Will Teradyne’s (TER) Dividend and Option Trends Reveal Shifts in Institutional Confidence?

- Teradyne, Inc. recently announced a quarterly cash dividend of $0.12 per share, payable on December 17, 2025, to shareholders of record as of November 24, 2025.

- While Teradyne's dividend declaration was routine, recent trading shows large investors expressing increased caution through a sharp rise in put option activity.

- We'll examine how renewed bearish sentiment among institutional investors could influence Teradyne's investment narrative moving forward.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Teradyne Investment Narrative Recap

To be a Teradyne shareholder today, you need to believe in the company’s exposure to long-term trends in AI automation and semiconductor testing, while accepting short-term volatility from market sentiment. Despite the recent dividend affirmation and heightened bearish action in the options market, the most important short-term catalyst, demand for advanced semiconductor testing driven by AI, remains unchanged. Near-term risks, including caution on valuation and sector-wide shifts from growth to defensive stocks, have not materially altered Teradyne’s underlying business outlook.

Among recent developments, Teradyne’s Q3 2025 earnings revealed year-over-year sales growth but a decline in net income, echoing ongoing challenges in end-market demand and margin pressure. This is important context for investors focused on the earnings momentum as a key driver for future share price movement, especially when evaluating new bearish sentiment amid sector rotation.

However, beneath the strength in growth catalysts, investors should not overlook the effect that shifting macroeconomic conditions, such as persistently high interest rates, could have on...

Read the full narrative on Teradyne (it's free!)

Teradyne's outlook suggests $4.1 billion in revenue and $952.0 million in earnings by 2028. Achieving this would require 13.2% annual revenue growth and a $482.8 million increase in earnings from the current level of $469.2 million.

Uncover how Teradyne's forecasts yield a $172.62 fair value, a 9% upside to its current price.

Exploring Other Perspectives

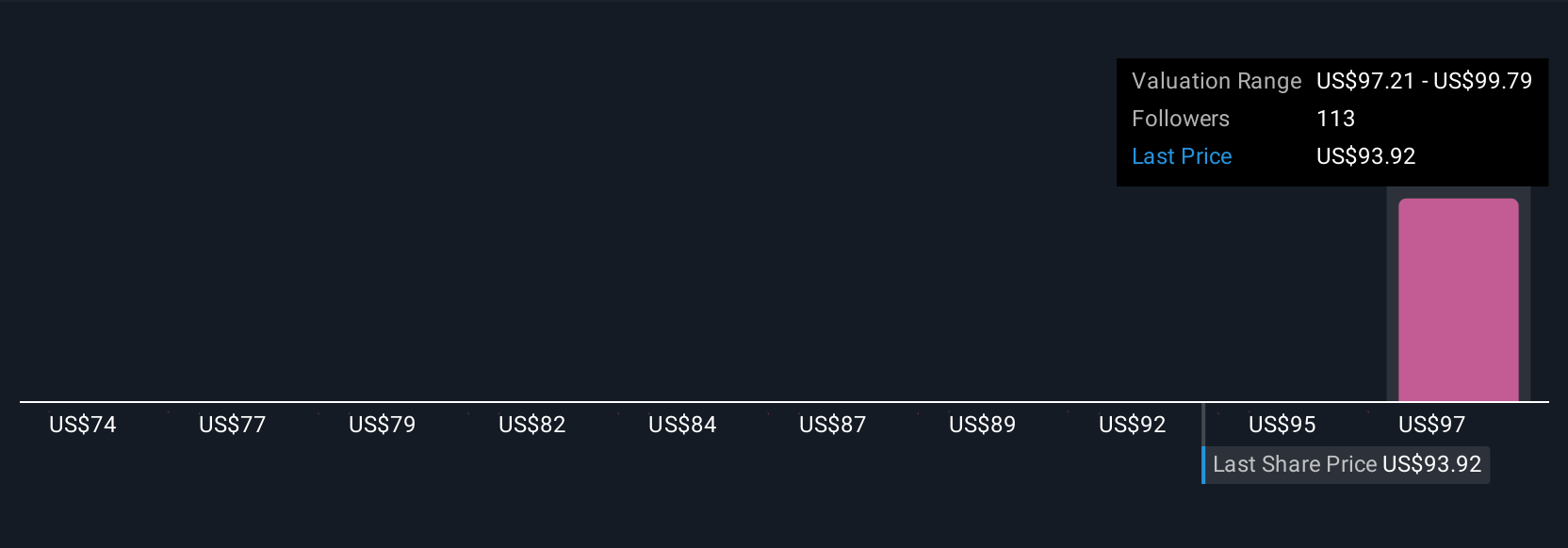

The Simply Wall St Community shared nine fair value estimates for Teradyne, ranging from US$74 to US$172.63 per share. While views vary widely, recent concerns over sector valuation and earnings visibility may influence how the company weathers future market uncertainties.

Explore 9 other fair value estimates on Teradyne - why the stock might be worth less than half the current price!

Build Your Own Teradyne Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teradyne research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Teradyne research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teradyne's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal