Can Everest Group Recognition Redefine Concentrix’s (CNXC) AI Strategy and Long-Term Positioning?

- Concentrix recently reported a year-on-year revenue increase to US$2.48 billion, exceeding analyst expectations and highlighting its ongoing growth momentum, while also missing full-year and next-quarter EPS guidance estimates.

- The company was again recognized as the top leader in Everest Group’s B2B Sales Services PEAK Matrix for 2025, underlining its investment and performance in AI-powered sales solutions such as Lead Factory and iX Hello.

- We’ll assess how the strong Everest Group recognition for AI-driven solutions might influence Concentrix’s broader investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Concentrix Investment Narrative Recap

To be a Concentrix shareholder, you need to believe in its ability to leverage AI-driven solutions like Lead Factory and iX Hello to drive sustainable growth, even as growth rates and earnings projections remain a watchpoint. The recent revenue beat confirms short-term momentum, but continued EPS guidance misses underscore that profitability remains a key short-term catalyst and risk for the business, with this quarter’s update not materially shifting that balance.

Among recent announcements, Concentrix’s back-to-back recognition as the top leader in Everest Group’s B2B Sales Services PEAK Matrix stands out. This reiterates the company’s focus on innovation in AI-powered sales, aligning directly with its efforts to catalyze higher revenue and margin expansion via AI adoption and related product launches.

However, against this progress, the company’s meaningful debt burden and the pressure from rising interest rates are risks investors should be aware of if...

Read the full narrative on Concentrix (it's free!)

Concentrix's narrative projects $10.6 billion revenue and $509.6 million earnings by 2028. This requires 3.2% yearly revenue growth and a $275.3 million increase in earnings from $234.3 million currently.

Uncover how Concentrix's forecasts yield a $64.83 fair value, a 81% upside to its current price.

Exploring Other Perspectives

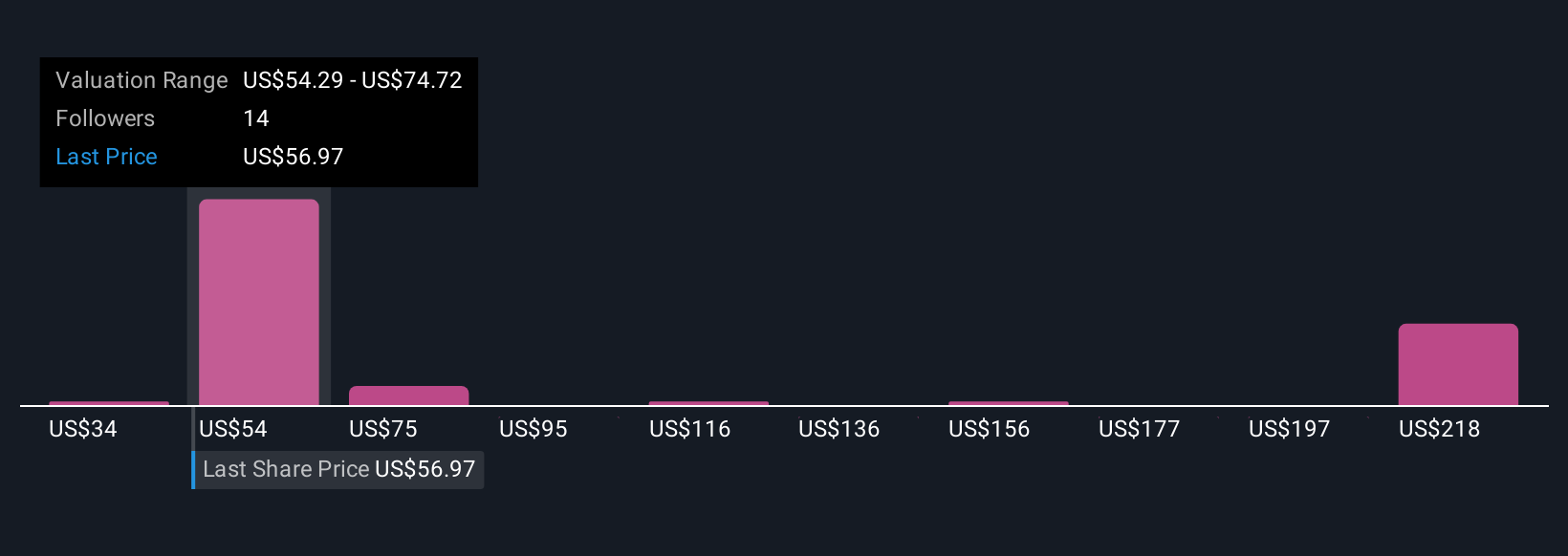

Six individual fair value estimates from the Simply Wall St Community span a wide US$33.87 to US$164.09 range per share. While many expect AI solutions to drive growth, the company’s recent earnings misses remind you that forecasts and outcomes may widely differ, explore how other investors view the company’s prospects.

Explore 6 other fair value estimates on Concentrix - why the stock might be worth 5% less than the current price!

Build Your Own Concentrix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Concentrix research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Concentrix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Concentrix's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal