A Look at Corporación América Airports (NYSE:CAAP) Valuation Following Strong October Operational Growth

Corporación América Airports (NYSE:CAAP) just released its latest operating results, showing year-over-year increases in passengers, cargo volume, and aircraft movements for October and the year so far. These numbers caught investor attention for good reason.

See our latest analysis for Corporación América Airports.

These strong operational updates seem to have fueled fresh optimism, with a sharp 25.2% 1-month share price return and a 16.5% gain year-to-date. While the stock took a brief pause last week, momentum is still apparent. Over the longer haul, shareholders have enjoyed an impressive 19.7% total return in the past year and a staggering 603% total return over five years. Recent gains suggest investors are seeing more potential ahead, likely reflecting both improved results and a broader re-rating of the stock’s prospects.

If the airport group's recent surge got you thinking, now is the perfect time to broaden your investing search and discover fast growing stocks with high insider ownership

The key question now is whether Corporación América Airports’ strong run still leaves the shares undervalued, presenting a compelling entry point. Alternatively, the market may have already priced in all the expected growth ahead.

Most Popular Narrative: 13.2% Undervalued

With the most widely followed narrative setting fair value at $25.87, Corporación América Airports’ last close of $22.44 suggests further upside potential remains. The difference hints at expectations for robust earnings growth ahead, even after the stock’s momentum.

Ongoing major infrastructure investments, such as the Florence Airport Master Plan (recently environmentally approved), expansion projects in Armenia, and future growth opportunities in M&A and concessions, should increase capacity and competitiveness, underpinning future top-line and adjusted EBITDA expansion.

Want to know what’s fueling this ambitious valuation? Behind it lies a bold growth trajectory built on scaling international operations, anticipated margin leaps, and a profit outlook that defies industry norms. Uncover the figures and forecasts rewriting the rulebook for this airport operator.

Result: Fair Value of $25.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained high inflation in Argentina or regulatory shifts in key markets could quickly alter the outlook and limit the potential for broad-based growth.

Find out about the key risks to this Corporación América Airports narrative.

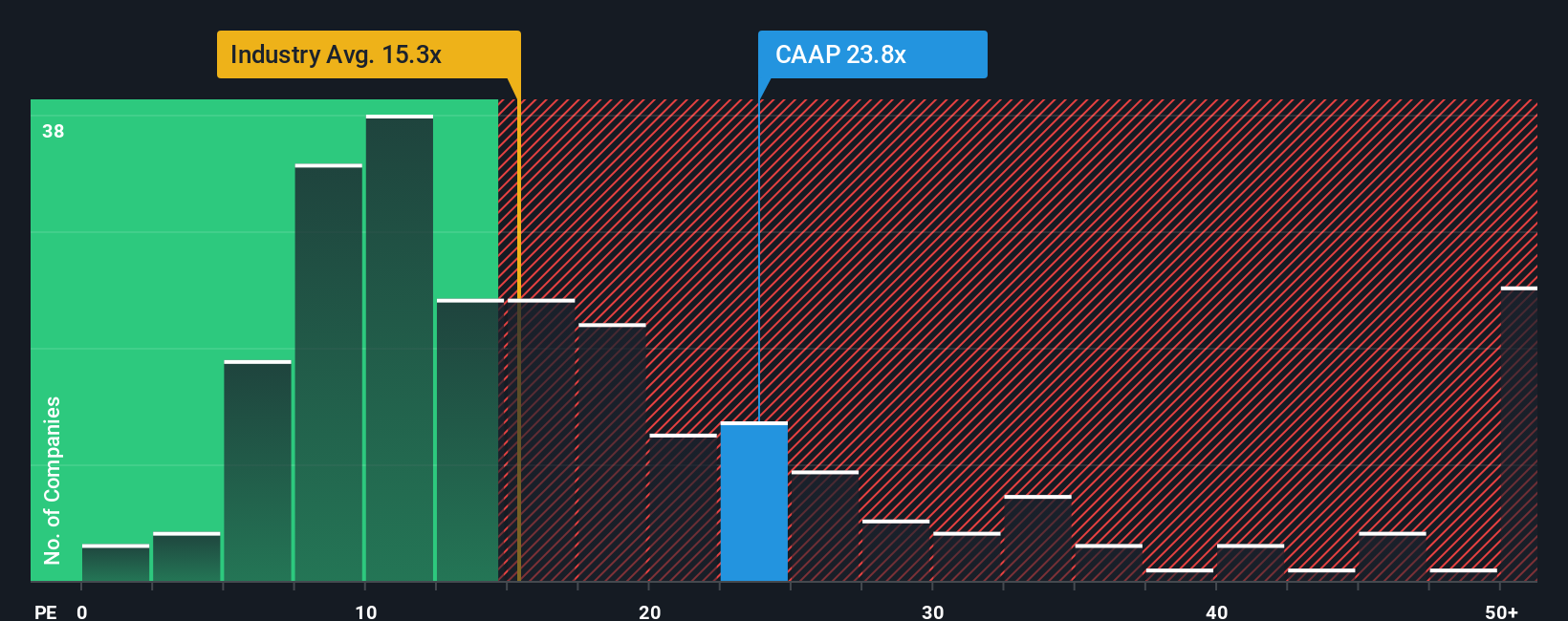

Another View: What About the Price-to-Earnings Ratio?

Looking at the price-to-earnings ratio, Corporación América Airports trades at 24.2x earnings. This is more expensive than the global infrastructure industry average of 14.6x and its fair ratio of 22.6x. However, compared to similar companies at 26.9x, it is cheaper than some peers. Does this valuation premium point to risk the market is ignoring, or opportunity the forecasts miss?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corporación América Airports Narrative

If you see the story differently or want to dive deeper into the numbers yourself, you can quickly craft your own perspective and make sense of the data in just a few minutes. Do it your way

A great starting point for your Corporación América Airports research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let this be where you stop your research. Step up your investment game by tapping into other powerful market opportunities that could reshape your portfolio.

- Catch the wave of innovative medical technology and breakthroughs by checking out these 30 healthcare AI stocks showing promising healthcare companies at the intersection of AI and medicine.

- Secure your future income with these 17 dividend stocks with yields > 3% delivering reliable dividend yields above 3% and helping you grow wealth with consistency.

- Unlock the upside of rapid sector growth as you browse these 25 AI penny stocks and see which AI-driven businesses are making the biggest impact this year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal