Is TPG's (TPG) Push Into AI Data Centers and Healthcare Education Shifting Its Growth Strategy?

- In recent days, TPG, a global alternative asset manager, announced significant minority investments in Healthcademia, a France-based healthcare education provider, and HyperVault, Tata Consultancy Services' AI data center venture in India. These moves reflect TPG’s focus on growth opportunities in healthcare education and digital infrastructure by partnering with sector specialists G Square Capital and Tata Consultancy Services.

- This dual investment highlights TPG’s interest in digital transformation and healthcare sectors, industries positioned for ongoing expansion and increased international demand.

- We’ll examine how TPG's expansion into AI data centers with Tata Consultancy Services could shift its investment outlook and growth narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

TPG Investment Narrative Recap

To own TPG, an investor needs confidence in the firm’s ability to capture long-term growth from thematic investments in healthcare and digital infrastructure while managing industry-wide fundraising slowdowns. The recent investments in Healthcademia and HyperVault support TPG’s focus on high-demand sectors but are not likely to materially change the near-term catalyst, which remains the pace of institutional capital inflows and fee revenue growth. Fundraising headwinds, particularly concerns about alternatives allocations reaching capacity, are still the most significant risk for the business right now.

Of all recent announcements, TPG’s commitment to invest up to Rs 8,820 crore in Tata Consultancy Services’ HyperVault data center platform stands out, reflecting a move toward scalable digital assets. This aligns with catalysts around finding new growth avenues and potential to diversify recurring fee streams, but also introduces integration and execution risk as TPG expands into new, operationally intensive markets.

However, investors should be aware that fundraising constraints could still impact TPG’s ability to sustain earnings growth, particularly if ...

Read the full narrative on TPG (it's free!)

TPG's narrative projects $2.3 billion revenue and $827.7 million earnings by 2028. This requires a 16.5% yearly revenue decline and an earnings increase of $807.5 million from the current earnings of $20.2 million.

Uncover how TPG's forecasts yield a $65.85 fair value, a 18% upside to its current price.

Exploring Other Perspectives

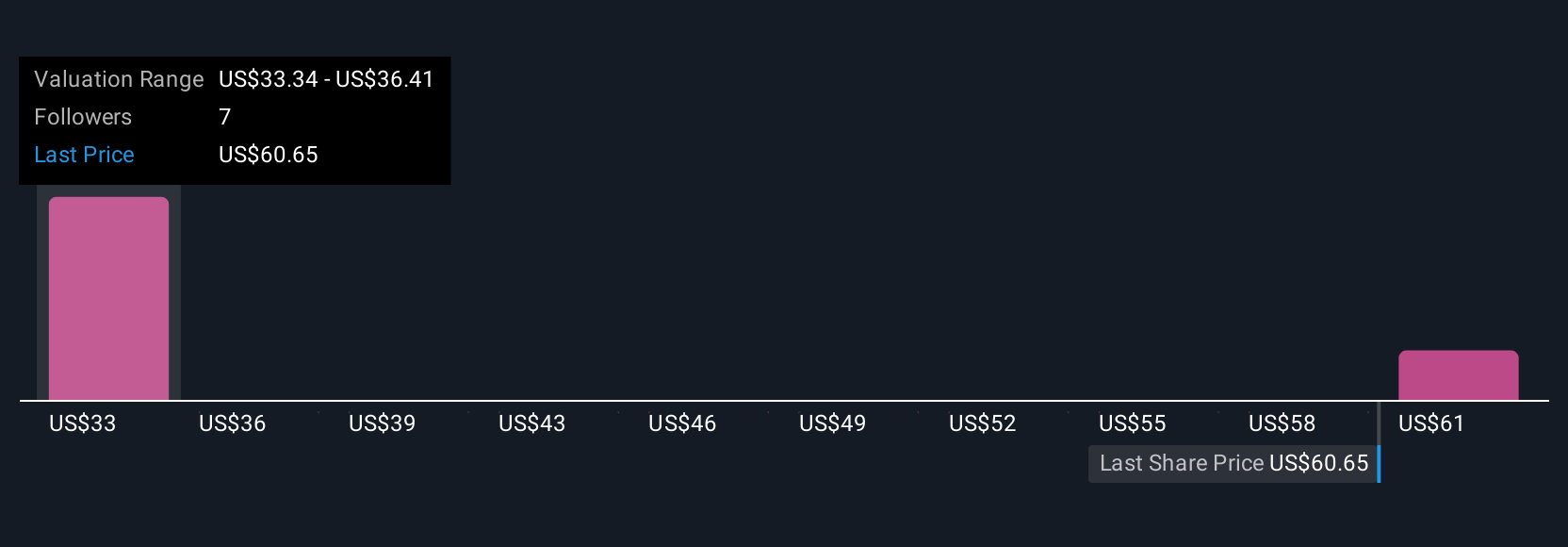

Two retail investors in the Simply Wall St Community set TPG’s fair value between US$40.90 and US$65.85 per share. With growing industry risks around slower fundraising, your outlook may differ depending on confidence in TPG’s fee revenue growth, explore several perspectives before making up your mind.

Explore 2 other fair value estimates on TPG - why the stock might be worth as much as 18% more than the current price!

Build Your Own TPG Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TPG research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TPG research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TPG's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal