Leadership Transition and Family Succession Might Change the Case for Investing in Ermenegildo Zegna (ZGN)

- Ermenegildo Zegna N.V. has announced a comprehensive leadership transition, effective January 1, 2026, with Gianluca Tagliabue set to become Group CEO and Ermenegildo “Gildo” Zegna stepping into the role of Group Executive Chairman, alongside additional changes in brand and financial leadership.

- This shift sees the fourth generation of the Zegna family taking operational leadership of the ZEGNA brand, marking a significant milestone in the company's ongoing succession planning and long-term strategy development.

- We'll examine how the appointment of Gianluca Tagliabue as Group CEO could influence Zegna's investment narrative and execution of future growth plans.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Ermenegildo Zegna Investment Narrative Recap

To be a shareholder in Ermenegildo Zegna, you need to believe in its ability to execute a luxury-driven growth strategy fueled by brand strength, direct-to-consumer expansion, and family stewardship. The recent leadership changes, including Gianluca Tagliabue's appointment as incoming Group CEO, are not expected to materially alter the most important short-term catalyst, continued DTC growth and premiumization, nor fundamentally change the main risk, which remains exposure to Greater China volatility and margin pressure from ongoing SG&A investment.

Of the recent announcements, the Thom Browne CEO transition is particularly relevant, as this brand's wholesale channel has faced double-digit declines and margin compression, making executive direction critical to offset risk and ensure stability as Zegna sharpens its focus on high-margin direct-to-consumer channels and global brand expansion. Yet, in contrast to leadership continuity, the durability of wholesale recovery still depends on how new leadership can steady the ship amid known channel headwinds...

Read the full narrative on Ermenegildo Zegna (it's free!)

Ermenegildo Zegna is projected to reach €2.2 billion in revenue and €127.2 million in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 3.4% and a €50.1 million increase in earnings from the current level of €77.1 million.

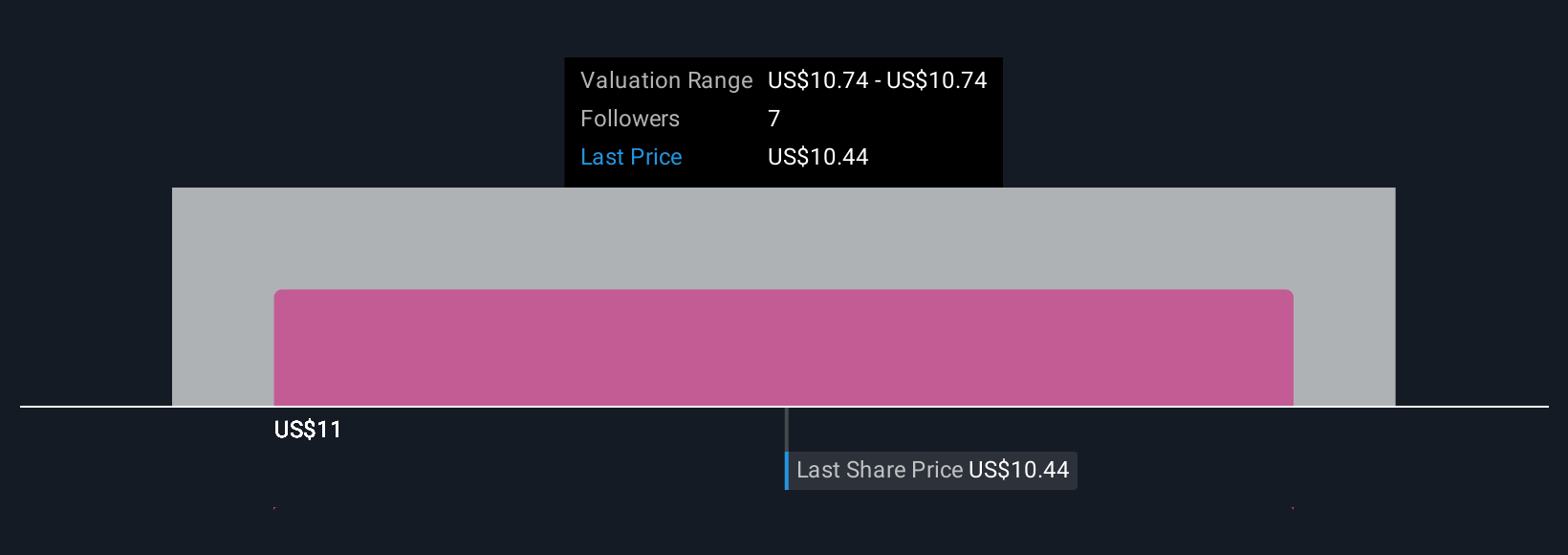

Uncover how Ermenegildo Zegna's forecasts yield a $11.09 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered two fair value estimates for Zegna ranging from €7.15 to €11.09 per share. With such a spread, and wholesale margin risks looming, it is clear opinions can vary widely, see how these perspectives inform your approach.

Explore 2 other fair value estimates on Ermenegildo Zegna - why the stock might be worth 31% less than the current price!

Build Your Own Ermenegildo Zegna Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ermenegildo Zegna research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Ermenegildo Zegna research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ermenegildo Zegna's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal