Did Strong Shareholder Returns Just Shift OneMain Holdings' (OMF) Investment Narrative?

- In recent weeks, OneMain Holdings attracted investor attention as it reported solid annual revenue and net income growth, along with ongoing buybacks and a high dividend yield.

- Despite mixed analyst ratings and increased insider selling, the company's policies on shareholder returns and profitability have strengthened its appeal among yield-focused investors.

- We'll explore how OneMain Holdings’ robust dividend policy is shaping its investment narrative in light of recent financial performance.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

OneMain Holdings Investment Narrative Recap

To own shares in OneMain Holdings, you must believe in sustained demand for non-prime lending and management’s capacity to balance growth with tight credit discipline, even as the company faces execution risks from rising competition and digital disruption. The recent news, centered on analyst ratings and insider selling, has not materially altered the key short-term catalyst, which remains the company's ongoing capital returns to shareholders; however, these developments continue to spotlight pressure points around credit quality and margin sustainability.

Among the recent developments, OneMain’s newly authorized US$1 billion share repurchase program stands out as highly relevant for potential investors. This initiative, paired with an elevated dividend, reflects management’s focus on direct shareholder returns, currently the main driver of investment interest against a backdrop of steady operating results. But in contrast, investors should still keep an eye on industry-wide risks linked to potential regulatory actions in high-yield lending, as these could...

Read the full narrative on OneMain Holdings (it's free!)

OneMain Holdings' narrative projects $6.8 billion revenue and $1.3 billion earnings by 2028. This requires 34.9% yearly revenue growth and a $636 million earnings increase from $664 million currently.

Uncover how OneMain Holdings' forecasts yield a $66.21 fair value, a 11% upside to its current price.

Exploring Other Perspectives

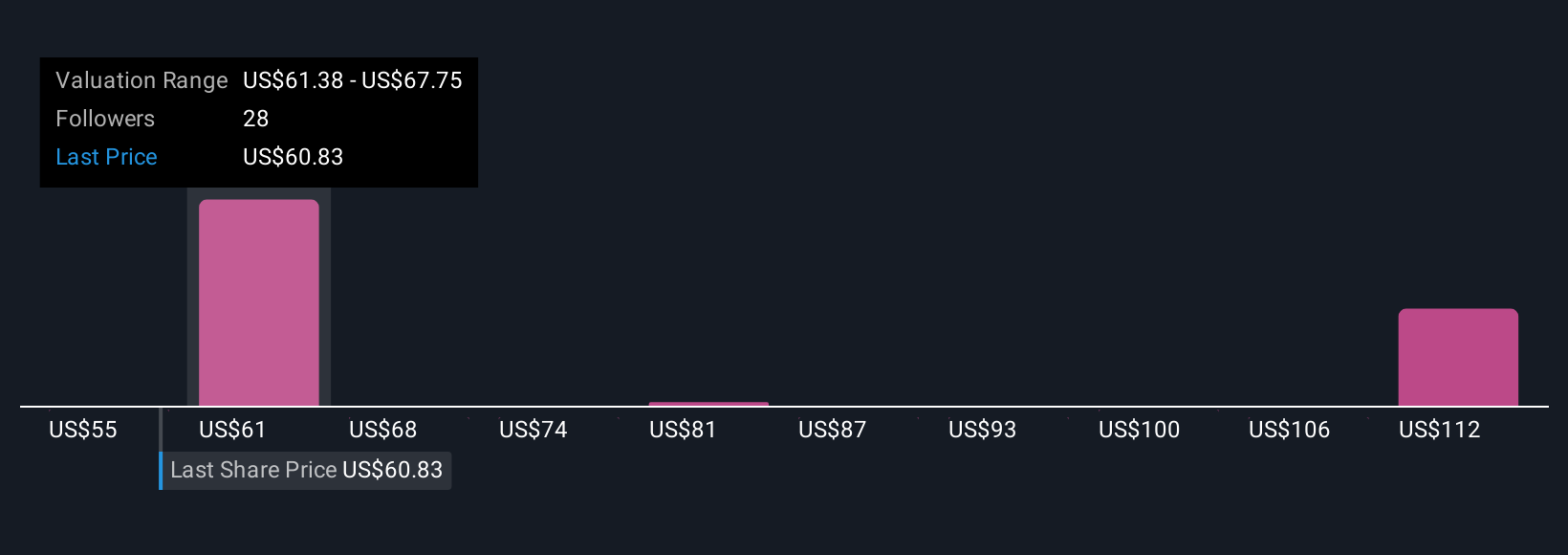

Five individual fair value estimates from the Simply Wall St Community range widely between US$55 and US$124 per share. While community members hold divergent opinions, continued branch-based expansion carries cost risks as digital competitors target the same non-prime lending segment.

Explore 5 other fair value estimates on OneMain Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own OneMain Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OneMain Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free OneMain Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OneMain Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal