Kohl's Names New CEO Amid Sales Slump— Q3 Earnings In Focus On Tuesday

Kohl’s Corp. (NYSE:KSS) named interim chief Michael Bender as its permanent CEO on Monday, marking the department store’s third leadership change in as many years, as it works to reverse a prolonged sales slump.

The announcement comes just ahead of the retailer’s third-quarter earnings report, and follows months of turmoil after the board ousted former chief executive Ashley Buchanan over improper dealings with a vendor with whom he had a personal relationship.

Buchanan was fired from Kohl's just four months after he had taken the top job.

What Does Wall Street Expect From Kohl’s Q3 Report?

Kohl’s said in August that it expects net sales to drop by 5% to 6% for the fiscal year.

The company, which houses brands like Jumping Beans and Simply Vera Vera Wang, has been trying to revive sales amid a challenging economic environment for many shoppers, who are grappling with an affordability crisis. Retailers are also navigating sweeping tariffs rolled out this year by the Trump administration.

For the third quarter results, due before markets open on Tuesday, analysts expect Kohl’s to report a loss of 18 cents per share on revenues of about $3.4 billion, according to data from Benzinga Pro.

Bender Revived Shares, But What’s Ahead?

Bender, 64, is a retail veteran with 30 years of experience. He previously held top roles at retailers including Victoria’s Secret, Walmart, and Eyemart Express.

“Working with the teams over the last six months has deepened my love of this company and my conviction in what’s possible for our future,” Bender said in a statement.

Since he was named interim CEO in May, Kohl’s shares have surged nearly 135% as of Monday’s close. They were up 1.65% at $15.99 apiece in after-hours trading on Monday. So far this year, its stock is up 12%.

Still, over the past five years, Kohl’s shares have fallen by about 53%. By contrast, Macy’s Inc. (NYSE:M) stock is up 84.5%, TJ Maxx and Marshall’s owner TJX (NYSE:TJX) has increased by 135%, and Ross Stores Inc. (NASDAQ:ROST) is up 59%.

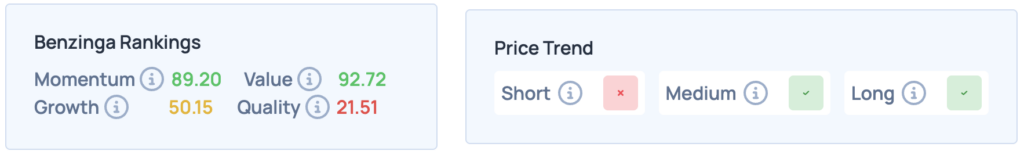

Benzinga’s Edge rankings show Kohl’s scoring strong on momentum and value but weak on quality, while its price trend appears negative in the short term yet positive over medium- and long-term periods. For more such rankings, click here.

READ NEXT:

Image via Shutterstock

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal