover how American International Group's forecasts yield a $88.28 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community estimate AIG’s fair value from US$88.28 to US$139.62. With concentrated core operations posing ongoing risk, wide-ranging views highlight the importance of examining several scenarios for AIG’s future.

Explore 5 other fair value estimates on American International Group - why the stock might be worth as much as 82% more than the current price!

Build Your Own American International Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American International Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free American International Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American International Group's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal