Major Shift In The AI Chip Market? Why Broadcom (AVGO) Stock Could Be The Sleeper Winner

Broadcom Inc (NASDAQ:AVGO) stock is little changed Tuesday morning, even as fresh AI headlines highlight its growing opportunity in the AI chip space. Here’s what investors need to know.

- AVGO is performing well relative to peers. Check the market position here.

What To Know: According to The Information, Meta Platforms is considering using Google's custom tensor processing units (TPUs) for its data centers in 2027, and may rent the chips from Google Cloud sooner, which puts Broadcom in the slipstream of a potentially major architectural shift in AI infrastructure.

Broadcom is Google's key silicon partner on these TPUs, meaning any large-scale Meta adoption could mean higher custom-chip revenue and better multi-year visibility. Because TPUs are customized, Broadcom can capture higher margins than on commodity networking chips, and design wins tend to lock in multi-year production tied to cloud capex cycles.

Read Also: AMD Stock Tanks Amid Shifting Sands In Semiconductor Space

The potential Google-Meta TPU deal also highlights that hyperscalers want to reduce their dependence on Nvidia by broadening their chip supply. That plays directly to Broadcom's strengths in designing application-specific accelerators and networking gear that can be integrated into cloud providers' stacks.

Meanwhile, expectations for a possible Federal Reserve rate cut in December are, in general, improving risk appetite for mega-cap tech and semiconductors, supporting continued heavy AI spending.

Along with Tuesday commentary from Jim Cramer, who calls Broadcom the most likely winner of any Google-Meta TPU agreement, these developments underscore Broadcom's central role in next-generation AI data centers, even as the stock pauses following a strong rally.

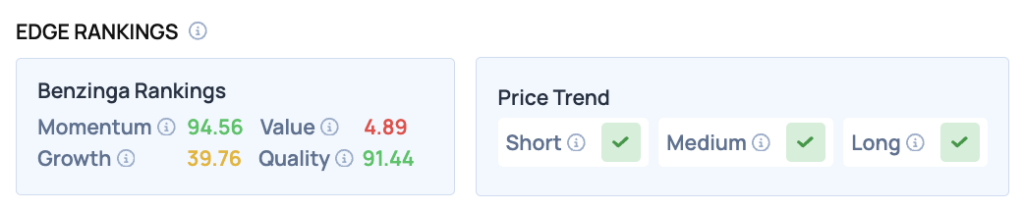

Benzinga Edge Rankings: Broadcom's Momentum score sits at an exceptional 94.56, according to Benzinga Edge rankings.

AVGO Price Action: Broadcom shares were down 0.73% at $375.42 at the time of publication on Tuesday. The stock is trading near its 52-week high of $386.48, according to Benzinga Pro data.

Read Also: Producer Inflation Stays Hot, But Consumer Pullback Adds To Fed Cut Debate

How To Buy AVGO Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Broadcom’s case, it is in the Information Technology sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal