Does Zebra’s (ZBRA) Push Into AI and RFID Signal a New Era for Retail Technology Leadership?

- Zebra Technologies unveiled findings from its 18th Annual Global Shopper Study earlier this month, highlighting the rising significance of generative AI, automation, and inventory solutions in the retail sector as well as introducing new products equipped with advanced RFID and AI capabilities.

- The research shows both online and in-store shopper satisfaction dropping for the second consecutive year, while retailers increasingly plan to adopt real-time technologies like computer vision and RFID to address inventory and loss-prevention challenges.

- We’ll explore how Zebra’s focus on retail automation and AI-driven inventory solutions shapes its investment narrative and future opportunities.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Zebra Technologies Investment Narrative Recap

To own shares in Zebra Technologies, you need to believe in the company’s ability to drive revenue growth through retail automation, digital transformation, and real-time workflow optimization. The recent Shopper Study underlines strong retail sector demand for AI and automation, supporting Zebra’s pivot to software and recurring revenue, but does not materially alter near-term risks such as escalating competition in consumer-facing markets following the Elo acquisition, or exposure to global trade and tariff uncertainties.

Among the latest announcements, the launch of the ET401 tablet with world-first enterprise mobile RFID integration stands out. This product directly addresses key retail pain points like real-time inventory tracking and out-of-stock scenarios, issues highlighted in the Shopper Study, and closely links innovation to Zebra’s investment story around digital transformation and operational efficiency. Contrast this with the growing risk that market fragmentation and price competition in newly entered segments could affect...

Read the full narrative on Zebra Technologies (it's free!)

Zebra Technologies' outlook anticipates $6.2 billion in revenue and $855.4 million in earnings by 2028. This is based on a 6.0% annual revenue growth rate and a $307.4 million increase in earnings from the current $548.0 million.

Uncover how Zebra Technologies' forecasts yield a $358.47 fair value, a 49% upside to its current price.

Exploring Other Perspectives

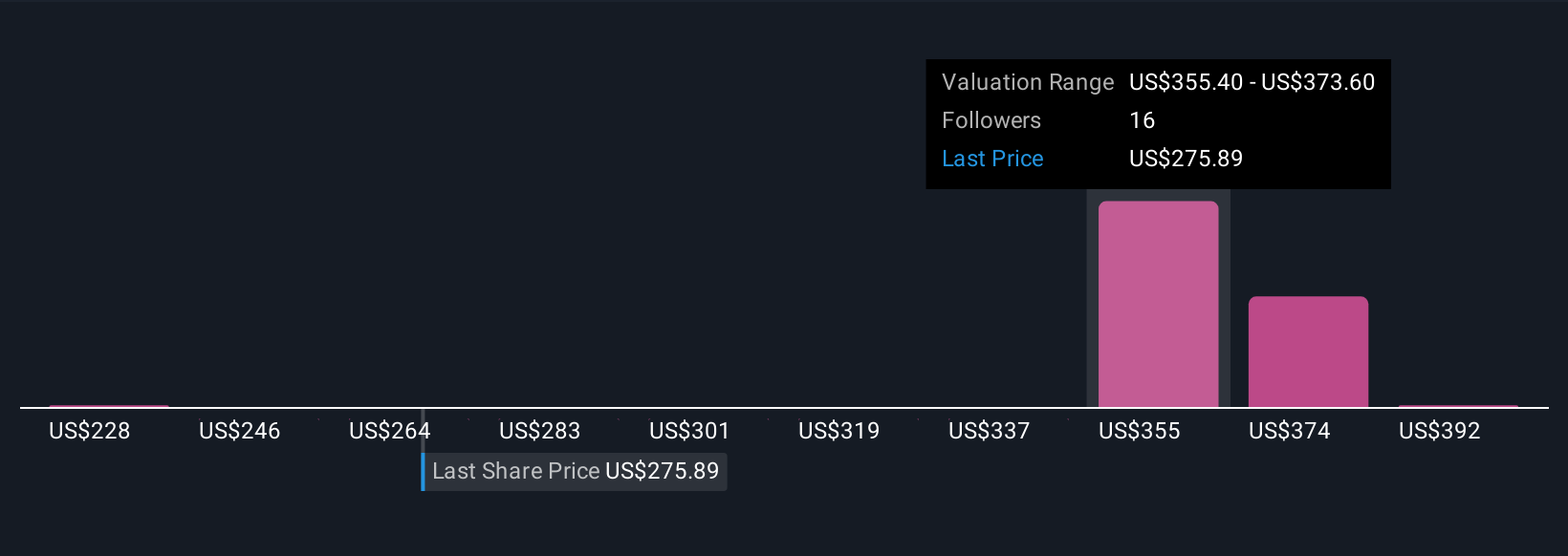

Simply Wall St Community members estimate Zebra’s fair value between US$228 and US$410 from 5 perspectives, signaling a wide range of expectations. Consider how increased competition in point-of-sale and consumer automation may drive both upside and risk in Zebra’s future, and explore the many viewpoints shaping investment decisions today.

Explore 5 other fair value estimates on Zebra Technologies - why the stock might be worth as much as 70% more than the current price!

Build Your Own Zebra Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zebra Technologies research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Zebra Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zebra Technologies' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal