A Closer Look at GlobalFoundries (GFS) Valuation After Strategic GaN Partnership With Navitas Semiconductor

GlobalFoundries (GFS) has drawn increased attention from investors after unveiling a long-term strategic partnership with Navitas Semiconductor. This collaboration targets U.S.-based GaN design and manufacturing for high-power applications such as AI datacenters and energy infrastructure.

See our latest analysis for GlobalFoundries.

GlobalFoundries’ latest moves, including its GaN manufacturing alliance and new wins in aerospace chips, are stirring conversation, but the share price return tells a mixed story. Though the stock edged up 5.1% over the past week, its year-to-date share price return stands at -18.5%, and a tough 12 months means the total shareholder return is down 22.9%. Momentum remains cautious even as the company lands important industry partnerships that may set the stage for a rebound.

If GlobalFoundries' recent strategic plays have you thinking about the broader tech landscape, now is a great time to discover See the full list for free.

With the stock trading well below recent analyst price targets despite brighter earnings and growth in strategic partnerships, investors now face a key question: Is GlobalFoundries undervalued, or is the market already factoring in future gains?

Most Popular Narrative: 12.2% Undervalued

At the last close of $34.64, the narrative’s fair value estimate of $39.43 points to a double-digit upside, suggesting market skepticism versus bullish projections. This backdrop makes it worth exploring one of the narrative’s main drivers.

GlobalFoundries' diversified manufacturing footprint in the U.S., Europe, and China aligns with customer needs for regionalized, resilient supply chains amid geopolitical uncertainty and tariff risks. This positions the company to capture increased volumes and benefit from government incentives, supporting long-term growth in revenue and free cash flow.

Curious what bold assumptions power this valuation? The secret sauce is locked in future margin leaps, government-backed expansion, and a dramatic profit growth forecast. What’s the real story behind these aggressive projections? Unlock the narrative’s financial blueprint inside.

Result: Fair Value of $39.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained pricing pressure and GlobalFoundries’ limited exposure to advanced chip technologies could limit future revenue and margin expansion, which may challenge the bullish outlook.

Find out about the key risks to this GlobalFoundries narrative.

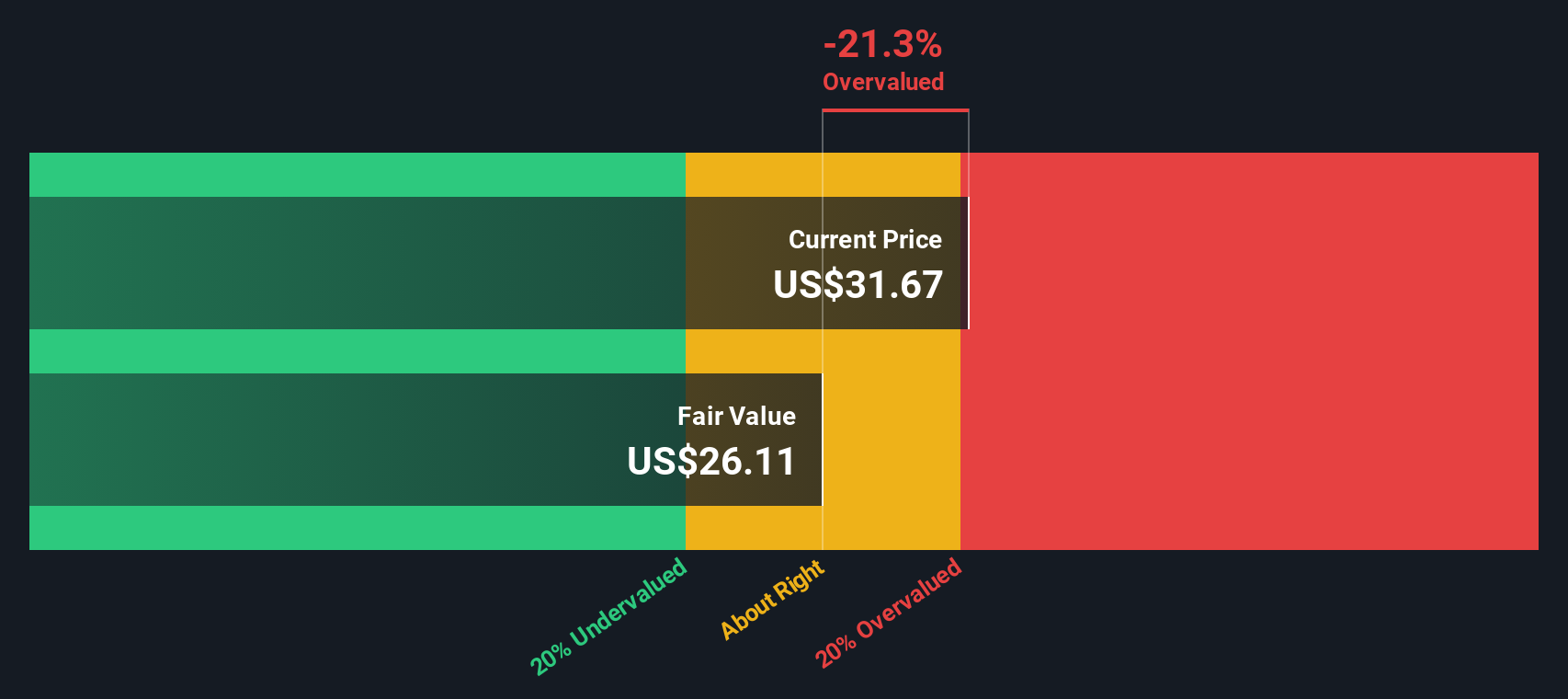

Another View: The SWS DCF Model’s Verdict

While analyst targets suggest upside, our SWS DCF model comes to a less optimistic conclusion. It currently pegs GlobalFoundries’ fair value lower than the market price. This suggests investors are paying a premium for future growth. Is this optimism warranted, or are risks being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GlobalFoundries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 922 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GlobalFoundries Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own view of GlobalFoundries in just minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding GlobalFoundries.

Looking for More Investment Ideas?

Upgrade your portfolio with powerful ideas you won’t want to miss. Make smarter moves by targeting stocks with unique trends and solid upside potential. See what others overlook and capitalize now.

- Boost your strategy by grabbing strong income opportunities through these 14 dividend stocks with yields > 3% and find stocks with robust dividend yields above 3%.

- Tap into innovation early by gaining exposure to these 26 AI penny stocks shaking up industries with transformative artificial intelligence breakthroughs.

- Catch value that others miss. Seize the chance with these 922 undervalued stocks based on cash flows centered on companies trading below their intrinsic cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal