Will Jabil's (JBL) Thailand BESS Facility Redefine Its Sector Position and Supply Chain Strategy?

- Jabil Inc. recently announced the expansion of its collaboration with Inno to manufacture battery energy storage system enclosures at a new 15,000-square-meter facility in Rayong, Thailand, with the site expected to be operational for prototyping by late 2026.

- This move could strengthen supply chain efficiency and cost competitiveness for battery energy storage system clients by locating production near Southeast Asia's major port infrastructure.

- We'll examine how Jabil's new Thailand partnership to localize BESS enclosure production may reshape its growth narrative and sector positioning.

Find companies with promising cash flow potential yet trading below their fair value.

Jabil Investment Narrative Recap

Jabil’s investment case centers on its ability to capture opportunities in high-growth sectors like energy storage, AI, and advanced manufacturing, leveraging its global supply chain. The recent Thailand expansion with Inno adds regional manufacturing scale and may improve cost efficiency, but given existing caution around renewable energy market weakness, it may not materially impact near-term catalysts or alleviate the main risk of sluggish demand in key segments right now.

Among Jabil’s recent announcements, the collaboration with Axiado Corporation on AI-driven cybersecurity stands out in light of strong AI-related revenue growth forecasts. This move, paired with continued innovation in data center products, reinforces exposure to growth drivers that could offset recent headwinds in regulated industries and consumer sectors.

On the other hand, investors should keep in mind that continued softness in the renewable energy and EV markets remains a risk...

Read the full narrative on Jabil (it's free!)

Jabil's outlook anticipates $34.3 billion in revenue and $1.3 billion in earnings by 2028. This implies 6.4% annual revenue growth and an increase in earnings of $723 million from the current $577 million.

Uncover how Jabil's forecasts yield a $247.38 fair value, a 26% upside to its current price.

Exploring Other Perspectives

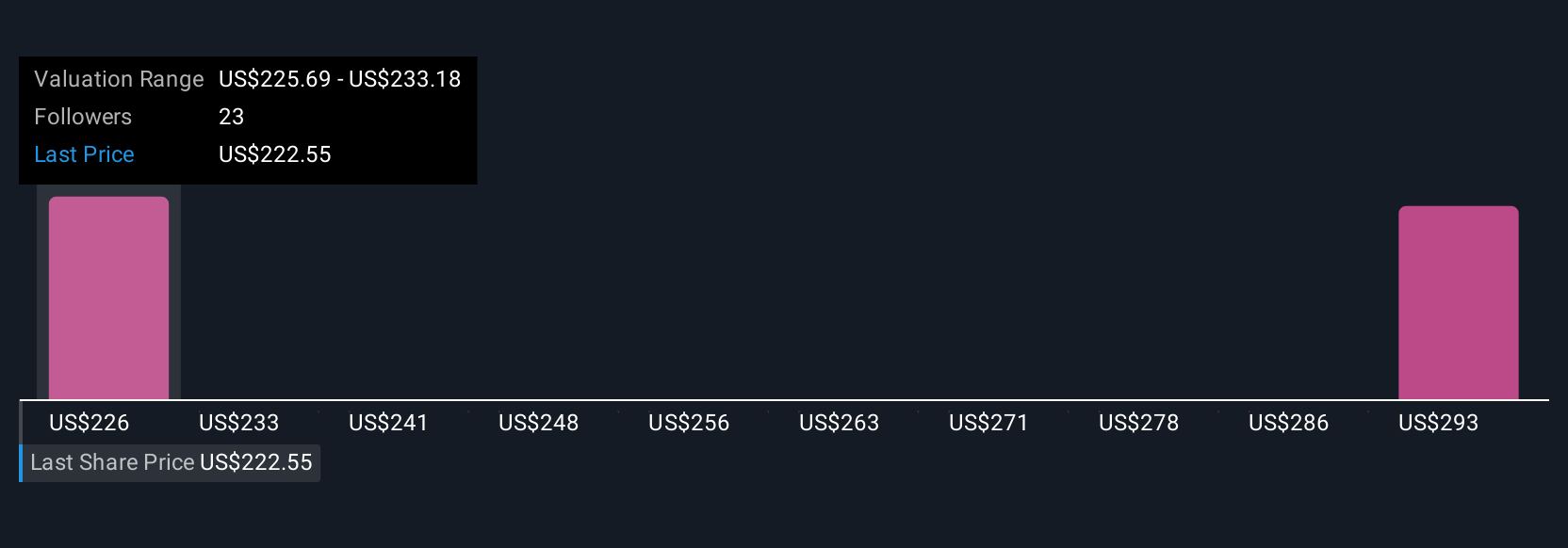

Two investors from the Simply Wall St Community see Jabil's fair value between US$247.38 and US$258.31 per share. However, continued demand challenges in renewable energy and EV may affect the company's progress in the coming quarters, so consider how different viewpoints can affect your outlook.

Explore 2 other fair value estimates on Jabil - why the stock might be worth just $247.38!

Build Your Own Jabil Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jabil research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Jabil research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jabil's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal