Will Levi's (LEVI) Bold AI Partnership with Microsoft Reshape Its Competitive Edge in Retail?

- Microsoft and Levi Strauss recently announced an expanded global partnership to accelerate Levi's digital transformation through AI-driven tools, cloud migration with Azure, and the adoption of Microsoft Copilot+ PCs across corporate and retail operations.

- This collaboration highlights Levi Strauss's focus on using advanced technology to streamline employee workflows and create richer consumer experiences in a rapidly evolving retail landscape.

- We'll explore how Levi Strauss's embrace of AI-powered workplace productivity through its Microsoft alliance could influence the company's long-term investment outlook.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Levi Strauss Investment Narrative Recap

To have conviction in Levi Strauss as a shareholder, you need confidence in the company’s ability to maintain cultural relevance and deliver profitable growth through international expansion, premium brand initiatives, and direct-to-consumer momentum. The expanded Microsoft partnership, focused on AI-driven productivity and cloud migration, supports Levi’s efficiency and innovation goals but does not materially change the near-term catalysts; core denim demand and shifting consumer preferences remain the most important factors and biggest risks.

Among recent announcements, the company’s Q3 2025 earnings update stands out: robust sales and profit growth reinforce continued progress in international markets and margin gains from DTC expansion, aligning with the central catalysts driving interest in the stock today.

However, it is important for investors to remember that while technology upgrades can drive efficiency, the company still faces challenges if denim trends...

Read the full narrative on Levi Strauss (it's free!)

Levi Strauss' narrative projects $6.8 billion in revenue and $769.0 million in earnings by 2028. This requires 1.4% yearly revenue growth and an increase of $345.9 million in earnings from the current $423.1 million.

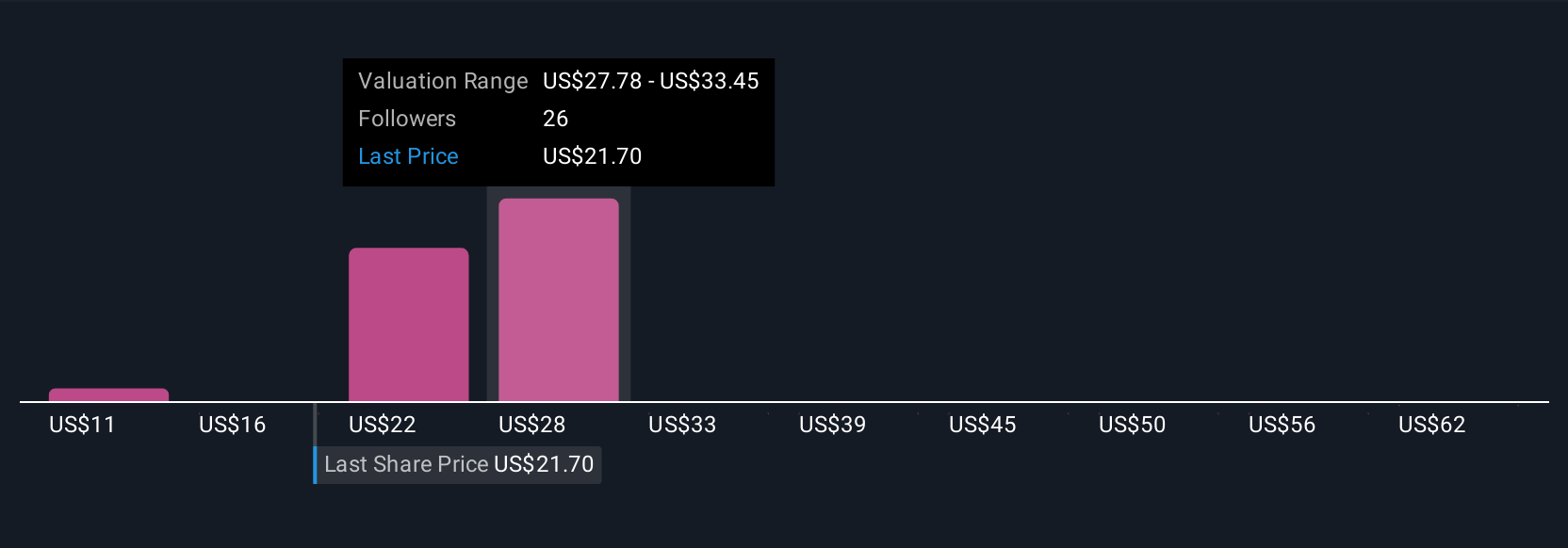

Uncover how Levi Strauss' forecasts yield a $26.79 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span from US$10.77 to US$1,010.96, based on 7 different analyses. With this much variation, you can see how much expectations differ, especially as direct-to-consumer and brand expansion remain critical to Levi Strauss’s broader performance in the apparel sector.

Explore 7 other fair value estimates on Levi Strauss - why the stock might be a potential multi-bagger!

Build Your Own Levi Strauss Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Levi Strauss research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Levi Strauss research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Levi Strauss' overall financial health at a glance.

No Opportunity In Levi Strauss?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal