Is Concentrix a Bargain After Its 17% Share Price Drop?

- Wondering if Concentrix is a hidden value or just another overhyped name? You are not alone in trying to separate signal from noise with this stock.

- After a tough run, Concentrix shares have dipped nearly 17% in the last month and are off more than 18% year-to-date. This suggests shifting investor sentiment around its prospects and risks.

- This downward momentum has been influenced by broader industry shake-ups and recent strategic announcements from Concentrix itself. The company is expanding services and exploring new markets. Recent headlines about customer experience technology deals and sector partnerships have fueled conversations about its long-term positioning.

- For those seeking a quick answer, Concentrix scores a 6/6 on our value checks, meaning it passes every major valuation test for being undervalued. Next, we will break down the main valuation approaches and, at the article's end, introduce a way to see what fair value really means in today’s market.

Find out why Concentrix's -18.9% return over the last year is lagging behind its peers.

Approach 1: Concentrix Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to their present value. This approach helps investors understand what Concentrix’s shares could be worth based on expected cash generation, rather than simply recent earnings or peer comparisons.

According to the latest data, Concentrix reported trailing twelve-month Free Cash Flow (FCF) of $507 million. Analysts estimate FCF will rise each year, reaching $981 million by 2029. These forecasts rely on a combination of analyst-derived projections for the first five years and cautious long-term extrapolation for years beyond, as provided by Simply Wall St.

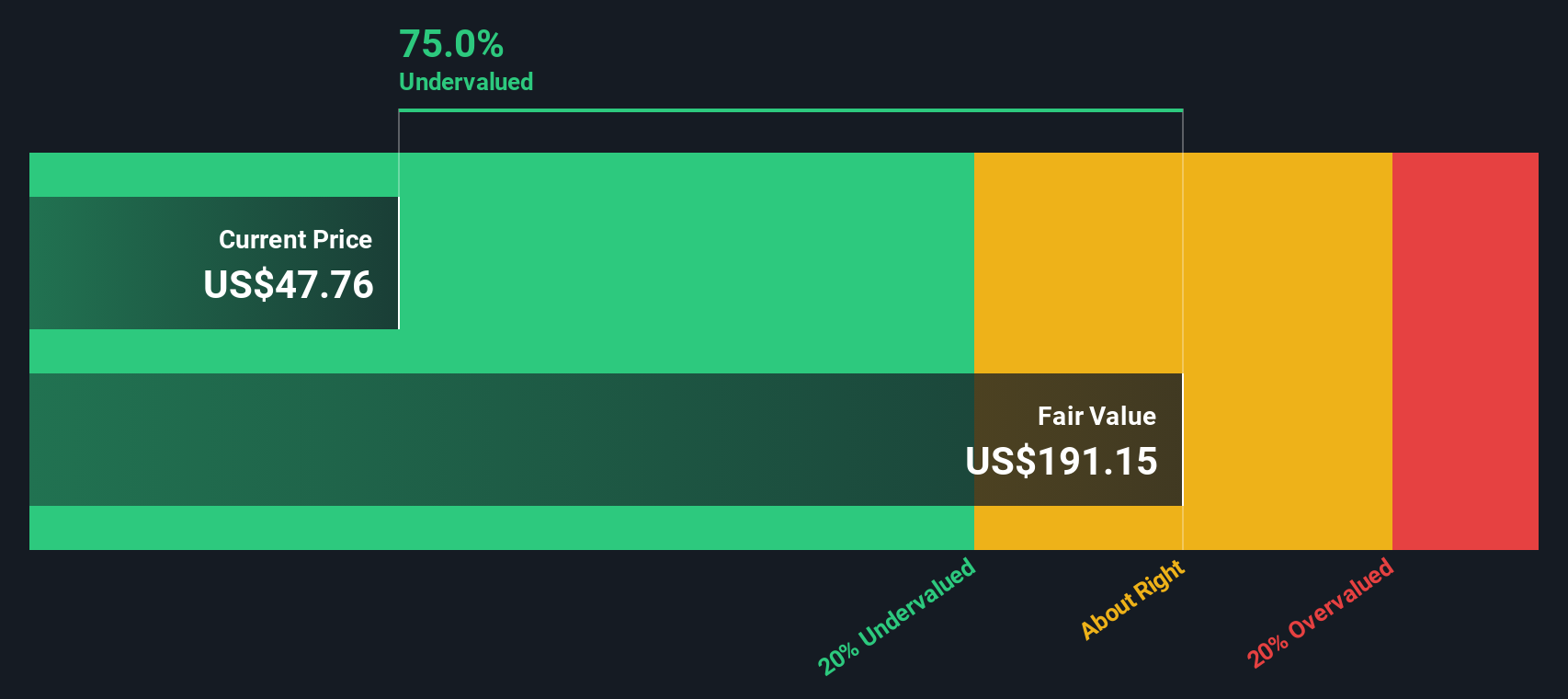

The DCF model concludes that the intrinsic value of Concentrix shares is $163.61. Compared to current trading levels, this suggests the stock is trading at a 78.3% discount to its calculated fair value. Such a wide margin of undervaluation is rare among established names, especially in the professional services industry.

Simply put, if these forecasts prove accurate, Concentrix shares look deeply undervalued today.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Concentrix is undervalued by 78.3%. Track this in your watchlist or portfolio, or discover 923 more undervalued stocks based on cash flows.

Approach 2: Concentrix Price vs Earnings

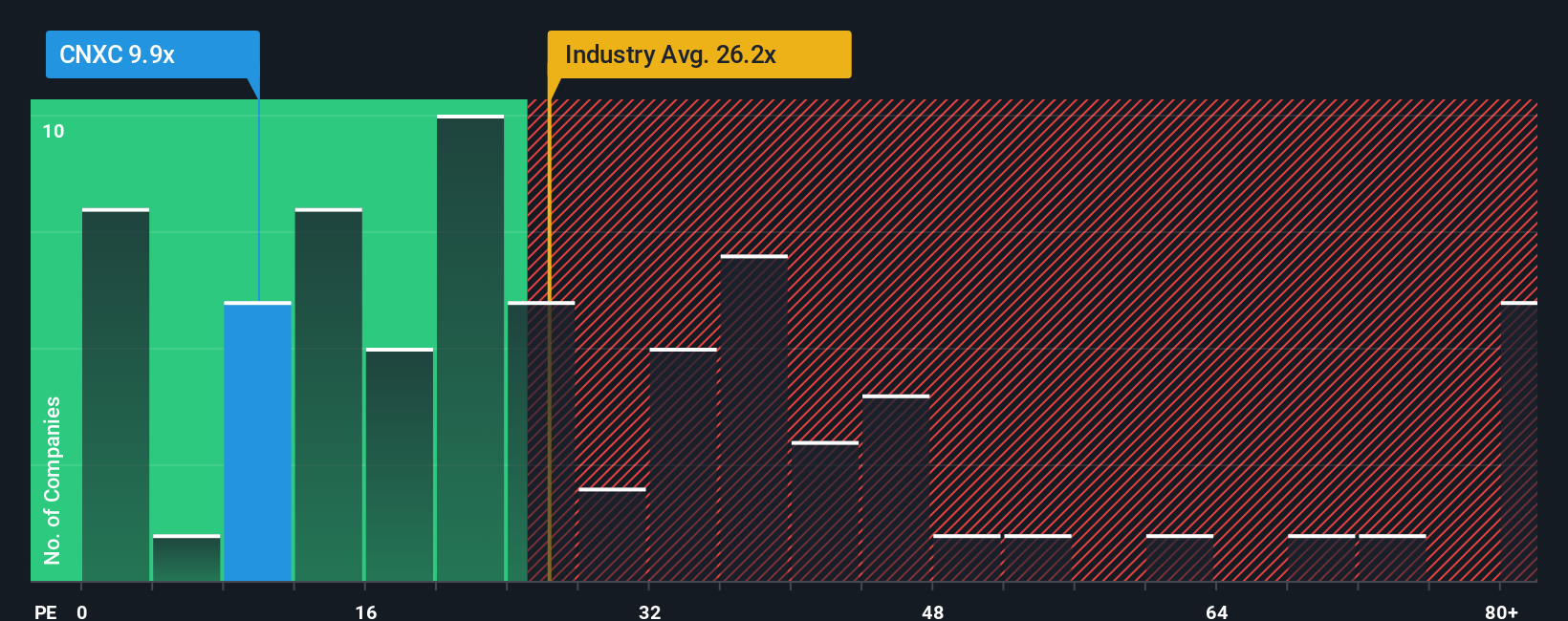

The Price-to-Earnings (PE) ratio is widely considered the preferred multiple for valuing profitable companies like Concentrix because it directly relates share price to the company’s bottom-line profitability. For businesses generating consistent earnings, the PE ratio offers a quick snapshot of how much investors are willing to pay for each dollar of earnings.

Growth expectations and risk play a big role in shaping what is considered a "normal" or "fair" PE ratio. Higher expected earnings growth typically justifies a higher PE, while increased risks often pull it lower. Comparing a company's PE to its industry or peers can help, but it is important to recognize that benchmark multiples reflect diverse company profiles and operating conditions.

Concentrix currently trades at a PE ratio of 7.3x. For context, the average PE for the professional services industry sits at 24.3x, and the peer group average is even higher at 30.3x. Simply Wall St’s proprietary “Fair Ratio” for Concentrix is 20.8x, determined by factoring in the company’s specific earnings growth prospects, profit margins, scale, and risks. Unlike a simple industry or peer comparison, the Fair Ratio aims to capture the real valuation justified by these unique fundamentals and provides a truer benchmark for investors.

With a current PE of 7.3x versus a Fair Ratio of 20.8x, Concentrix appears meaningfully undervalued relative to what a balanced assessment suggests it should be trading at.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1437 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Concentrix Narrative

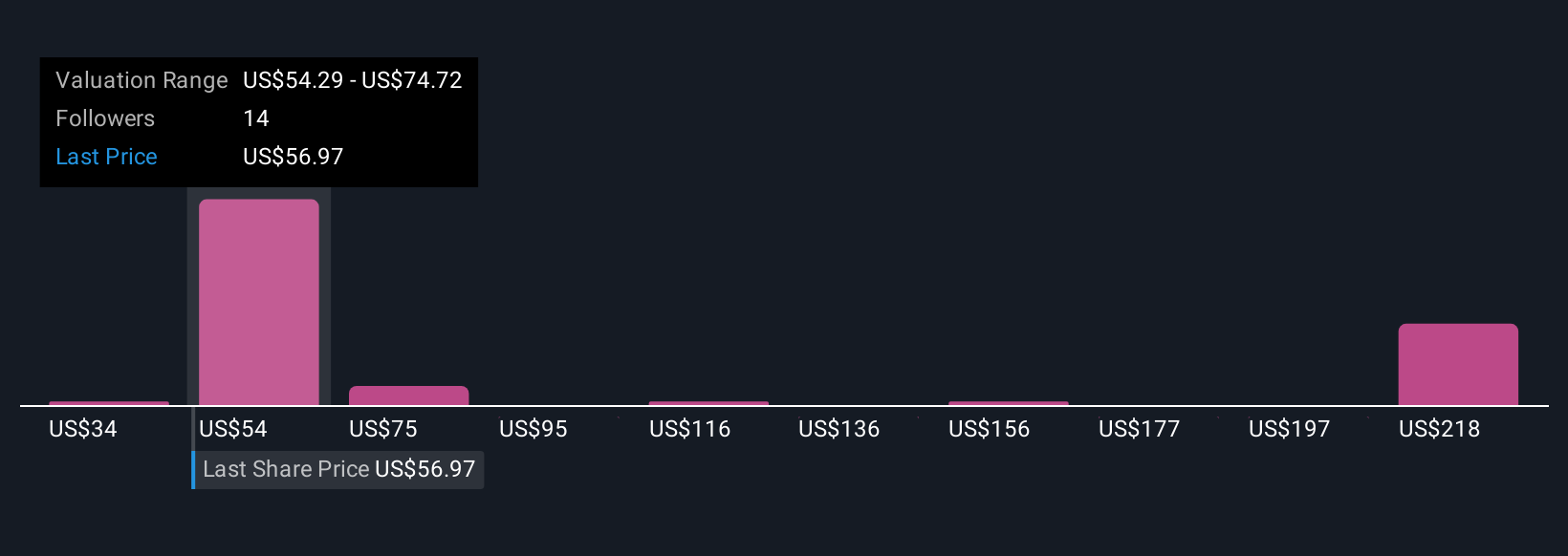

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, yet powerful way for investors to create a story about a company by blending your view of its future with key numbers like estimated revenue, margins, and fair value. Instead of just looking at the latest financials, Narratives connect the company’s business story directly to a projected financial outcome and an actionable fair value, making valuation more personal and dynamic.

Narratives are designed to be accessible for everyone on Simply Wall St’s Community page, where millions of investors explore and build their own perspectives. They help you make more informed buy or sell decisions by showing how fair value shifts relative to the share price as your assumptions change, much like how analysts update price targets after earnings or major news.

Because Narratives are updated in real time as new information emerges, they remain accurate and relevant. For example, some Concentrix investors with an optimistic narrative see fair value above $80 per share, focusing on AI-driven growth and operational improvements, while more cautious investors, highlighting risks like modest revenue growth and client concentration, set fair value closer to $61.

Do you think there's more to the story for Concentrix? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal