Does GlobalFoundries’ (GFS) GaN Partnership with Navitas Signal a New Era in U.S. Chip Leadership?

- Earlier this week, GlobalFoundries and Navitas Semiconductor announced a long-term partnership to accelerate U.S.-based gallium nitride (GaN) technology development and manufacturing for high-power applications, aiming for production at GlobalFoundries' Vermont facility in late 2026.

- This agreement positions GlobalFoundries as an essential supplier in U.S. semiconductor supply chains for critical sectors such as AI datacenters, energy infrastructure, and industrial electrification, while aligning with national security and decarbonization efforts.

- We'll explore how this domestic GaN manufacturing initiative could impact GlobalFoundries' role in advanced power markets and future growth expectations.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

GlobalFoundries Investment Narrative Recap

To be a GlobalFoundries shareholder, you need to believe that the company’s expanding U.S. manufacturing and partnerships, like the new Navitas Semiconductor alliance, can offset its modest exposure to leading-edge technology nodes and help drive steady growth. While this GaN initiative strengthens GlobalFoundries’ relevance in emerging power applications and resilient supply chains, it may not immediately affect the key short-term catalyst: increasing design wins in the automotive and communications sectors. However, the main short-term risk, persistent pricing pressure in the smart mobile device segment, remains largely unchanged by the recent GaN news.

While the GaN partnership targets future power markets, GlobalFoundries’ recent deal with BAE Systems highlights its momentum in secure, high-value chip manufacturing for space applications, another sector benefiting from onshoring and advanced specialty technologies. This supports the ongoing catalyst of capturing growth in automotive, defense, and communications infrastructure markets.

But even as GlobalFoundries builds out its U.S. technology roadmap, investors should not overlook the continued challenge of pricing pressure in core consumer chip markets…

Read the full narrative on GlobalFoundries (it's free!)

GlobalFoundries' outlook anticipates $8.6 billion in revenue and $1.4 billion in earnings by 2028. This is based on analysts expecting 8.0% annual revenue growth and a $1.515 billion increase in earnings from today’s -$115 million.

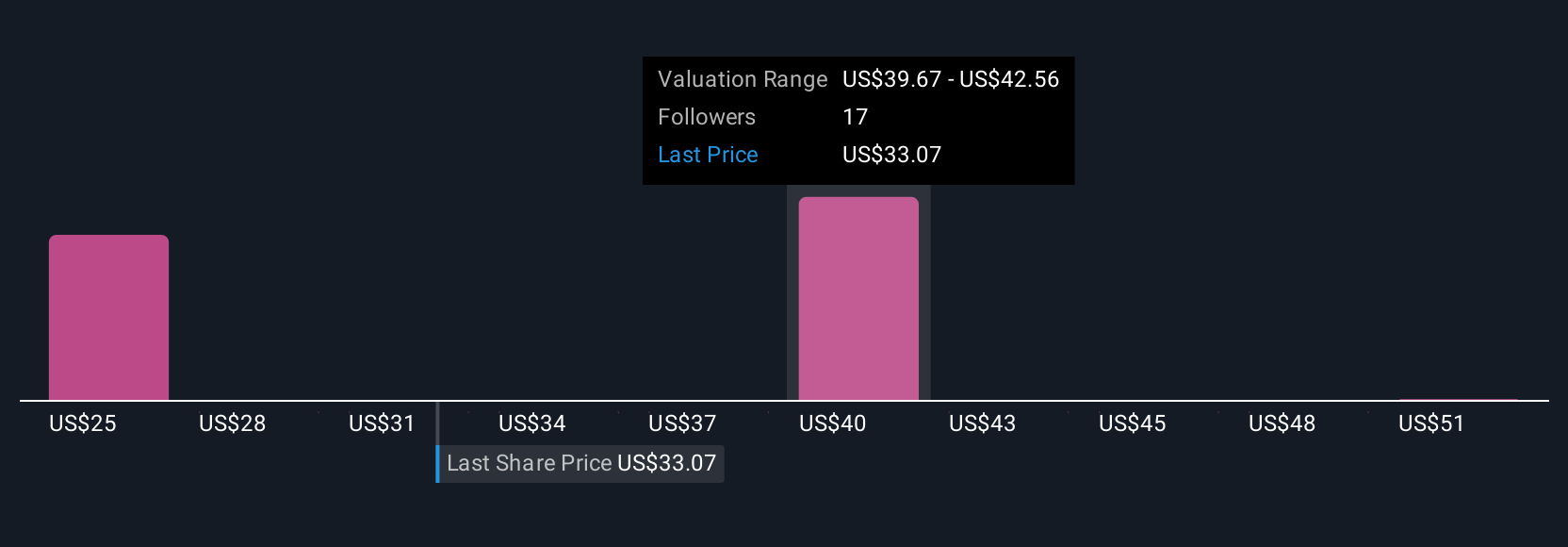

Uncover how GlobalFoundries' forecasts yield a $39.43 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate GlobalFoundries’ fair value ranges from US$27.47 to US$54.13, based on five independent forecasts. Despite such a wide spectrum, ongoing exposure to pricing pressure in the mobile segment could have meaningful impacts on near-term results, see how other investors weigh these influences.

Explore 5 other fair value estimates on GlobalFoundries - why the stock might be worth 19% less than the current price!

Build Your Own GlobalFoundries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GlobalFoundries research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free GlobalFoundries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GlobalFoundries' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal