Is Carlisle Companies Fairly Priced After Leadership Changes and Recent Share Price Drop?

- Wondering if Carlisle Companies could be one of those stocks that’s undervalued but overlooked? Let’s dig into what might be driving interest or doubt around its share price.

- The stock has seen some sharp moves lately, rising 1.6% over the last week, but still down 10.0% in the past month and 16.7% year-to-date. These movements hint at changing sentiment and fresh questions about future growth.

- Big headlines in recent weeks have focused on leadership changes and expanding environmental initiatives. Both factors have shaped investor expectations and serve as important context for the stock’s recent performance.

- On our 6-point value checklist, Carlisle Companies currently scores 4, suggesting it could be attractively priced compared to many peers. Before considering classic valuation yardsticks, there may be an even more insightful way to judge value later in this article.

Find out why Carlisle Companies's -34.3% return over the last year is lagging behind its peers.

Approach 1: Carlisle Companies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a straightforward way to estimate a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This method helps investors understand what a business is truly worth, based on its ability to generate cash in the years ahead.

For Carlisle Companies, the latest reported Free Cash Flow (FCF) stands at $1.01 billion, reflecting the company’s strong cash generation over the last twelve months. Analyst estimates extend to 2027 and project FCF of $862 million, with further forecasts using a gradual downward trend that culminates in about $881 million ten years from now. While the FCF dips slightly in coming years, the general trajectory remains stable according to Simply Wall St’s extrapolations.

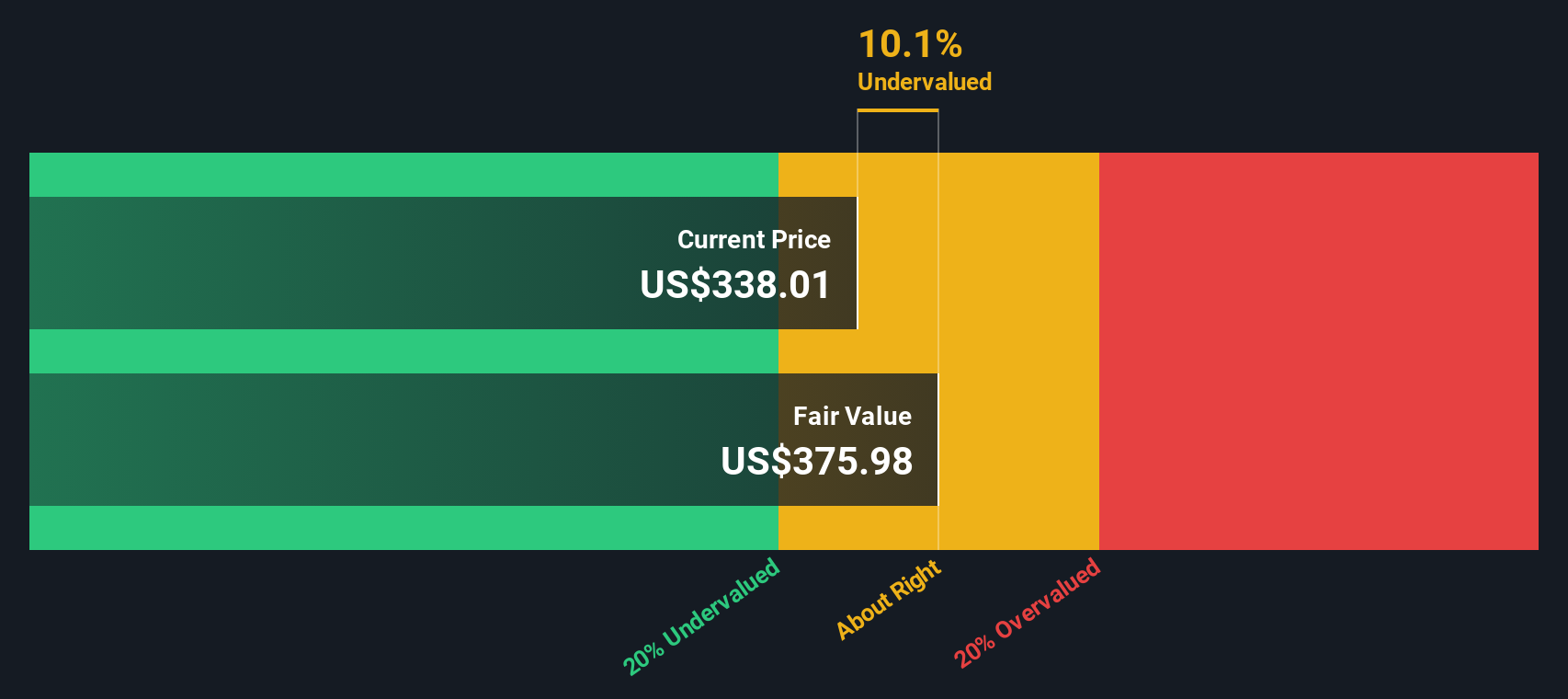

Using these cash flow projections, the DCF model estimates the fair value of Carlisle Companies shares at $296.02. Based on this analysis, the stock currently trades at a 3.1% premium to its intrinsic value, suggesting it is about fairly valued given typical market swings.

Result: ABOUT RIGHT

Carlisle Companies is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Carlisle Companies Price vs Earnings

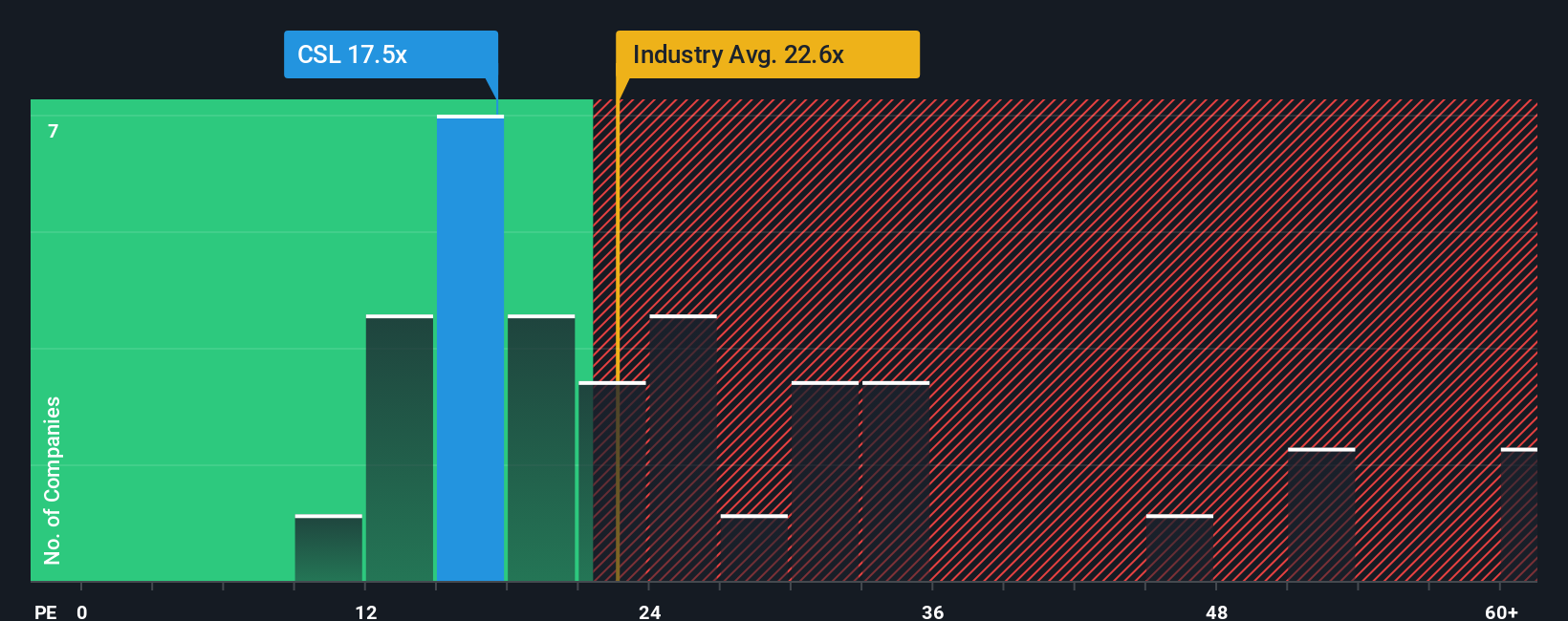

The Price-to-Earnings (PE) ratio is a widely used metric for valuing established, profitable companies like Carlisle. It helps investors gauge how much the market is paying for each dollar of the company’s earnings, offering a quick snapshot of value relative to profits. For businesses with consistent earnings, the PE ratio is often the best yardstick for comparison because it incorporates earnings quality and profitability.

When deciding what a “normal” or “fair” PE ratio should be, it is important to remember that companies with faster growth prospects, lower risk profiles, or higher profit margins typically command higher multiples. Conversely, slower-growing or riskier companies may trade at lower PE ratios. Looking at Carlisle Companies, its current PE stands at 16.5x, which is slightly below the Building industry average of 17.3x and noticeably under the peer average of 19.8x. This may suggest a modest market discount.

However, Simply Wall St’s proprietary Fair Ratio model goes beyond these simple peer or industry benchmarks. The Fair Ratio for Carlisle, calculated at 22.2x, accounts for factors such as company-specific growth rates, profitability, risk, and market size. This approach provides a much more tailored estimate of fair value than standard comparisons because it reflects the unique mix of fundamentals that drive Carlisle’s long-term performance.

As the actual PE (16.5x) is meaningfully below the Fair Ratio (22.2x), the stock appears undervalued based on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Carlisle Companies Narrative

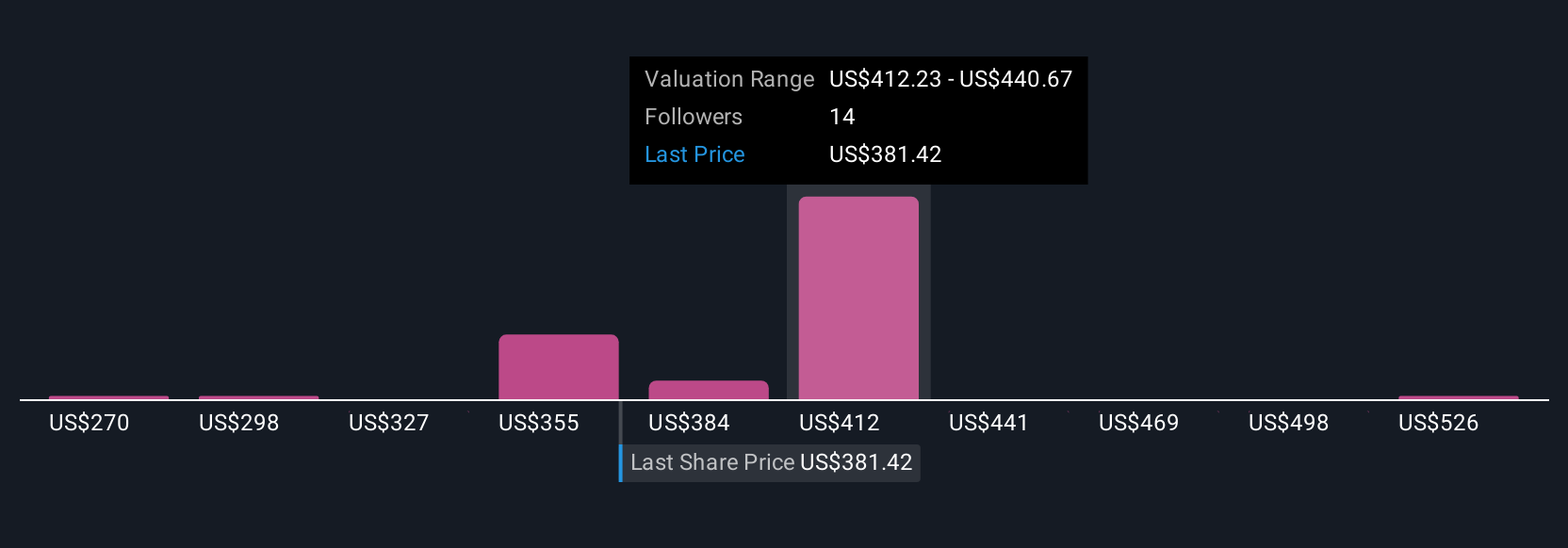

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is more than just a set of numbers; it is your own story, your perspective on a company, grounded in what you believe about its future revenue, earnings, and margins and how those connect to fair value.

On Simply Wall St’s Community page, millions of investors use Narratives to link a company’s story to their financial forecasts and determine a fair value specific to their view. Narratives make it easy and accessible for anyone to model their assumptions, apply their reasoning, and see how the evolving story (including company updates or market news) might impact fair value and the decision to buy or sell.

If new earnings or business developments emerge, Narratives update dynamically, helping you instantly sense-check your thesis. For example, with Carlisle Companies, one investor might be bullish, expecting new buybacks and higher margins, and therefore see fair value closer to $480 per share, while another could worry about margin compression and estimate fair value down at $380. Narratives allow each person to clearly articulate their view, compare it with others, and make more informed investment decisions.

Do you think there's more to the story for Carlisle Companies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal