How Surging AI Data Center Demand Will Impact Fabrinet (FN) Investors

- Fabrinet, a contract manufacturer specializing in optical networking equipment, recently experienced heightened demand for its highest bandwidth products used in expanding artificial intelligence data centers.

- This surge highlights Fabrinet’s uniquely strong position at the intersection of optical networking and AI-driven data center infrastructure, as well as the impact of its expansion into auto components and laser assembly.

- We’ll examine how Fabrinet’s increasing visibility in AI infrastructure could reshape its investment narrative and long-term prospects.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Fabrinet Investment Narrative Recap

To be a Fabrinet shareholder, you need to believe in the accelerating demand for high-bandwidth optical networking driven by AI data centers and the company’s ability to maintain a leading position despite risks like customer concentration. The recent uptick in AI-related orders highlights near-term opportunity, though it does not directly reduce exposure to large customers or address ongoing component supply challenges, the latter of which remains the key short-term catalyst and risk.

Among Fabrinet’s recent corporate updates, the Q1 FY2026 earnings report stands out, sales and net income both rose notably year over year, supporting the view that AI infrastructure demand is translating to strong financial performance. This result is particularly relevant to the ongoing supply chain and margin pressures, since continued high demand for premium optical products could intensify component shortages or amplify margin volatility if not managed with operational flexibility.

However, investors should also be aware that even with robust demand, Fabrinet’s reliance on a few major customers still means...

Read the full narrative on Fabrinet (it's free!)

Fabrinet's outlook projects $5.4 billion in revenue and $537.3 million in earnings by 2028. This reflects a 16.3% annual revenue growth rate and an increase in earnings of about $204.8 million from the current $332.5 million.

Uncover how Fabrinet's forecasts yield a $479.25 fair value, a 12% upside to its current price.

Exploring Other Perspectives

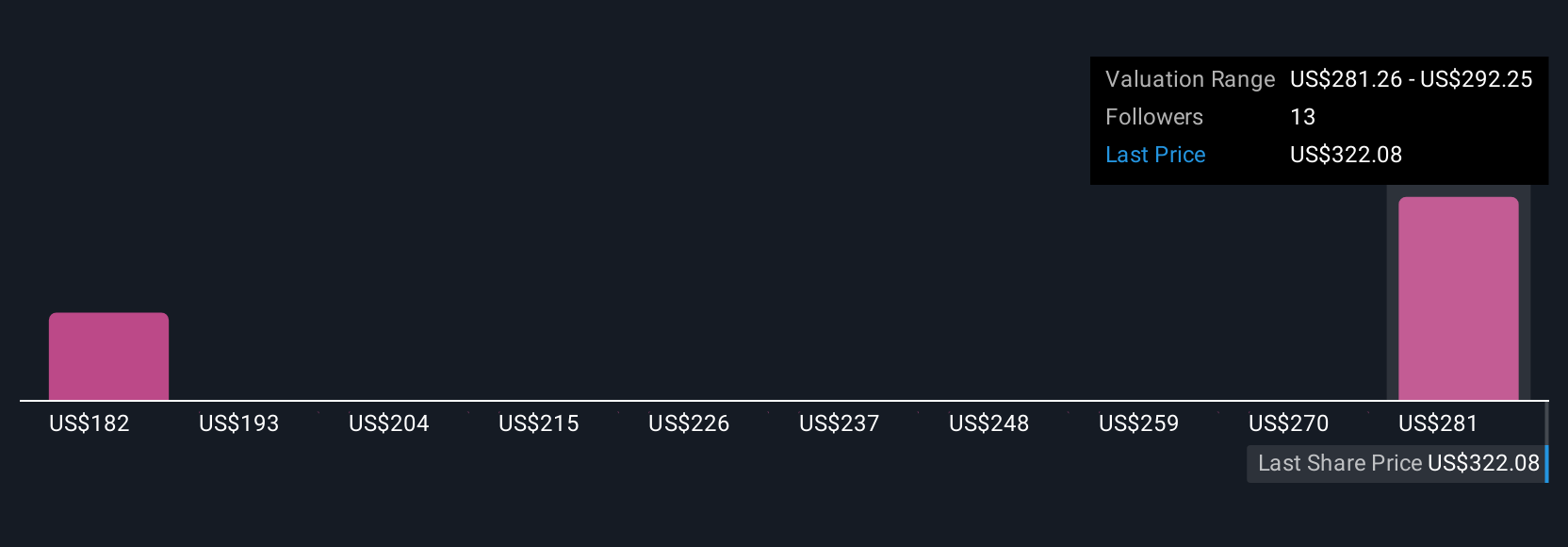

Simply Wall St Community members supplied 4 fair value estimates for Fabrinet, ranging from US$292.01 to US$479.25 per share. With such dispersed opinions, keep in mind persistent supply chain challenges may shape actual outcomes very differently in the near term.

Explore 4 other fair value estimates on Fabrinet - why the stock might be worth as much as 12% more than the current price!

Build Your Own Fabrinet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fabrinet research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fabrinet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fabrinet's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal